Cryptocurrency Weekly Digest: Bitcoin falls below $ 100,000, Ethereum is preparing for scalability, and ton is expanded in the telegram ecosystem.

Victoria Deste

Post: January 27, 2025 8:25 AM Update: January 27, 2025 8:28 AM

Modification and fact confirmation date: January 27, 2025 8:25 am

Briefly

Bitcoin (BTC)

Last week, Bitcoin’s violent rise has fallen below $ 100,000, a threshold that has never been touched since President Trump’s inauguration.

BTC/USD 4H Chart, Coin Base. Source: TradingView

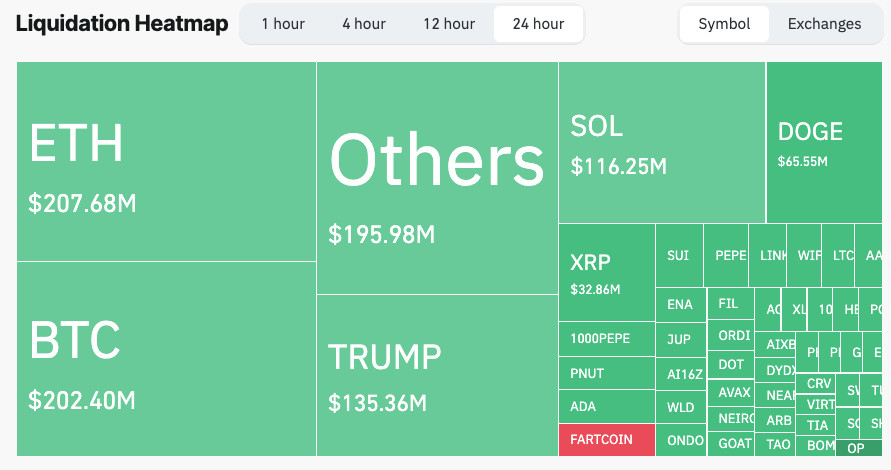

One of the biggest destroyers is China’s new AI model, DEEPSEEK, which is a big wave in the global market. Investors seemed to be interested in the development of the latest technology in more dangerous assets, such as cryptocurrencies, which resulted in a large amount of $ 860 million in just 24 hours in cryptocurrency futures.

This is a total cryptocurrency liquidation over the last 24 hours. source: Coin glass

Before the fall, Bitcoin surged nearly $ 110,000, thanks to Trump’s optimism on Trump’s cryptocurrency -friendly promises, including hints on national digital asset reserves. However, due to the lack of immediate measures by the government, the assembly became dizzy as traders recovered their cash.

In Korea, the FOMC (Federal Open Market Committee) meeting raised concerns about high interest rates, and the liquidity crisis was announced by discussions on debt limit. Meanwhile, reports that China offered off the $ 20 billion Bitcoin by seizure of plus token, and the traders feared additional large -scale selling.

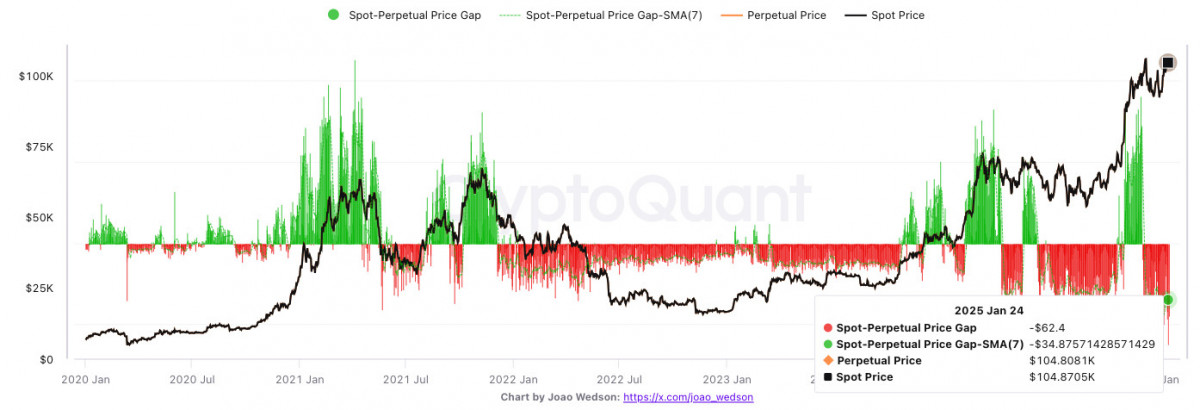

Technically, the market was under pressure. Binance’s in-kind-futures price gap is at an all-time high, showing weak emotions among leverage traders. Globally, analysts are warning that $ 100,000 is a key support area and that it can lead to deeper adjustments.

Bitcoin spot-permanent price gap (screenshot). Source: Crypto Quick

Despite confusion, Bitcoin’s long -term outlook is still a champion. Institutional players like Microstrategy are accumulating, and active wallet growth is still powerful. But in the short term, Bitcoin is likely to be traded in the range of fluctuations between $ 95,000 and $ 105,000. At this time, all interests are fixed to the future movement of the Trump administration.

Ethereum (ETH)

Ethereum also started approximately by 2025 and fell 7% in January in a larger market selling tax. Ethereum was not the main culprit, but the second largest cryptocurrency could not avoid the ripple.

ETH/USD 4H Chart, Coin Base. Source: TradingView

In the positive side, Vitalik Buterin has launched a new roadmap for Ethereum expansion. He is focusing on strengthening “Blob Scaling” and Layer 2 (L2) infrastructure, which aims to solve network congestion and notorious high fees. Another ambitious plan designed to maintain Ethereum’s competitiveness, but can it meet the topic? Let’s wait.

Source: Vitalik.eth

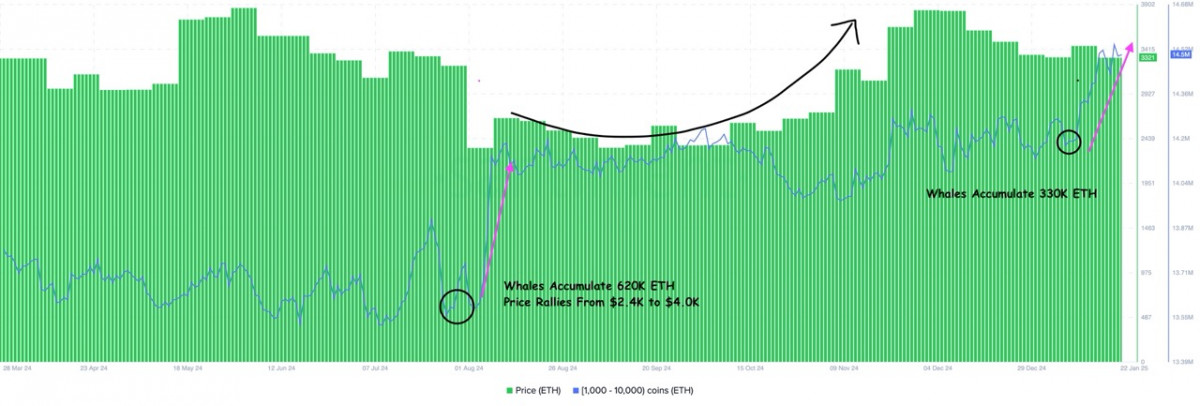

Overall, there are still many optimisms in Ethereum. February and March were historically good moon for ETH. The recent movement of whales, which cost more than $ 1 billion in ETH, suggests long -term trust in tokens. This accumulation indicates the belief in the ability of Ethereum to restore despite the current difficulties.

Ether Whale Address Analysis. source: Max Spain

The ecosystem is also making progress in terms of usefulness and scalability. First of all, Metamask cooperated with Ramp Network so that users can withdraw directly from nominal currency in L2 networks. As a result, Ethereum is more easily accessible to ordinary users.

But not everything goes smoothly. While DAPP activity is slowing, competitors such as Solana are receiving considerable attention. Analysts are also concerned that the overpower of tokens flooded to the market can reduce demand for Ethereum -based projects.

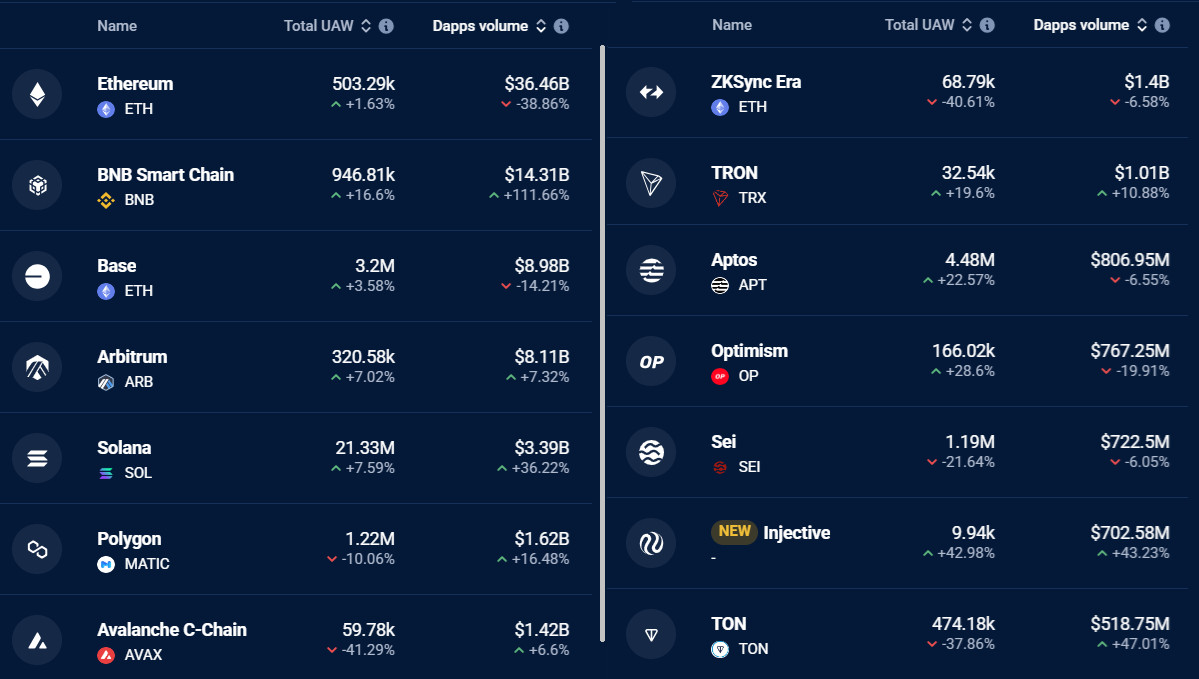

On the 7th, we ranked the upper blockchain based on the DAPP trading volume (USD). Source: DAPPRADAR

Despite these obstacles, institutional interest in Ethereum is still strong. Rumors of stewed Ether ETFs are growing, and many are expected to approve regulatory approval. Ethereum Foundation is also strengthening the game through Etherealize, a new marketing initiative to educate and misunderstand traditional financial officials.

source: Anthony Sasano

If February and March maintain historical forms, ETH can regain the lost foundation and potentially push a $ 1,800 – $ 2,000 resistance. If institutional support and technology upgrades are made, long -term prospects are still optimistic, and if Ethereum keeps the house in order, the $ 5,000 goal is not a problem.

Tone (ton)

In the traditional way, Ton has been showing a pretty big movement recently. In terms of price, Toncoin has recently fallen to $ 4.81, falling below the 20th and 50th day, falling below the simple moving average. RSI has reached the level of overreagy at 29.13, which is very interesting because it suggests that potential rebound may soon appear.

Ton/USD 4 hours chart. Source: TradingView

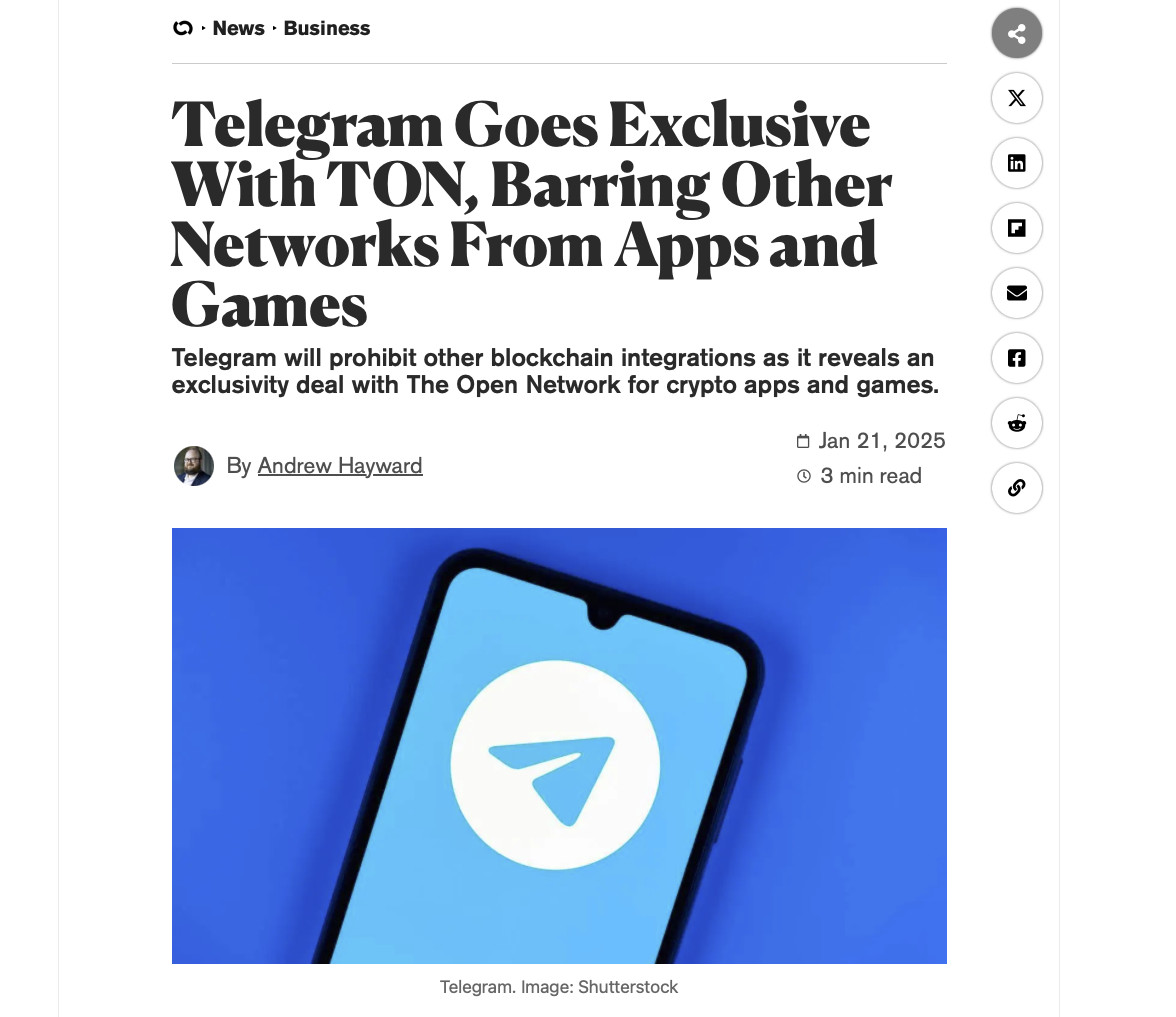

One of the most prominent developments in terms of news is Telegram’s new partnership, and now all blockchain -based mini apps in the app must support Ton. This integration has made blockchain technology closer to Telegram’s large ecosystem.

Source: Detoxification

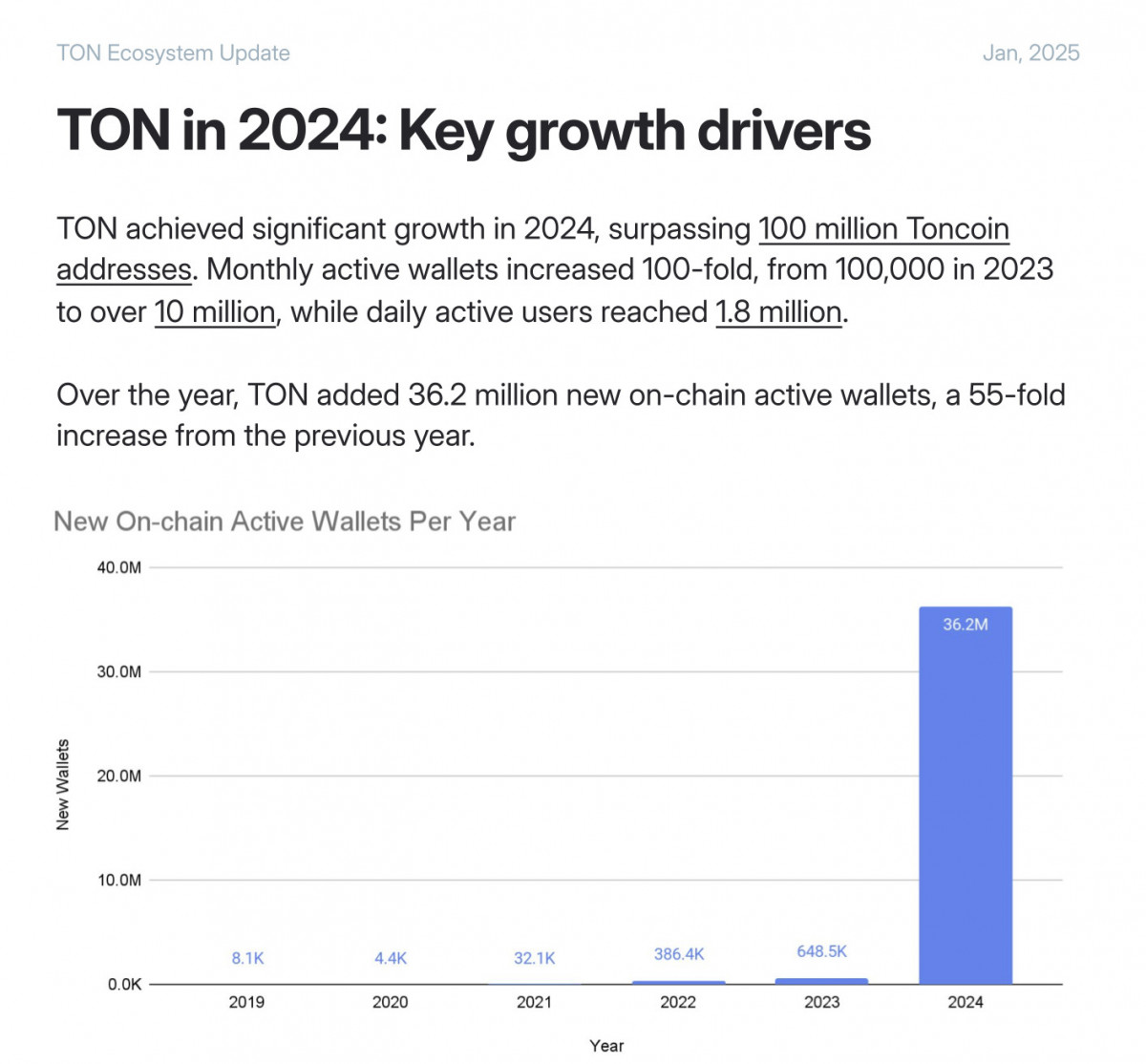

The recent drop in prices reflects the wider warnings of the market, but TON boasts an impressive 2024 statistics of 36.2 million new wallets and $ 60 million developer revenue, showing that the ecosystem is still lively.

Source: Ton ecosystem update

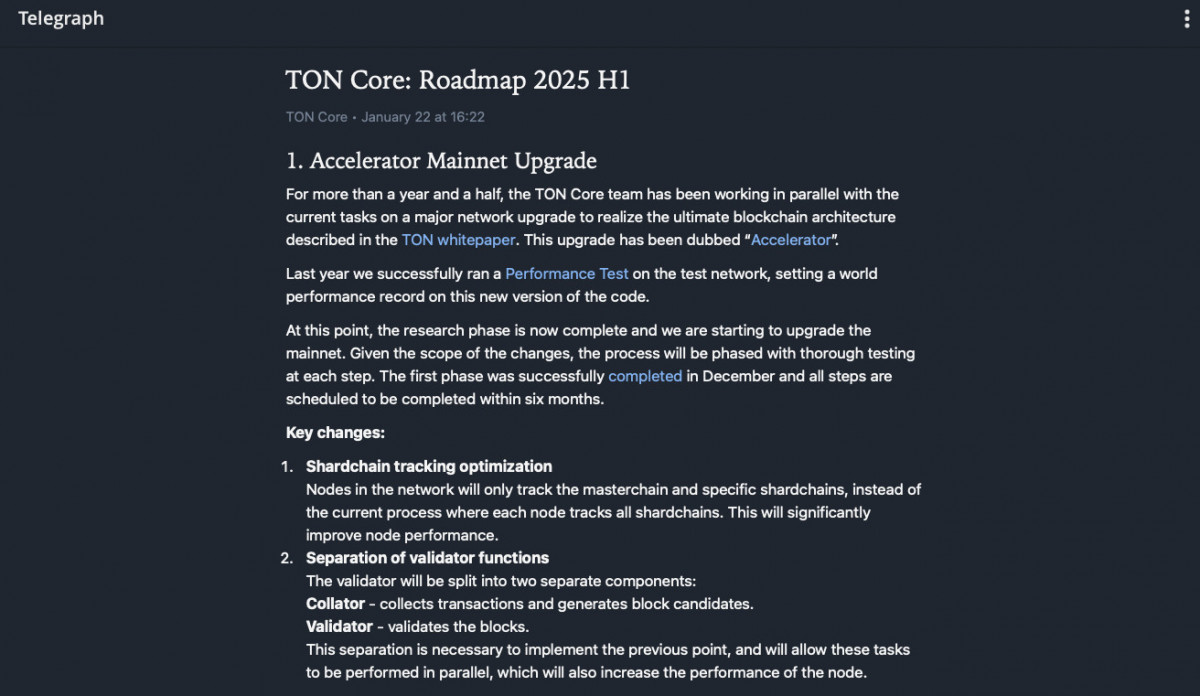

If you add an ambitious 2025 roadmap that includes updates such as BTC Teleport and L2 Payment Network, TON is doubling.

Source: Telegraph

In terms of technical aspects, Ton Core unveiled a 2025 roadmap full of ambitious updates. The Accelerator Core upgrade promises faster performance, while the new Toncenter API and L2 payment networks are aimed at making the interaction more smoothly. In addition, adding a BTC teleport, which is a function that can simplify Bitcoin transmission, will make TON’s global expansion prospects firm.

With this in mind, pay attention to the main support of $ 4.75 and the next breakthrough resistance of $ 5.08. The decline in toncoin can be a break for a while. In particular, if the RSI reaches the excess area, it may be a moment to be integrated before potential rebound.

disclaimer

According to the trust project guidelines, the information provided to this page is not intended and should not be interpreted by law, tax, investment, finance or other forms of advice. It is important to find independent fiscal advice if you can only invest in losses and suspect that you can lose losses. For more information, please refer to the Terms and Conditions and the Help and Support Pages provided by the publisher or advertiser. MetaverSepost is doing its best for accurate and prejudice, but the market situation can be changed without notice.

Author introduction

Victoria is a writer who deals with various technical topics, including Web3.0, AI and cryptocurrency. Through her extensive experience, she can write an insightful article for more audience.

More

Victoria Deste

Victoria is a writer who deals with various technical topics, including Web3.0, AI and cryptocurrency. Through her extensive experience, she can write an insightful article for more audience.