XRP whales seem to be frustrated with the current bearish sentiment. Today, September 19, 2024, blockchain transaction tracker Whale Alert posted on X (formerly Twitter) that XRP whales had dumped 18.03 million tokens worth $10.39 million on Bitstamp cryptocurrency exchange. However, the wallet address is still unknown.

XRP Whale Offloads Millions of Tokens

This significant XRP dump during the downtrend is likely to create selling pressure. At the time of writing, XRP is trading near $0.578 and has experienced a price drop of over 1.8% in the last 24 hours. During the same period, volume has increased by 15%, showing greater participation from traders and investors even amid the market decline.

XRP Technical Analysis and Upcoming Levels

For the past 6 days, the price of XRP has been consolidating between $0.56 and $0.59. According to expert technical analysis, despite the massive selloff and continued consolidation, XRP is still in an uptrend as it is trading above the 200 exponential moving average (EMA). The 200 EMA is a technical indicator used by traders and investors to determine if an asset is trending up or down.

Based on price momentum, it looks like XRP could experience a bullish rally once it breaks out of the consolidation zone. If XRP closes the daily candle above the $0.60 level, it is likely to surge 20% to $0.75 in the coming days.

However, during this potential rally, XRP may encounter resistance near the $0.65 level, where it faces significant selling pressure. This bullish outlook is only valid if XRP closes the daily candle above the $0.60 level, otherwise it may fail.

Bearish On-Chain Indicator

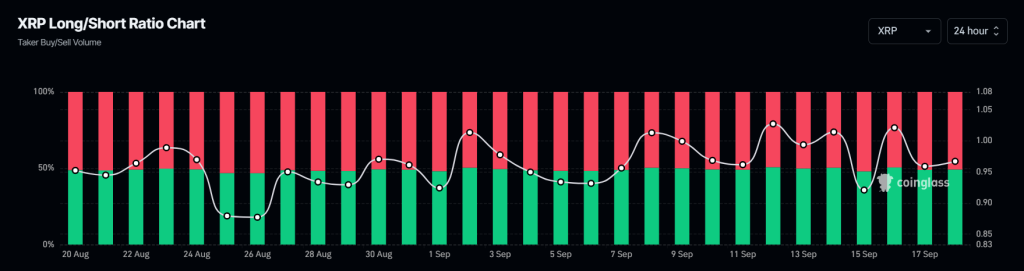

Currently, XRP’s on-chain metrics are showing a bearish trend. The XRP long/short ratio on Coinglass is currently at 0.96, indicating bearish market sentiment among traders. Additionally, futures open interest has decreased by 5.5% over the last 24 hours.

According to the data, 50.85% of the top traders hold short positions, while 49.16% hold long positions, suggesting that the bear market is dominating the asset class.