Crypto Weekly Update: Bitcoin falls to $ 82K from Fed and ETF leaks. Ether Lee is less than $ 2.1K, and tones struggle to hold $ 2.7.

Victoria D ‘E is

Post: March 10, 2025 12:27 PM Update: March 10, 2025 12:27 PM

Edit and fact confirmation: March 10, 2025 12:27 pm

simply

Bitcoin goes to 82K for Fed Fears and ETF leaks, while Ether Leeum is less than $ 2.1K, with a weak demand, with less than $ 2.7.

Bitcoin (BTC)

Over the past week, Bitcoin slipped from $ 90,000 to about $ 82,500, riding a rough ride. In the four-hour chart, it is clean and clean through 50-SMA of $ 87,406 and is currently tempted to RSI level (36.9). Let’s find out what is behind this slide.

BTC/USD 4H Chart, Coin Base. Source: TradingView

One of the biggest hits came from the tremendous exaggerated Trump “Strategic Bitcoin Protection Zone”. In the end there was nothing.

Suis: White House

Of course, the government said it would hold onto the existing Bitcoin. The market did not like it.

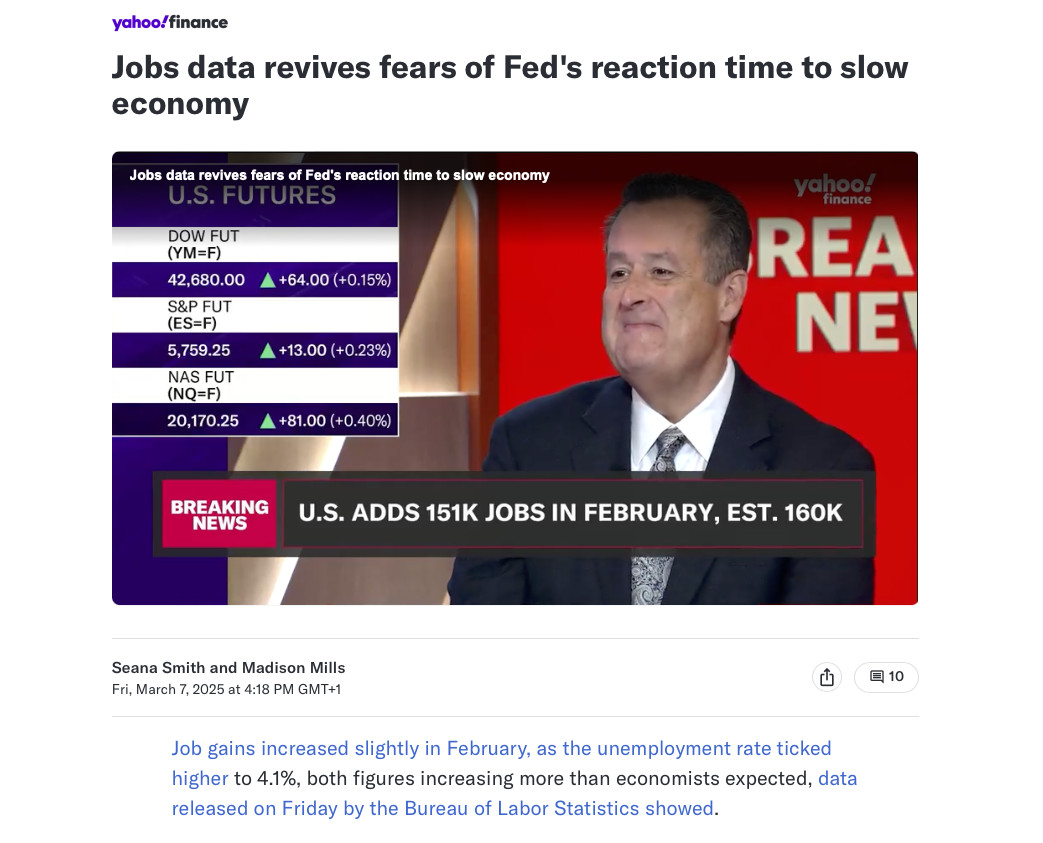

Source: Yahoo! financial resources

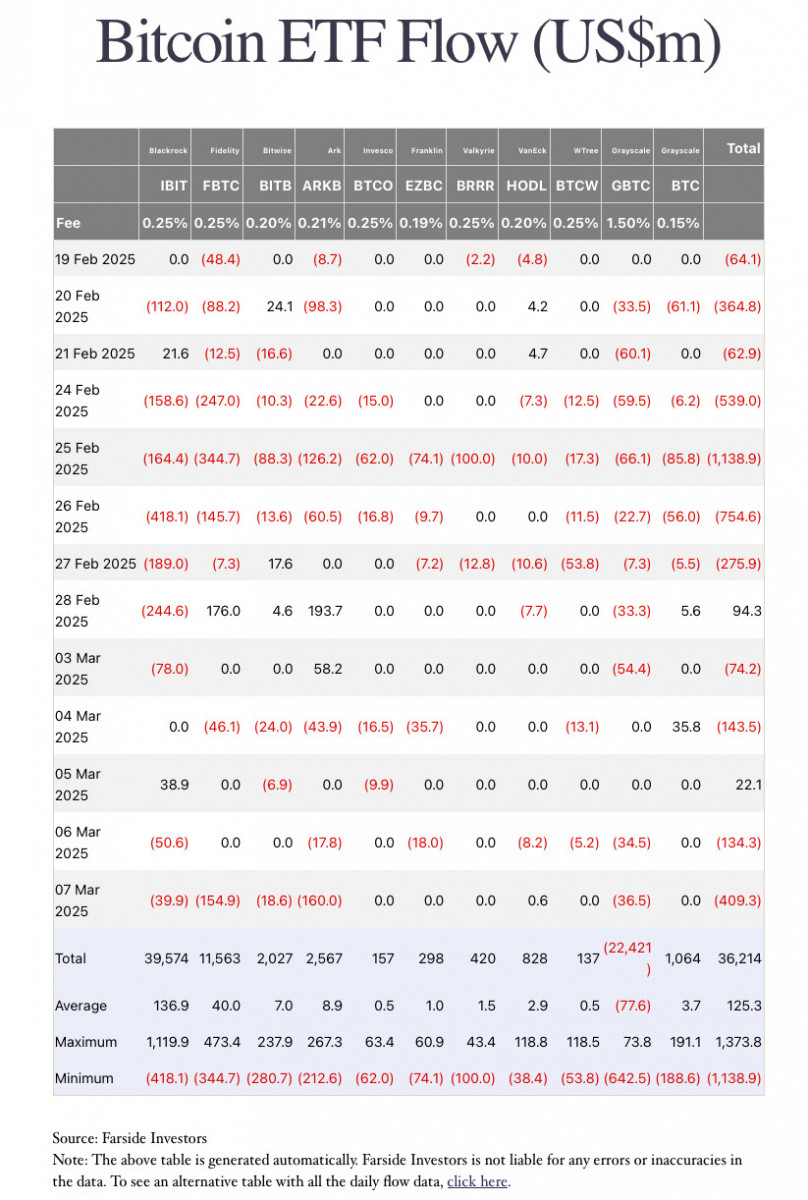

At the same time, strong US job data and continuous inflation signals have almost been hopeful for the Fed Fed Rates, which are under pressure at risk assets such as Bitcoin. In order to make matters worse, ETFS has leaked more than $ 370 million after Trump’s speech, and now the government has a whisper to some governments hidden by Bitcoin.

Source: FARSIDE Investors

Bitcoin has rapidly surged for $ 80,000, but now it is a breakdown of the level. Nevertheless, if the wider feelings continue to taste sour, the floor can be easily seen. Traders are now laser -centered in the range of $ 78,000 to $ 82,000. If Bitcoin is broken under it, the situation can be much messy.

Ether Leeum

Ether Lee is not much better than Bitcoin. As you can see on the shared chart, we’ve been dragged from $ 2,400 to about $ 2,070. The RSI is limping along 39, and the price behavior is still trapped at $ 2,199 under 50-SMA, so there is almost no sign of power.

ETH/USD 4H Chart, Coin Base. Source: TradingView

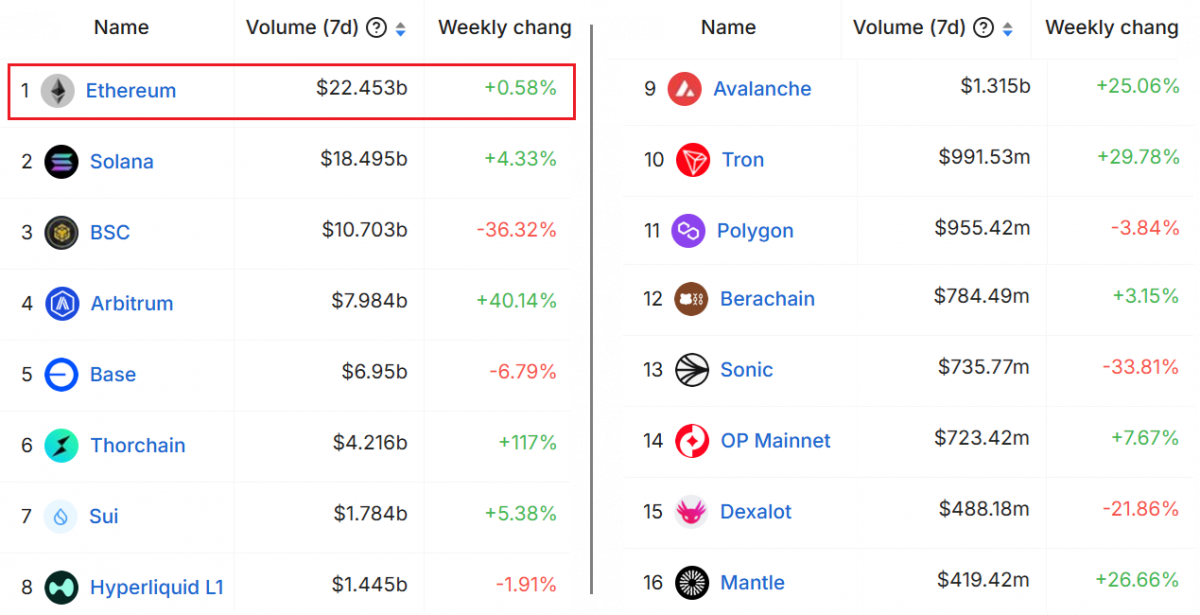

The big part of the ETH’s slump is related to the wider market response to the overwhelming Trump Bitcoin preliminary news, but Ether Lee has its own baggage. This week, the defect and staying activities were sluggish, raising questions about chain demand. In addition, chattering about the delay in PECTRA upgrade is growing, which does not help confidence.

7 days diversified exchange volume, USD. Source: Defillama

Another blow: Trump’s Bitcoin protection area mentioned Zero about Ether Lee, and ETH hopes to get a piece of “strategic asset.” It was a cold shoulder for ETH holders who nodded the institutional head.

Ethereum is still moving in Bitcoin and Lockstep. Therefore, if the BTC does not find a foothold, the ETH seems to be able to run another running at a $ 2,000 psychological level. On the contrary, if the macroscopic conditions change (e.g., if the fare is reduced), Ether Leeum can set a sharp bounce due to the close proximity to the long -term support. But now, merchants are noticeable $ 2,000 for sand.

Tonore (ton)

Toncoin (TON) has a much harder time than the major, and it slides from about $ 3.40 to $ 2.68, and the RSI drops to 24.0, and the large amount of territory is deep. But so far, there is no real sign of the bounce. Drop reflects a wider risk atmosphere throughout the encryption, but TON’s slide has been partially excluded from the US protection area, so it has been bitcoin for a while.

Tone/USD 4H chart. Source: TradingView

Unlike BTC and ETH, TON has no big institutional money after that, so Ton tends to be more difficult when the entire market begins to be in danger. If Bitcoin can’t keep it steadily, Ton can slide more easily, and traders can slide more easily by watching the next landing point of $ 2.50- $ 2.60. Nevertheless, if the RSI can win, even the small rally of Bitcoin or Ether Lee can start a sharp and fast bounce, but it can be a tactical transaction rather than a long -term recovery signal.

Source: Tone Blog

Meanwhile, a lot of things happen under the hood in the tone ecosystem. Ton Core just launched an accelerator upgrade and pushed the network capacity beyond 100,000 TPS. Now we are trying to reduce the waiting time for transactions to improve the user experience. But they are a definite technical signpost, but at least not yet translated.

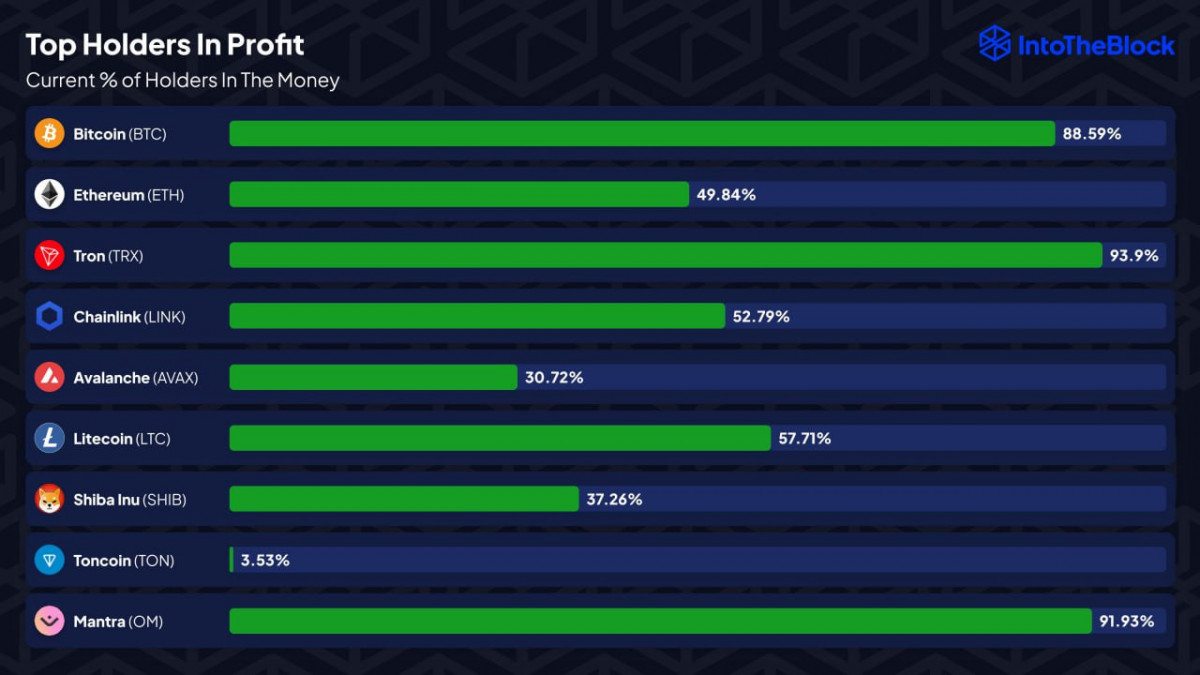

Source: INTOTHEBLOCK

In addition to the weakness of the weakness, only about 3.5%of the tone holder gained the current profit, which is one of the main blockchains.

Finally, long -term regenerative brewing, such as Ton Ventures’ new AI and Crypto Research Initiative, and Telegram can add paid DM to reconnect to the ton ecosystem. But the chart is currently talking about the story. If Bitcoin does not soon find a foothold, the tone will not be pressed even if it is primed for short -term bounces for wider market relief.

disclaimer

The trust project guidelines are not intended and should not be interpreted as advice in law, tax, investment, finance or other forms. If you have any doubt, it is important to invest in what you can lose and seek independent financial advice. For more information, please refer to the Terms and Conditions and the Help and Support Pages provided by the publisher or advertiser. METAVERSEPOST is doing its best to report accurate and prejudice, but market conditions can be changed without notice.

About the author

Victoria is a writer about various technical topics, including Web3.0, AI and Cryptocurrencies. Through her extensive experience, she can write insightful articles for more audience.

More

Victoria D ‘E is

Victoria is a writer about various technical topics, including Web3.0, AI and Cryptocurrencies. Through her extensive experience, she can write insightful articles for more audience.