Be with us telegram Channel to maintain the latest state for news reports

The adoption of cryptocurrency is increasing at an amazing speed that surpasses major technology development. According to Blackrock’s data, the number of encryption users has reached 300 million in just 12 years. This adoption rate is 43% faster than mobile phones and 20% faster than the Internet. Various factors contribute to this rapid growth, such as the rise of the Bitcoin exchange trading fund (ETF) and the increase in the participation of retail and institutional investors.

Moreover, the US regulatory environment also became more advantageous, providing clarity and encouraging additional investments. As the market expands, investors are looking for the following: The best encryption to buy now. This article focuses on projects with long -term growth potential and active development.

The best encryption to buy now

Helium prices have risen 7.42% over the last 24 hours, reflecting the market profit growth, reaching $ 3.75. Meanwhile, SUI has partnered with Dark Machine, a multiplayer MECH shooter to debut on a PC. AAVE is intended to increase user fluidity and capital efficiency by introducing three enhanced 3 pools in balancer V3.

1. kidney (HNT)

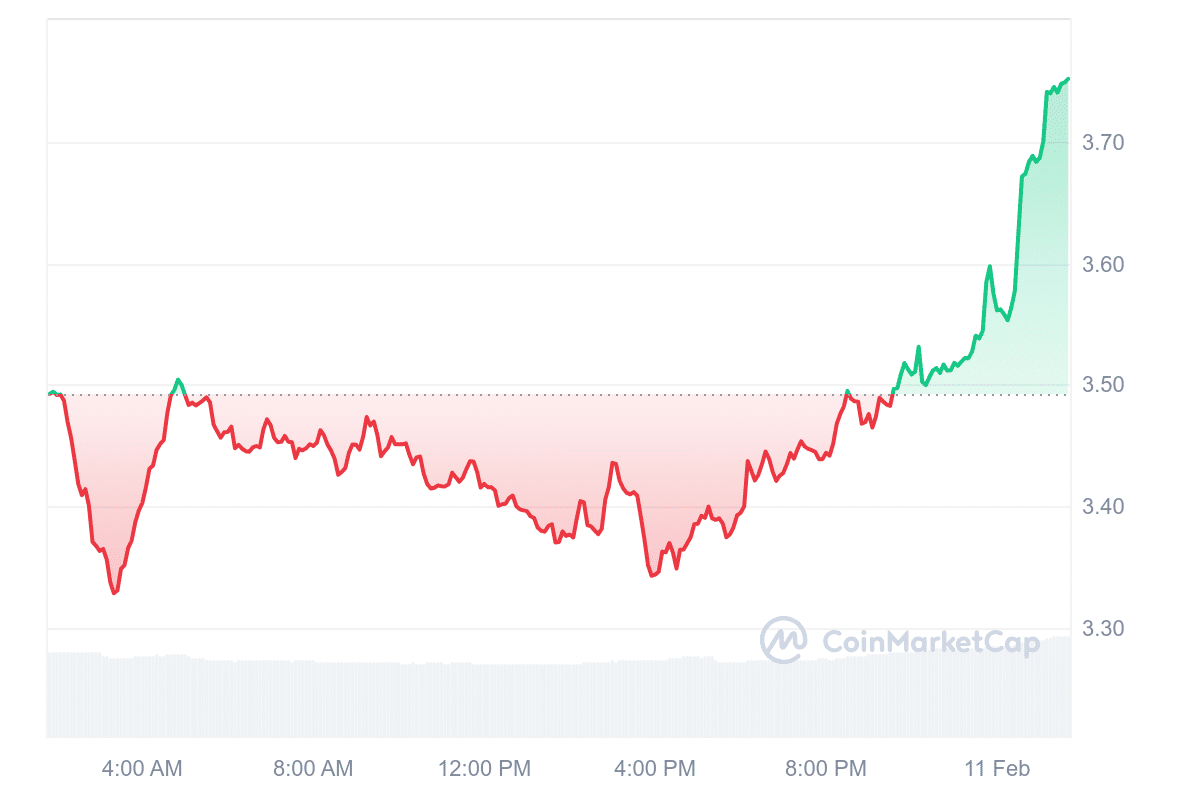

Coinbase plans to introduce a permanent futures contract for helium (HNT) and other cryptocurrencies on February 13, 2025.This movement improves market liquidity and increases trading volume to the trader for leverage exposure and risk management. Can be provided.

Helium’s trading activity has soared after the announcement. The amount increased to $ 8.67 million, up 8.65%. The introduction of permanent futures contracts for helium can increase the volume and liquidity, further stabilizing the market.

This price has reached $ 3.75 with a surge of 7.42%over the last 24 hours. In addition, HNT is currently trading 66.87%from $ 2.25 than the 200 -day simplicity (SMA), suggesting a powerful rise.

Despite these profits, the volatility of helium is relatively low. In the last 30 days, volatility has been at 17%(less than 30%) and is compared to more volatile assets. Meanwhile, the predictions are likely to reach $ 4.25 next month, estimating the price hike of 22.95%.

2. On (SUL)

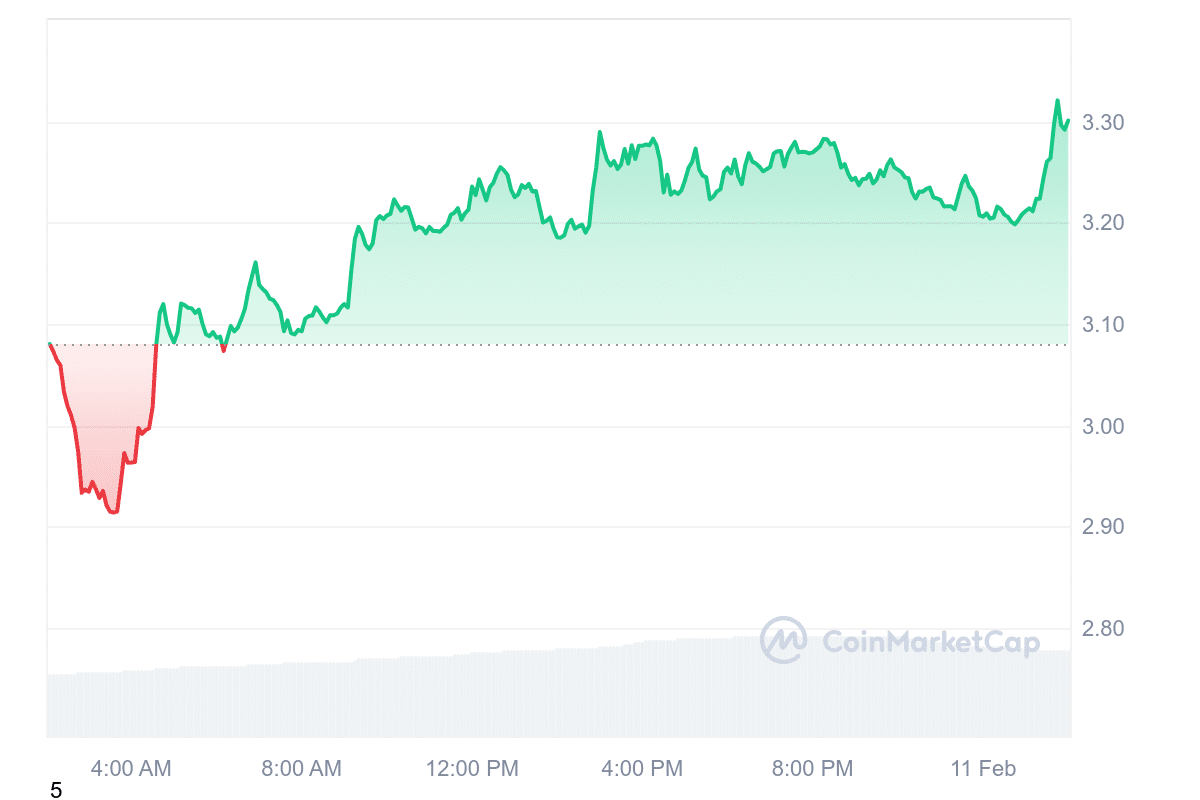

SUI recently partnered with Dark Machine, a multiplayer MECH shooter to be released on a PC. This partnership brings the game to suiply0x1, SUI’s handheld game device. Dark Machine is characterized by a team -based battle with a huge machine and appeals to gamers who are interested in battle full of action.

At the same time, the price of the SUI reached $ 3.37 on February 4 and rose 8.5%. This has been announced by SUI Bridge to support the packaged Bitcoin (WBTC) so that the user can transmit the Bitcoin to the SUI network in Ethereum. The SUI team says the WBTC is now a “fully synthesized asset,” which allows users to lend, borrow, and trade with distributed financial platforms such as Bluefin, Navi and SUILEND.

you’re right. We seize dark ✊

Welcome to the big thing @darkmachinegameTeam -based Mech Shooter is ready to electrize the SUI game community.

Experience both e -sports and blockchains as a one -minute package. pic.twitter.com/p30UTYP0DF

-SUI (@suinetwork) February 8, 2025

The market indicator suggests optimism on SUI’s long -term potential. The token is trading at $ 3.30, up 7.04%, and remains 14.09% from a 200 -day simple move average of $ 2.92. This average of moving helps to assess the long -term trend of assets, and the price often shows positive prospects.

In addition, the 14 -day relative intensity index (RSI) suggests neutral exercise at 52.69, which means that it can move in any direction without a strong purchase or sales pressure. The 24 -hour volume -to -market cap ratio of the SUI is 0.4192, indicating relatively high fluidity.

3. Culture (SOLX)

culture This is a layer -2 scaling solution designed to improve the transaction speed of Solana and reduce congestion. Solana is famous for its low fees and high throughput, but heavy network activities often fail to delay and transaction. Gatehwa aims to solve this problem by processing some transaction off chains before finishing in the main network.

This approach reduces Solana’s blockchain load to make transactions faster and more reliable. This platform has a transaction bundle, grouping multiple transactions into a single deployment. This minimizes fees and shortens the processing time. By optimizing the way transactions process, Solaxy tries to improve efficiency without changing the core structure of solana.

Another focus is interoperability. The culture plans to connect Solana to Ethereum so that users can move assets between two networks. This allows developers and merchants to access Ether Leeum’s liquidity and benefit from the speed of Solana while establishing an ecosystem.

The project is currently in the pre -sales stage and has raised $ 19.4 million so far. price drowsiness It is set to $ 0.00163 as the future is expected to increase. This provides an opportunity for early adapters, but the long -term success of culture depends on execution and adoption.

Please visit the reading dictionary

4. Theta Network

Theta Network is a blockchain platform for video, media and entertainment. Lowing the cost of providing content, it is a cheap option for developers and businesses. Built to support Ether Lee Smart Agreement, this product offers a flexible environment for development.

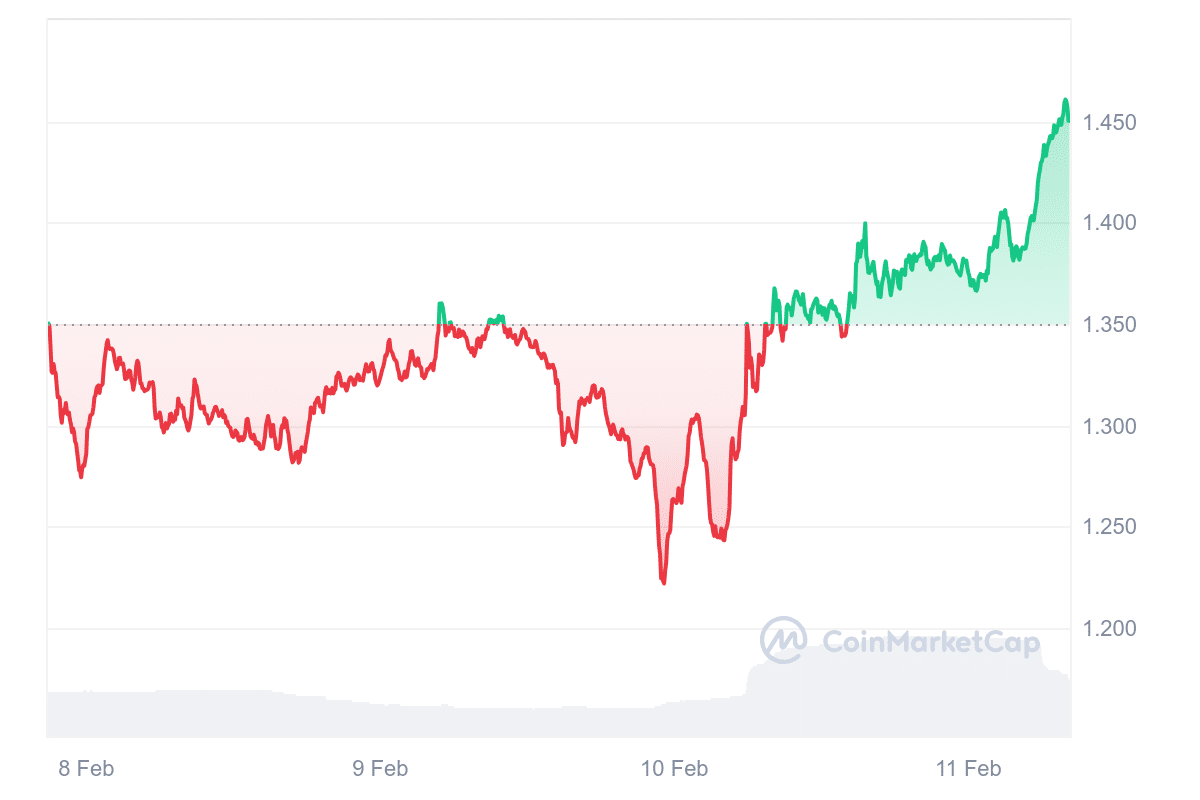

Theta is also changing to $ 1.45 and reflects an increase of 7.55% over the last 24 hours. It increased 3.58%over last week and increased 39%last year. Within the same period, it surpassed 59%of the top 100 cryptocurrencies. Theta Network showed positive growth compared to the initial token sales price.

The 24 -hour trading volume of the token is 0.0903, suggesting a relatively high level of liquidity. The 14 -day relative strength index (RSI) is 46.57, showing neutral market conditions and as possible.

The price of Theta token does not show very volatility. The 30 -day volatility is currently 15%and less than 30%. Price forecasting suggests an increase of 25.10%, and tokens can reach $ 1.66 by March. But market conditions and external factors can affect future performance.

5. AAVE (AAVE)

AAVE’s GHO Stablecoin is now available on the default network of Coinbase. This expansion can use the CCT (Cross-Chain Token) standard to smoothly move assets on other networks. Some of the GHO supply have been assigned to ARBITRUM, which is supported by Arbitrum Dao subsidies.

This initiative aims to increase the liquidity of GHO in AAVE’s ecosystem and a wider intervention network. Meanwhile, AAVE provides financial services on large -scale users. Bringing GHO as standard, it will be introduced to the limited ecosystem where AAVE’s Stablecoin is expanded.

In addition, AAVE started the 3 pulls boosted in the balancer V3. This liquidity swimming pool improves the efficiency of the Starable Coin by ordering all assets to AAVE’s loan market. This allows users to get yields while providing liquidity at a single position.

AAVE is a default maximum liquidity protocol and provides services to hundreds of thousands of users.

GHO’s expansion brings AAVE’s native Starble Lecomin as a defective ecosystem to grow rapidly.

The number does not lie. pic.twitter.com/p10sinnwm4

-Aave (@aave) February 10, 2025

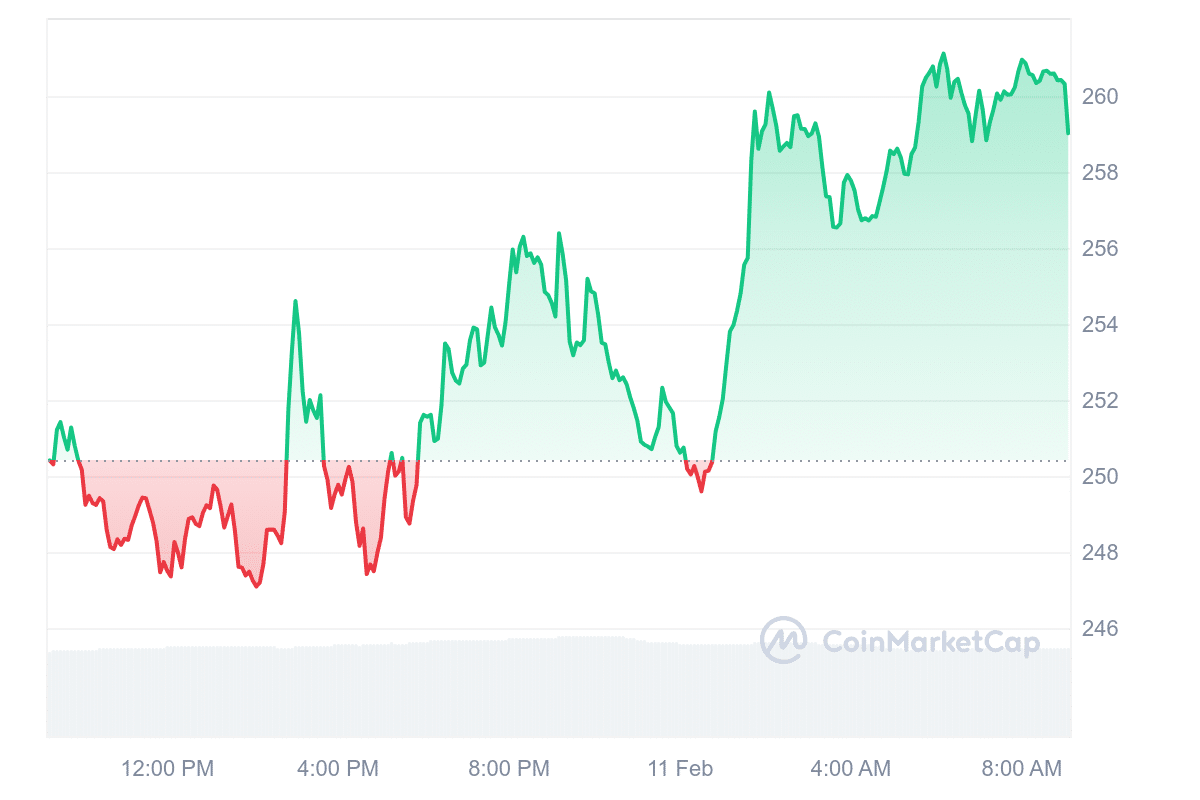

AAVE’s token, AAVE, is currently $ 259.02, 24 -hour trading volume is $ 533.7 million and market cap is $ 39.1 billion. The price increased 3.7% in 24 hours and remains 21.8% from a 200 -day move of $ 213.30. The liquidity is still strong and the relative robbery index (RSI) is 52.73 and indicates neutral market conditions.

Such development aims to improve the staffable coin accessibility and liquidity while maintaining security in several blockchain networks. AAVE continues to expand its role in distributed finance The best encryption to buy now.

Read more

Latest Mew Coin ICO-Wall Street Pepe

- Thank you for Coinsult

- Initial access to pre -sale round

- Private transaction alpha for the $ wepe army

- Staying Pool -High Dynamic Api

Be with us telegram Channel to maintain the latest state for news reports