join us telegram A channel to stay up to date on breaking news coverage

According to Bitcoin price predictions, BTC is showing strength for the fourth consecutive day as technical indicators are heading north.

Bitcoin prediction statistical data:

- Current Bitcoin price – $72,532.71

- Bitcoin market cap – $1.44 trillion

- Bitcoin Circulating Volume – 19.77 million BTC

- Bitcoin total supply – 19.77 million BTC

- Bitcoin CoinMarketCap Ranking – 1st

Bitcoin (BTC) demonstrates the potential rewards of an initial investment in cryptocurrency. Starting at $0.04865 in July 2010, Bitcoin has surged more than 149 million% in 14 years, marking one of the most significant financial gains of all time. Today, BTC trades between $68,473.60 and $72,685.30, reflecting its impressive long-term growth. Even after reaching an all-time high of $73,750.07 in March 2024, Bitcoin still remains a top choice for investors, demonstrating the value of early participation in promising cryptocurrency projects.

BTC/USD Long-Term Trend: Bullish (Daily Chart)

Main level:

Resistance levels: $79,000, $81,000, $83,000

Support levels: $64,000, $62,000, $60,000

BTC/USD currently maintains a long-term bullish stance, which is reflected in its continued upward movement on the daily chart. However, the market’s strength has not been given full confidence in recent months, with the price of Bitcoin consolidating within a range of $54,000 to $73,500. This means that despite the optimistic short-term signals, a breakout higher is needed to confirm a sustained upward trend.

Bitcoin Price Prediction: Will Bitcoin Reach $73,000 Level?

Bitcoin’s 9-day moving average is currently hovering above the 21-day moving average, indicating bullish momentum as the price attempts to break through the channel upper limit. However, Bitcoin has struggled within these moving averages over the past few weeks, suggesting that BTC/USD may experience a short-term bearish move before rising again. This consolidation reflects technical resistance and a possible pullback to the $60,000 range before a sustainable breakout occurs, with upcoming fundamental events putting pressure on the current trend.

Nonetheless, if Bitcoin manages to close the day above the $73,000 resistance level, the door could be opened for a rise to $79,000, $81,000, and even $83,000. Conversely, failure to hold above the moving average, currently trading at around $72,532, could send BTC down to a daily low of $69,581. If the decline deepens, important support levels at $64,000, $62,000 and $60,000 may stabilize. Moreover, these range-bound trades highlight the potential for continued consolidation before a more definitive trend emerges.

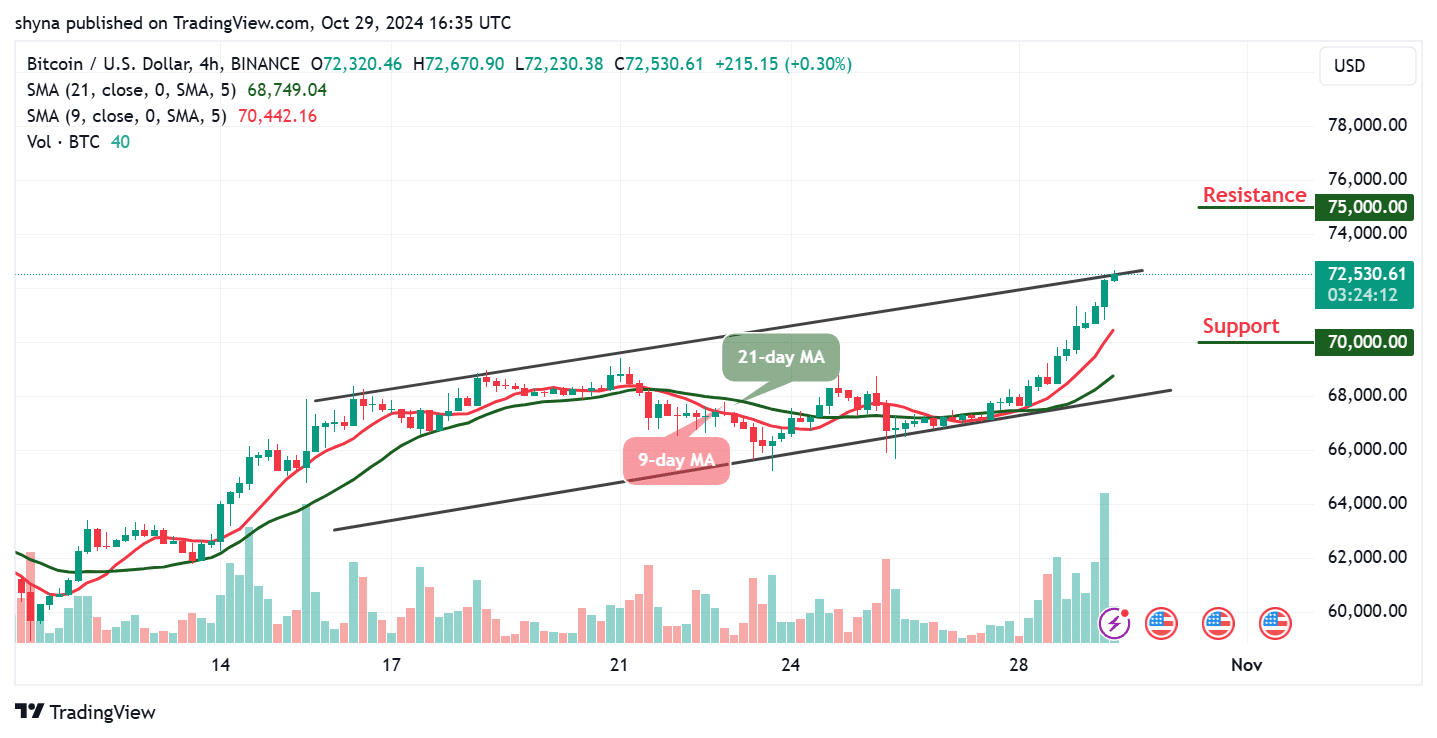

BTC/USD medium-term trend: Bullish (4H chart)

The 4-hour BTC/USD chart shows that Bitcoin is currently trading above the 9-day and 21-day moving averages, indicating that it has crossed the channel upper limit. This momentum could push the price towards resistance levels above $75,000. However, Bitcoin may consolidate near the cap, so buyers will need to hold positions to support continued growth.

Looking at the 9-day moving average and the 21-day moving average, we can see that BTC price may continue its upward trend with a surge northward. Conversely, if the coin decides to cross below the 9-day and 21-day moving averages, it could find support below $70,000.

Meanwhile, @CryptoBheem, which has over 54,000 followers on The price could still experience a significant retest before rising to 74.1k. To minimize the possibility of retesting, the sub-period (LTF) should be consolidated above 71k. Be prepared to buy when the price falls.

$BTC Update:

Everyone is chasing this breakthrough.

Be careful as the price may be tested again before it goes up to 74.1k.

If the possibility of a retest is eliminated, LTF should now start cutting sideways above 71k.

Get ready to buy this dip. pic.twitter.com/2z7BB4vKXG

— Ahmed (@CryptoBheem) October 29, 2024

Bitcoin Alternatives

An important factor supporting Bitcoin’s price dominance is its strong position compared to altcoins, which have failed to regain strength after recent bearish momentum. A high Bitcoin dominance ratio indicates that investor sentiment primarily favors Bitcoin over other cryptocurrencies. Meanwhile, Pepe Unchained has raised $23 million to date, providing a promising pre-sale opportunity in the meme coin sector as it targets early investor interest. By gradually increasing the price during the pre-sale, early buyers can benefit from a lower entry point and profit potential even before the coin is listed.

PEPE MEME Coins easily win 50x to 100x.

Despite its high-risk nature, Pepe Unchained’s strategic incentives and technical framework make it a potentially rewarding choice within the meme coin space, although thorough research is recommended. The unique pricing structure provides a low entry point for early investors, creating the potential for immediate profits once the coin is publicly listed.

Visit Pepe Unchained

Related news

Most Searched Cryptocurrency Launch – Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Cointelegraph Special

- Thanks to SolidProof and Coinsult

- Staking Rewards – pepeunchained.com

- Over $10 Million Raised in ICO – Ending Soon

join us telegram A channel to stay up to date on breaking news coverage