Bitcoin and altcoins have been on a bearish trend amidst a wide correction. The crypto market is witnessing a massive shift in long-side liquidation and fundamental sentiment towards bearishness as buyers fail to maintain critical levels. Let’s take a closer look at the on-chain data of the crypto market to find the bottom of the crash.

Liquidation is on the rise

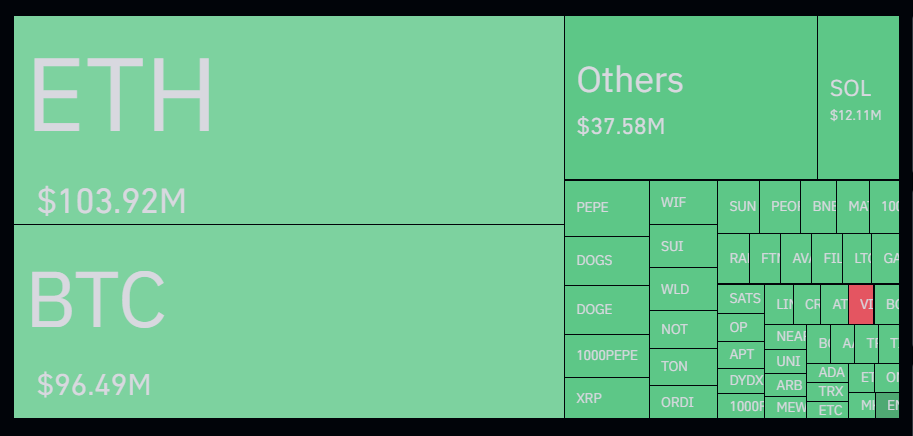

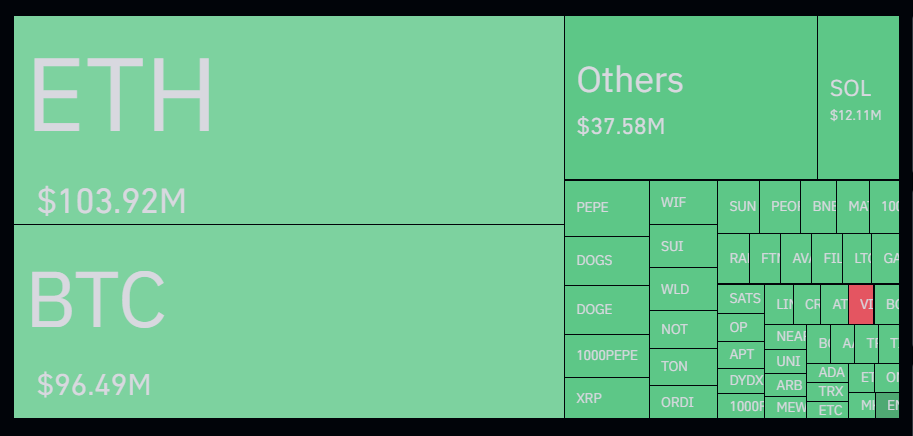

Speaking of liquidations, the cryptocurrency market witnessed a massive surge with liquidations. The entire cryptocurrency market witnessed a surge of $281 million with liquidations, and short positions were $32 million.

Coinglass

So, volatility has spiked amid the cryptocurrency market crash as positions worth over $300 million have been liquidated. In the past 24 hours, Ethereum has liquidated $103 million, Bitcoin has liquidated $96.49 million, Solana has liquidated $12.11 million, and other altcoins have liquidated $37.58 million.

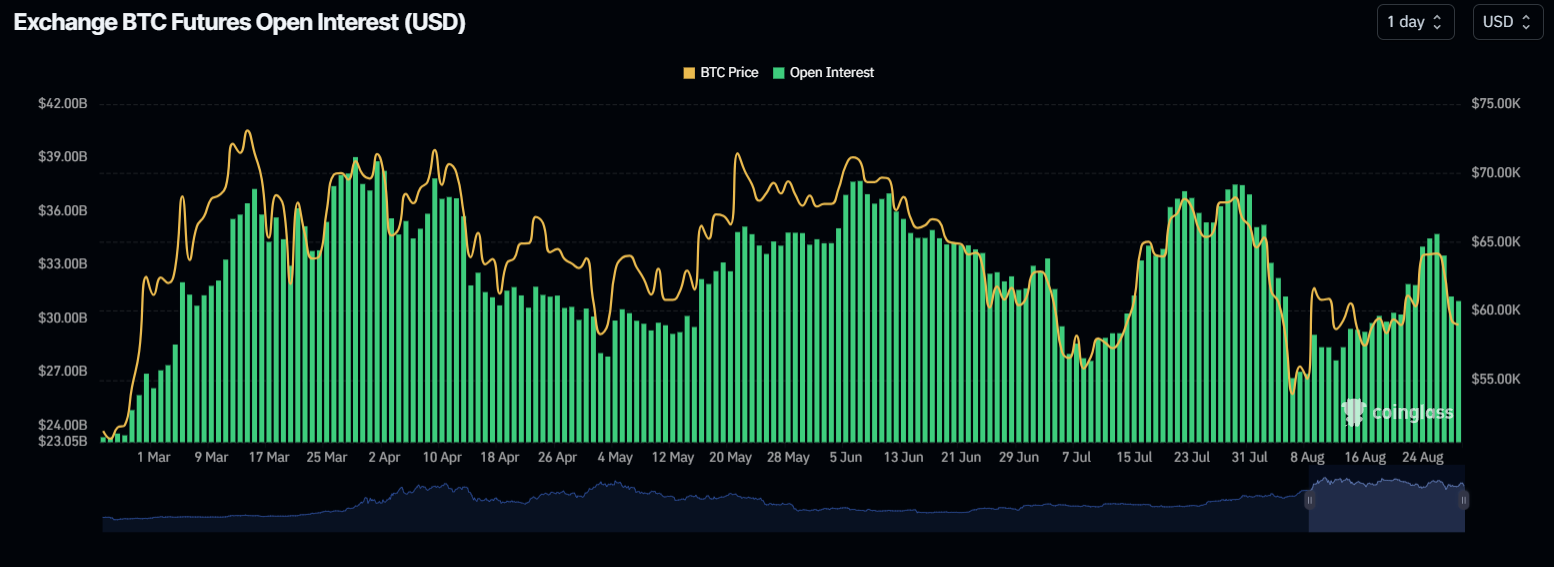

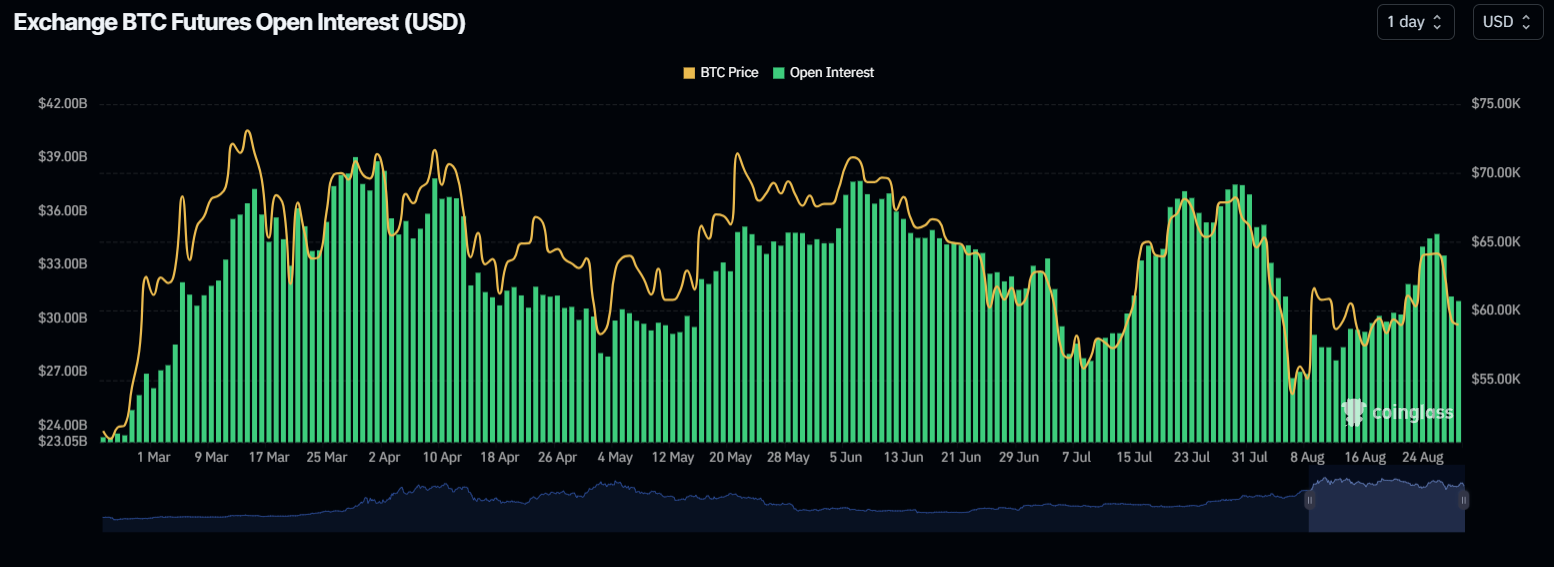

Open interest crash

Coinglass

Since March 2024, Bitcoin’s extremely volatile sideways movement within its massive price range has resulted in equally volatile open interest. The current cryptocurrency market crash has occurred as Bitcoin open interest plummeted from $347.2B to $307.9B in just three days.

Matrixport waits for a sell signal

In a recent tweet from Matrixport, a report suggests that there is no significant news to trigger the current selloff, so the downturn comes with long-term liquidation in illiquid markets.

Currently, BTC is holding the $59,000 support level, and as long as it holds this level, there may be no need to worry about an uptrend.

Stablecoin Market Cap Surpasses $166 Billion

With the market becoming increasingly volatile, the stablecoin market cap has reached an all-time high of $166 billion. An increase in the stablecoin market cap is often a signal for a surge in Bitcoin and altcoin prices. Therefore, based on the historical trend of stablecoin market cap, it is likely to recover from a sudden cryptocurrency market crash.

CryptoQuant

conclusion

In conclusion, the recent cryptocurrency market crash has increased bearish sentiment with $300 million liquidations and a plunge in open interest. However, Bitcoin is holding firm at the $59,000 support level, providing a glimmer of hope for the bulls.

Additionally, the surge in stablecoin market cap to $166 billion suggests a potential recovery opportunity, as historically such increases have often preceded cryptocurrency price increases.