Victoria D ‘E is

Post: April 21, 2025 12:59 Pm Update: April 21, 2025 1pm

Edit and fact confirmation: April 21, 2025 12:59 pm

simply

Last week, Bitcoin finally broke up, Ether Lee was carefully followed, tone coin quietly built momentum, and suggesting the encryption market could actually wake up.

It feels like we’re in breath for several weeks. I’m waiting for something to be broken, moving, or at least blinking. Well, last week was finally delivered. Bitcoin has shown appropriate movements by blocking cutting, and suddenly it began to act as if the whole market remembered the transaction method. Ether Lee Rium continues to be carefully working carefully. ton? I’m still watching in a side job. But there is a glance in the BTC. Let’s look at what’s just happening and what it sets.

Bitcoin (BTC)

Bitcoin popped out of the holding pattern for a week, as it was somewhere, and surpassed $ 87,500 after grinding between 83K and 86K for several days.

BTC/USDT 4H Chart, Coin Base. Source: TradingView

The brake out did not come anywhere. The mix of trade policy relief, the ETF flow turned the corner, and the noticeable profits from institutional buyers were brewed.

Sayler

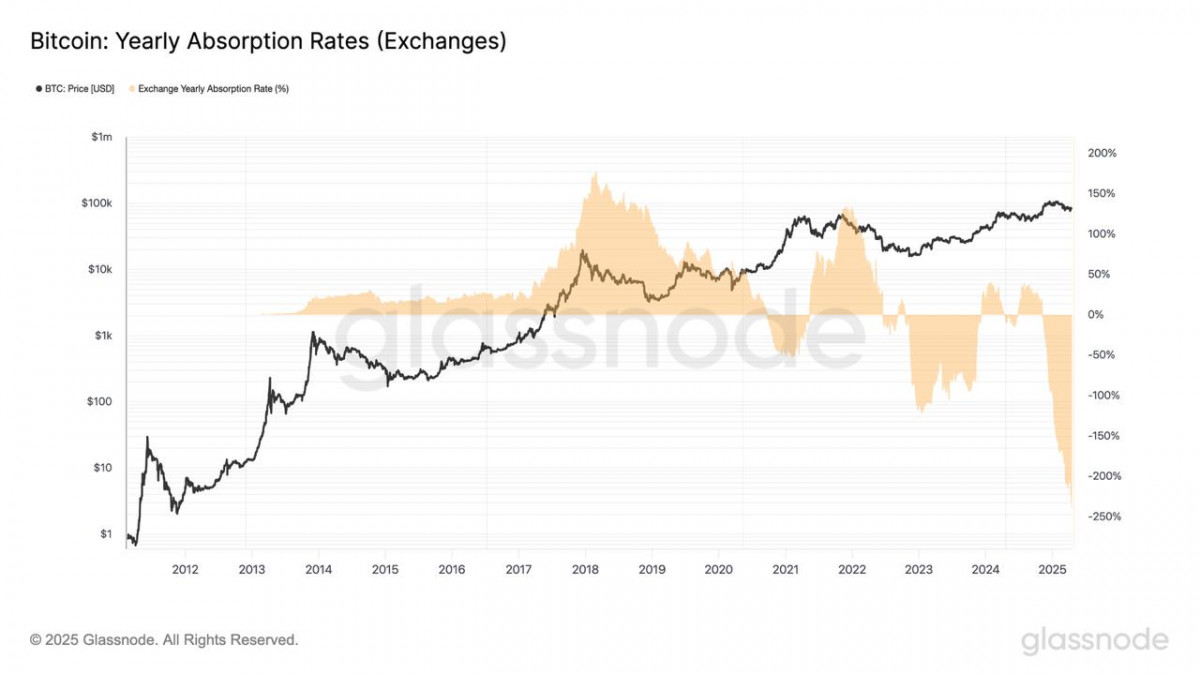

Saylor has returned to a $ 225 million buying, and the inflow of ETF has now stopped bleeding, and the whale is known to have absorbed the newly mined BTC supply this month.

Bitcoin annual absorption rate. Source: Glass Node

Meanwhile, Trump’s tariffs on technology products gave reasons why they breathe to risky assets. The STABLECOIN regulations are surprisingly soft tones of the Fed and suddenly BTC seems to have returned to the attack.

Therefore, Momentum is strong but hot -RSI is already screaming at 4H. In other words, if we maintain more than $ 85K for a long time, it can then come sooner than the pushes for $ 90K. The market is currently acting as if it is shaking in the slump in early April.

Ether Leeum (ETH)

ETH is tagging to ride by recovering $ 1,650 after the shuffle version to the side of its own version.

ETH/USDT 4H Chart, Coin Base. Source: TradingView

Compared to Bitcoin’s clean brake out, Ethereum’s movement feels like a reluctant follow -up. It is up and down -but it hasn’t been truly broken in the range. It is partially because ETH was quiet on the catalyst front. The SEC has delayed the decision of the ether steaking ETF, and the adoption of the layer is not made in a way with the headline. Even the proposal to exchange EVM for Vitalik’s RISC-V, Dev Circles’s big deal has almost never moved the needle.

Buterin provides a number that suggests that implementing a proposal can lead to 100 times efficient efficiency. source: Vitalik buterin

Nevertheless, there is a silver lining. The gas fee is the lowest point in five years. This is good for users, but it signals thin activity in Defi and NFT.

source: single

Therefore, ETH is trapped in this strange intermediate point. The wider market optimism is waiting for rich but to lead. Expect it to continue playing the second violin to Bitcoin until it appears.

Tonore (ton)

The tone is still in the room and has not moved yet.

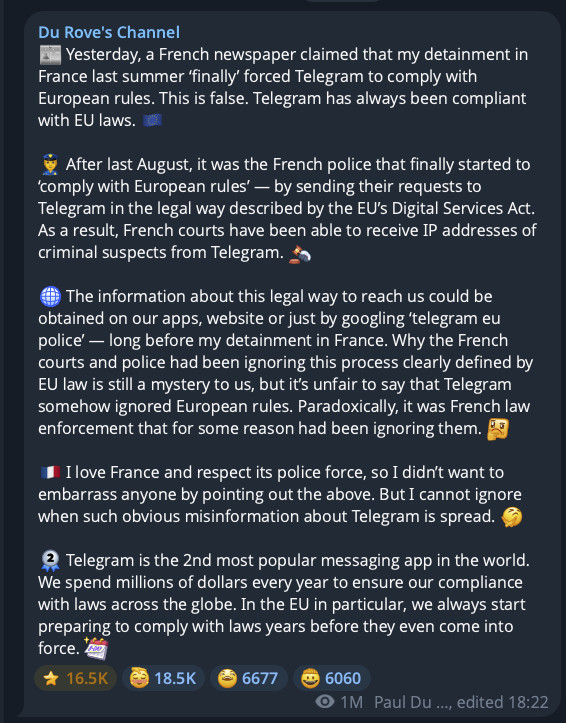

Tone/USD 4H chart. Source: TradingView

Toncoin has finally returned to $ 3.00 after holding a rigid range between $ 2.88 to $ 3.10. I did not follow BTC or ETH as a real belief, but there is a steady upward pressure. The foundation is still being built quietly. The difference now is the atmosphere around the ecosystem. There was a concern about a continuous legal investigation of French Telegram founder Pavel Durov, but this week’s update helped to liquidate the air. Durov publicly reaffirmed that Telegram comply with the EU law and pointed out that the French authorities turned into more constructive communication since 2024. His legal team even described the direction of the case as “positive,” which calmed the nerves in Ton’s tight community.

Source: @rove

Meanwhile, in terms of the product, Mytonwallet quietly released a new feature called a limited edition NFT card that personalizes the wallet interface. There is nothing groundbreaking yet. However, this key rollout, which is paired with the continuous influence of Telegram, slowly strengthens the foundation under the price.

Therefore, Ton is not torn like a BTC, but the foundation is laid. If Bitcoin continues to drive high, don’t be surprised if the tone suddenly grabs a bid and breaks the $ 3.10 ceiling.

But at this time, either of them hit the critical mass. Ton’s RSI rises but is not happy, and the price is still located according to 50 SMA. It is a type of chart that seems to be waiting for Bitcoin to reveal the fuse. If the BTC cuts more than $ 90K and is in danger, the tone may ride the waves. Until then, it mainly darkens the major.

What is the market atmosphere?

As we can see, feelings have changed. It’s not happy yet, but it’s no longer a dull mane earlier this month. Customs, Powell, Liquidity Jitter -The macroscopic uncertainty has not disappeared, but the market seems to have set prices.

If Bitcoin can hold a brake out and build more than 88K momentum, the rest of the board can finally start catching up.

disclaimer

The trust project guidelines are not intended and should not be interpreted as advice in law, tax, investment, finance or other forms. If you have any doubt, it is important to invest in what you can lose and seek independent financial advice. For more information, please refer to the Terms and Conditions and the Help and Support Pages provided by the publisher or advertiser. Metaversepost is doing its best to accurately and unbiased reports, but market conditions can be changed without notice.

About the author

Victoria is a writer about various technical topics, including Web3.0, AI and Cryptocurrencies. Through her extensive experience, she can write insightful articles for more audience.

More

Victoria D ‘E is

Victoria is a writer about various technical topics, including Web3.0, AI and Cryptocurrencies. Through her extensive experience, she can write insightful articles for more audience.