Cryptocurrency summary in late January: Bitcoin lost $ 100K due to market restructuring, and Ethereum faces selling and prices fall.

Victoria D ‘E is

Post: February 3, 2025 9:22 AM Update: February 3, 2025 9:23 am

Edit and fact confirmation: February 3, 2025 9:22 am

simply

In February, Bitcoin lost significant milestones and caused market reactions. Ether Leeum also suffered while the agency athletes moved. TON’s rapid ecosystem expansion has been rapidly corrected.

When January was finished, we did not set the tone in the first week of February. Bitcoin lost a grip on major milestones, causing a chain reaction throughout the market. Ether Lee has gained popularity with him, and the engineer is moving quietly under the surface as usual. Meanwhile, Ton’s fast ecosystem expansion failed to face one of the most rapid price modifications in a few months. As expected, macro economy continues to be volatile. It is clear that last week, we have laid the foundation for the future pivotal stretch. The following is how everything goes.

Bitcoin (BTC)

Bitcoin slipped to less than $ 1 billion this week and continued to slide on a low place at $ 96.8 million.

BTC/USD 4H Chart, Coin Base. Source: TradingView

This drop was not a slow fade. It was a difficult response to Trump’s latest tariff movement. It was a return to a trade war policy where the market price was not completely set. As you know, the United States has cut new imports in China and Canada. , Mexico causes immediate retaliation threats of all three. Investors boasted for economic falls, and the dollar gained robbery when stocks fell and ran away with more money.

source: Donald J. Trump

Bitcoin was not immune to kneeling in spite of the long -term hedge story. Sales pressure accumulated rapidly, falling 7.3% for BTC for a week. But the short -term trader abandoned the bag, but the big player didn’t blink.

source: Between Michael

Microstrategy has doubled the strategy of handling BTC as a long -term preliminary asset, adding $ 1.1 billion to Bitcoin Stash. Meanwhile, Bitcoin ETF continued to attract new capital as its total assets exceeded $ 125 billion.

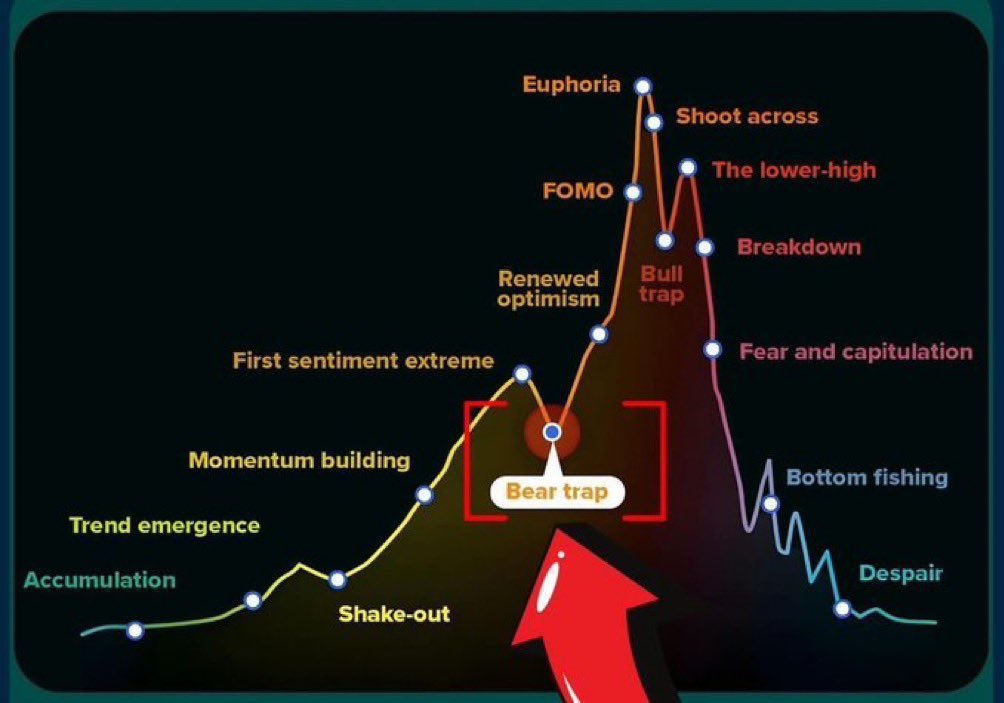

Bitcoin ETF dashboard. source: sand dune

That kind of institutional flow does not suggest a dying market. Conversely, it suggests that the market is leading time. Some analysts are called drop traps. The main argument is that economic shake and inflation risks only strengthen the appeal of Bitcoin.

Bitcoin Bear Trap, Market Psychology. source: teacher

Either way, US labor data will be important next week. Weak job reports can cause fear of economic downturn, and Bitcoin can strengthen its position as an alternative value repository. This can set the stage of recoil in turn. However, if the number becomes stronger, the dangerous appetite can be low and the BTC is trapped in this range.

Ether Leeum (ETH)

As Bitcoin crashed, Ether Leeum had no choice. Bitcoin’s dominance has passed 60.59%Altcoins discharged liquidity and ETH had difficult diving.

Currently, Bitcoin dominance is 60.59%. source: TradingView

This decline consisted of a steep sale from $ 3,546 to $ 2,802, deleting nearly 21%in a few days. After the ETH lost its support of $ 3,100, the failure gained momentum, and as the merchant withdrawal from danger, it accelerated the decrease.

The 50 -cycle SMA of $ 3,194 has already been a resistance to strengthen its weakness. RSI is now located at 23.63, indicating that pressure sales can be exhausted in the deeper areas.

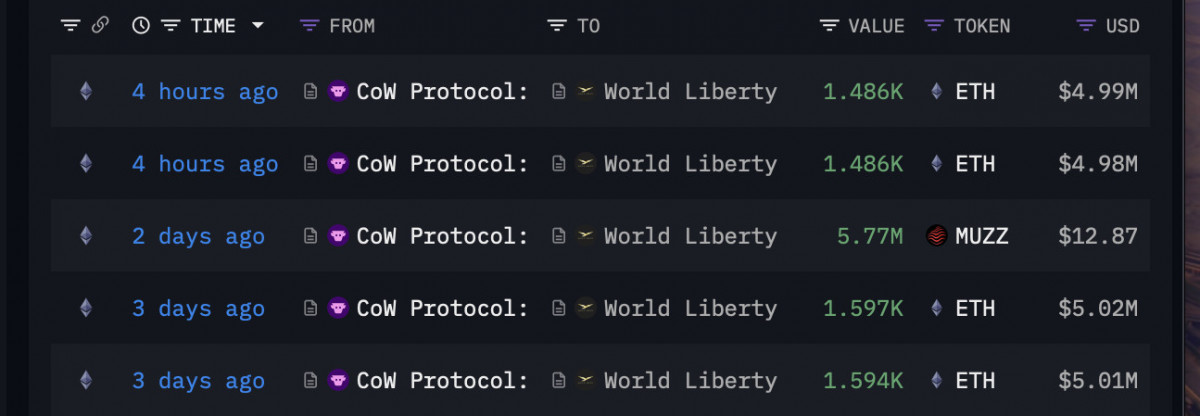

Buy the latest $ 10m ETH of World Liberty Financial. source: Arkham

In that sense, some big players seem to have found a big opportunity here. The Liberty Financial quietly bought a $ 10 million ETH and has always been encrypted while the retail merchant is sitting. On the other hand, Bitwise’s Bitcoin-Eteum ETF cleans the initial SEC hurdles, suggesting that ETH is creating more powerful places in the institutional portfolio.

Screenshot of SEC approval 19B-4. Source: SEC

In general, these movements were optimistic but low risks, so it was not enough to change market emotions. Ether Lee now requires a catalyst to restore exercise, which can come to the resurrection of network activities or to a wider market recovery. Clean rest of $ 3.5K can overturn the trend, but until then ETH follows Bitcoin’s lead.

Tone (ton)

Despite the last few weeks of price behavior, tone once again expanded the ecosystem. In the last few days, Ton has fallen more than 20%and has dropped from about $ 5.40 to $ 3.98 in a steep sale.

Tone/USD 4H chart, coin base. Source: TradingView

The 50-period SMA has a downward downward trend and strengthens the weak momentum, while the RSI has dropped deep in the rapid territory of 20.99. It usually shows a signal to sell fatigue, but the buyer is not yet in a hurry because Bitcoin is under pressure and Altcoins are having difficulty.

Source: Custody Display

Despite the decline, institutional interest in Ton went ahead. First of all, the Zodia custody of Standard Chartered adds support for TON’s Jetton Token Standard, allowing large -scale financial players to manage ton -based assets. At the same time, Crypto BOT can integrate Gram DNS to send transactions using domain names that can be read by users instead of complex addresses. This is an upgrade that makes Ton’s ecosystem more user -friendly.

Source: Gram DNS

In terms of the wallet, Mytonwallet is ready to strengthen the integration with The Telegram’s financial tools through the Mytonwallet Pay, which has launched a major update and adds support for HD’s Telegram futures and makes it possible to pay through Mytonwallet Pay.

Perhaps the most important change was in network security. The minimum stake required to start tone validation was likely to have soared in January. This raises confidence in TON’s long -term prospects despite the cost of higher entry threshold. In general, if Telegram continues to integrate the blockchain function, TON can quickly go to the main player to the main player when the market is in danger.

Bitcoin is still under control and everything else is responding to the movement. Perhaps the drop was not a complete collapse. Who knows? Clearly, Smart Money does not leave. The inflow of ETF was powerful and the institutional accumulation did not stop. Next week’s labor data may be a spark that returns Bitcoin to more than $ 1 billion and attracts the rest of the market. If not, you can see that merchants act more sideways while waiting for the next big catalyst.

disclaimer

The trust project guidelines are not intended and should not be interpreted as advice in law, tax, investment, finance or other forms. If you have any doubt, it is important to invest in what you can lose and seek independent financial advice. For more information, please refer to the Terms and Conditions and the Help and Support Pages provided by the publisher or advertiser. Metaversepost is doing its best to accurately and unbiased reports, but market conditions can be changed without notice.

About the author

Victoria is a writer about various technical topics, including Web3.0, AI and Cryptocurrencies. Through her extensive experience, she can write insightful articles for more audience.

More

Victoria D ‘E is

Victoria is a writer about various technical topics, including Web3.0, AI and Cryptocurrencies. Through her extensive experience, she can write insightful articles for more audience.