Crypto Weekly Recap: Bitcoin falls to $ 80K before rebelling, Ether Lee is ETF uncertainty, tone burning USDT boom

Victoria D ‘E is

Post: March 3, 2025 12: 5 update: March 3, 2025 12:05 pm

Edit and fact confirmation: March 3, 2025 at 12:05 pm

simply

Bitcoin has dropped to $ 80K before rebounding to $ 93K due to Trump’s password reserve news and ETF inflow. Ether Lee is struggling with ETF delays, and TON has seen USDT growth but is faced with unlocking tokens.

Okay, so in the 80’s Did wake up. Bitcoin was absolutely bumped into an unpleasant blow, but it fell less than $ 80K in hot seconds before rebounding like a boxer who refused to stay.

BTC/USD 4H Chart, Coin Base. Source: TradingView

The bounce was violent-that was, 93K. Surprisingly, however, he hit the wall from the 50 -period moving average of the 4H chart (see screenshot). RSI was first excited and cooled. Now we are at that awkward stage. Is this just a dead cat bounce or is Bitcoin preparing for another running?

So did you actually move the market?

Trump’s encryption preliminary bomb

This came out anywhere. Trump -Yes. The same person, once called Bitcoin, said it could include BTC, ETH, SOL, XRP and ADA in the US password protection area. And like the same, Bitcoin shot the gun as if there was an espresso.

source: Donald J. Trump

This movement clears up a lot of shorts to create classic short pressure. But real -political promises and market happiness are about oil and water. The question is that this is actually changing the long -term thing?

ETF flow finally overturns positive

For several weeks, I wondered if Bitcoin Spot ETF was bleeding and everyone was losing interest. But BOOM -Ark 21Shares and Fidelity’s Bitcoin ETFS saw the net inflow of $ 369.7m and finally gave something to work with Bulls.

From February 18th, it will flow to the US Spot Bitcoin ETF. Source: Distant investor

Is this the beginning of a bigger trend? maybe. But ETF buyers are notorious. So do not burst champagne yet.

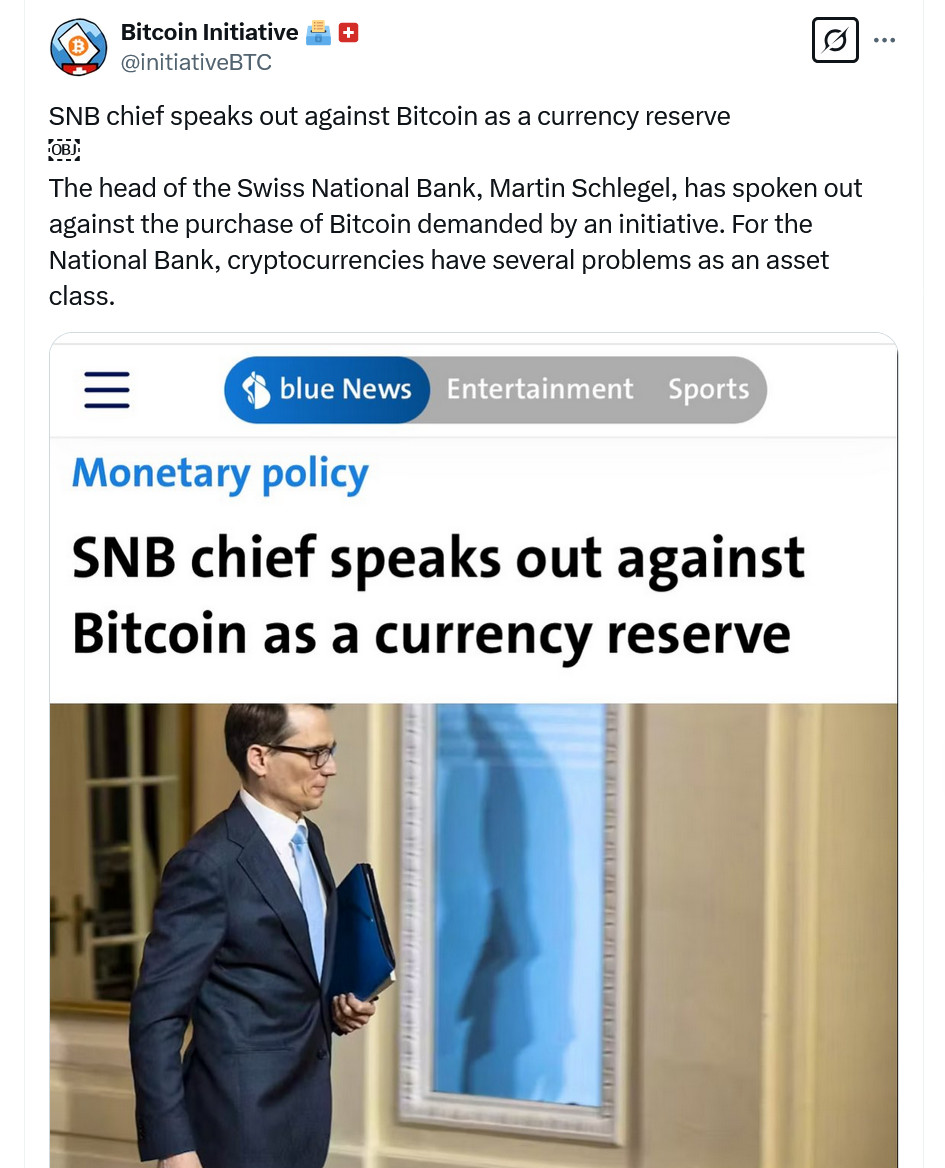

Swiss National Bank Dunk in Bitcoin

Trump was busy in reducing BTC, but Swiss National Bank decided to kill the mood, saying that Bitcoin is too volatile to be a preliminary asset.

source: Bitcoin Initiative

Now I came from a famous country for a very conservative financial policy, but it was not shocking. But it injected the short -term FUD into the market. Trump’s story was bigger and the volume was won in the market.

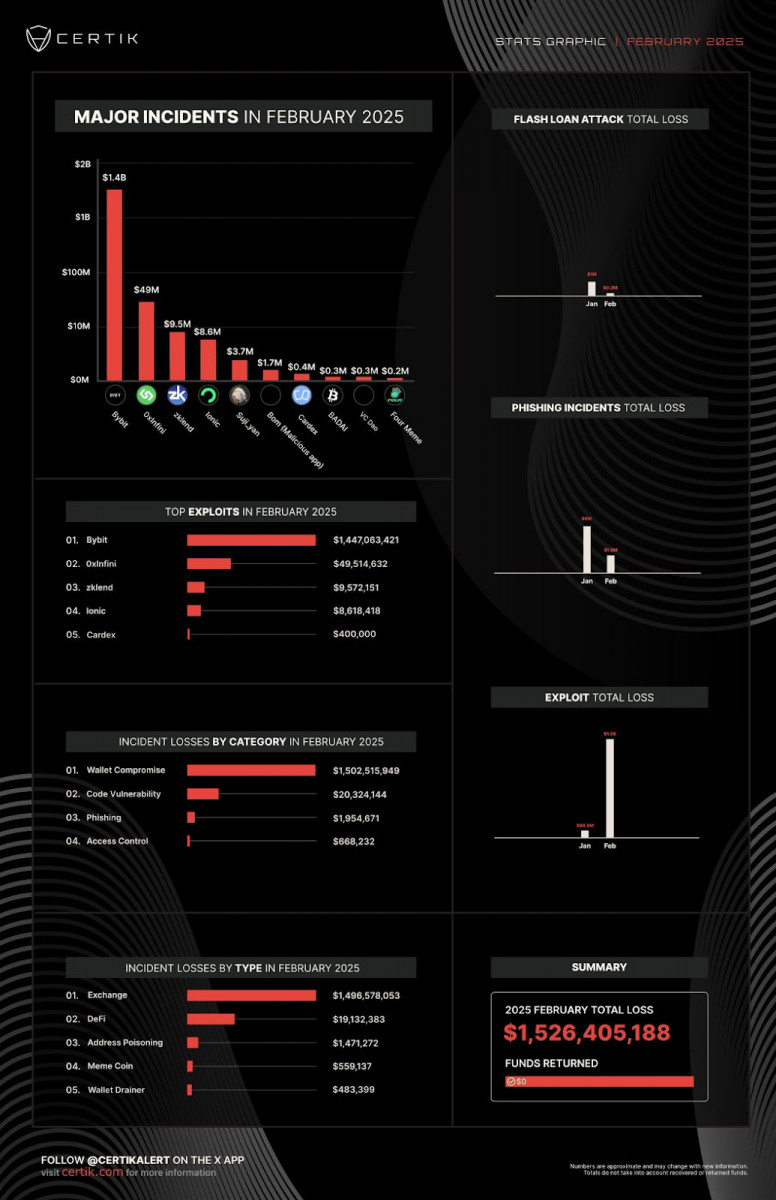

Bybit Hack: $ 1.4B disaster

Just as there is no problem with the market, BYbit Hack has descended and North Korean hackers have washed a large mass of stolen encryption.

BYBIT suffered the biggest loss in February, followed by the stablecoin payment company Infini and the decentralized money loan protocol ZKLEND. source: certification

This is a cruel In particular, after trialing the fear of exchange security, I face emotions. And if history tells us something, the regulators are probably preparing to polish the knife and crack down.

The largest CME gap (eg, forever)

Here is something fun: A $ 10K gap It was held at Bitcoin CME FUTURES.

CME gift gap. source: Joe Mccann

If you were around the block, we know that there is a habit of “filling the gap.” In other words, the reconsideration of $ 83K -$ 85K will not be shocking. Merchants see this like a hawk.

So where do you leave Bitcoin?

Of course, Bitcoin’s recovery was impressive, but don’t pretend to be out of the forest yet. The 50-SMA rejection is not a big signal, and if the ETF buyer doesn’t come in, you can easily see another drop in $ 85K. On the other hand, if Trump continues to push the encryption narrative and picks up ETF demand, you may be seeing another attempt to prohibit $ 95K – $ 100K. Either way, I look forward to it volatility.

Ether Leeum (ETH)

Ether Lee has a similar beat to Bitcoin and has plunged to $ 2,000 near $ 2,900 before starting a comeback. It briefly recovered $ 2,500, but like BTC, there was a problem in the 50 -period moving average of the 4 -hour chart (see screenshot).

ETH/USD 4H Chart, Coin Base. Source: TradingView

RSI has surpassed 60 before cooling and suggests some exhaustion in bounce. In $ 2,381, ETH is emerging in an unstable area, and traders are watching whether they can build more than $ 2,300 or if other legs are coming.

Now let’s dig into Ether Lee’s drama. First of all, the Ether Leeum Foundation announced a leadership shake after complaining for several months in the community.

The king described the left and the star Dak described to the right. source: Ether Leeum Foundation

Whether this brings fresh momentum still remains. Meanwhile, the long -awaited PECTRA upgrade is getting closer and promised to improve the major improvement of scaling and MEV relaxation.

source: Nic puckrin

However, as usual, regulatory uncertainty is weighed to ETH. The SEC once again delayed the decision on Etherum ETF options, and the trader once again is advantageous.

ETH/USD 4H Chart, Coin Base. Source: TradingView

Ether Lee’s short -term fate is still tied to Bitcoin, but these internal catalysts can give independence. If the BTC remains more than $ 90K, the ETH will get another shot for $ 2,700 or $ 3K. But if Bitcoin is found or a regulator throws another wrench in a mix, Ethereum can slip to less than $ 2,100. Either way, look forward to more turbulence.

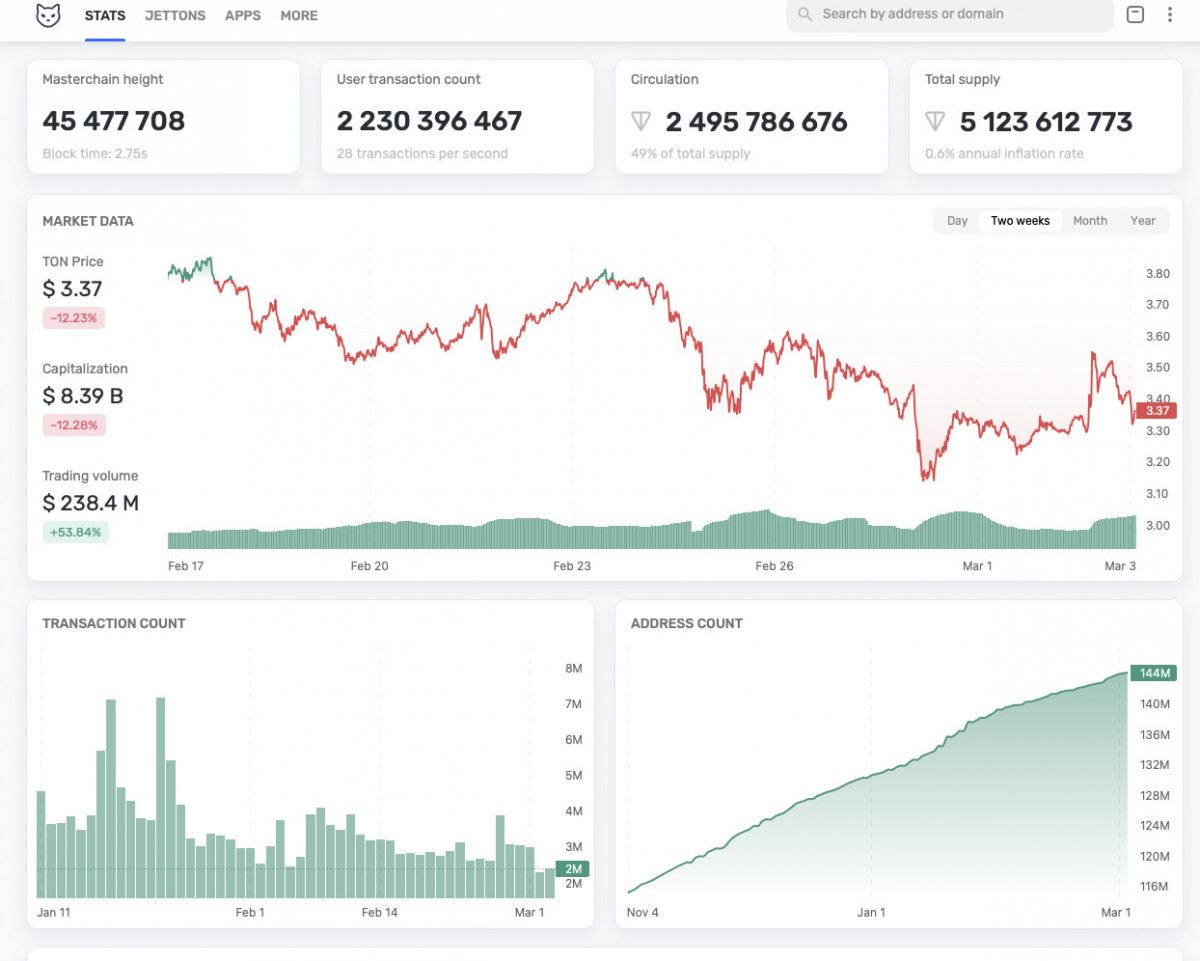

Tonore (ton)

Ton has been doing his work mainly under the radar. Of course, it fell with the rest of the market, but it was maintained better than most of the $ 3.10 zone and exceeded $ 3.50 before it fell into a 50-SMA resistance (see chart). authoritative. RSI sat at 47.42 -basically, Limbo was not overrowers.

Tone/USD 4H chart. Source: TradingView

First of all, let’s talk about ‘real’ adoption. In the last 10 months, USDTs of $ 1.5 billion have been published in tones, which is actually a liquidity game change.

Source: Artemis

More USDTs in the blockchain means a stronger foundation for better transaction conditions, deeper orders and defiers. Add Mytonwallet to start the Telegram Mini-App and make it easy to use tone wallets.

Source: telegram

Then there is a token lock on March 2 -5 million tons will be released in the market.

Source: Tronscan

Now, depending on who owns and what you are planning, this can be a slight collision or short -term headache on the road. But considering how elastic tone is, all dip can be just a deep opportunity.

reduction

In the short term, there is a volatility of the future. The BTC rally can slow down, and Ton’s unlocking can add turbulence. But on a wider scale, encryption has returned to the mainstream conversation, and Trump’s next sound bite will shake the market again, whether you love or hate him.

disclaimer

The trust project guidelines are not intended and should not be interpreted as advice in law, tax, investment, finance or other forms. If you have any doubt, it is important to invest in what you can lose and seek independent financial advice. For more information, please refer to the Terms and Conditions and the Help and Support Pages provided by the publisher or advertiser. Metaversepost is doing its best to accurately and unbiased reports, but market conditions can be changed without notice.

About the author

Victoria is a writer about various technical topics, including Web3.0, AI and Cryptocurrencies. Through her extensive experience, she can write insightful articles for more audience.

More

Victoria D ‘E is

Victoria is a writer about various technical topics, including Web3.0, AI and Cryptocurrencies. Through her extensive experience, she can write insightful articles for more audience.