XRP is up 42% in the past week after rallying nearly 1% on Friday. The altcoin hit a new all-time high on Thursday, surpassing Ethereum (ETH) in 24-hour trading volume. The token could continue its rising streak for several days following President-elect Donald Trump’s inauguration.

XRP could extend its rally alongside Bitcoin.

XRP is up more than 40% in the past week. Bitcoin (BTC), the largest cryptocurrency, recovered from a flash crash below $90,000 to return above $104,000 on Friday. XRPLedger’s native token is rallying alongside top cryptocurrencies.

Trump’s upcoming inauguration is one of the key catalysts, along with optimism about cryptocurrency regulation, cryptocurrency-friendly policies, and a new approach from US financial regulators.

XRP may enter price discovery next week and rise further.

XRP is trading at $3.26 at time of publication.

On-chain indicators support gains

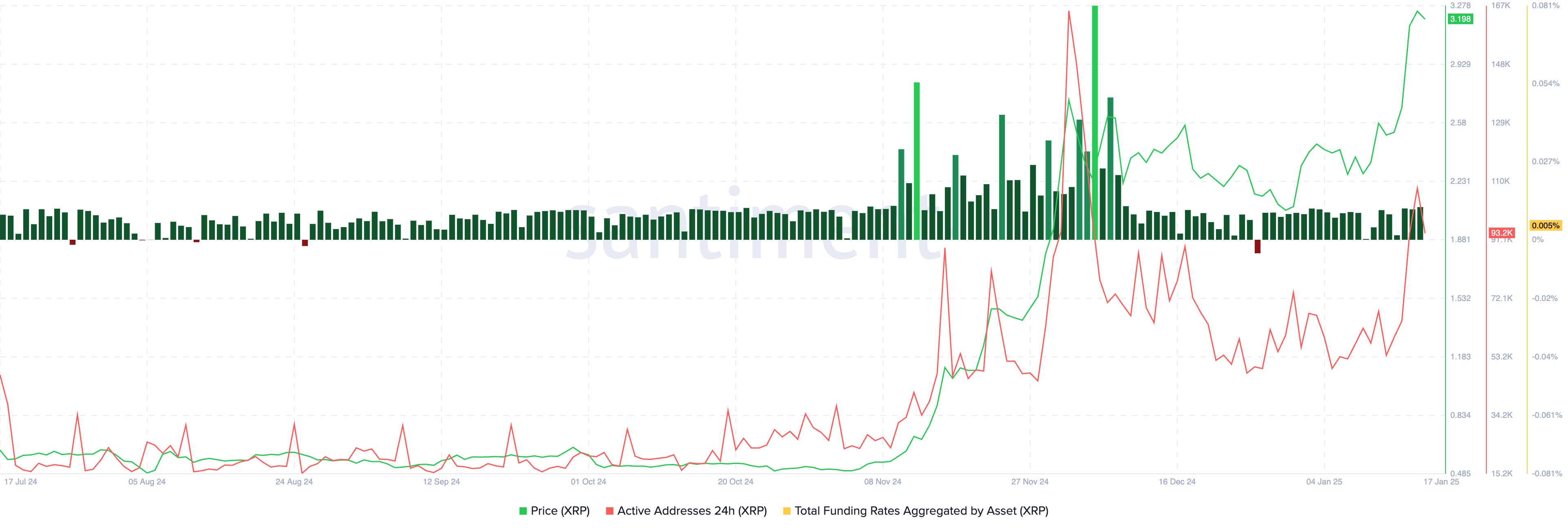

XRP’s on-chain metrics support the bullish case for the altcoin. The Total Funding Rate indicator is a positive number greater than 1 throughout January 2025. The number of active addresses recorded a significant spike on Thursday, January 16th.

Santiment’s on-chain indicators are helping XRP rise further in the coming week.

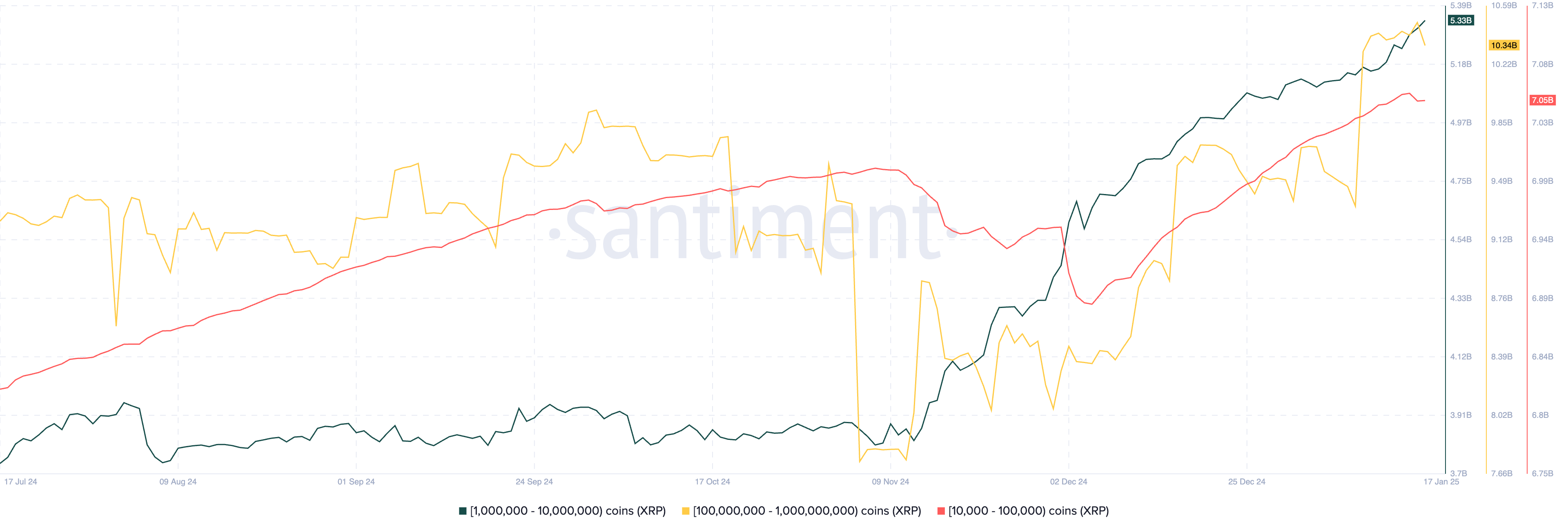

Santiment’s Supply Distribution Indicator shows an increase in the supply of Holders of all three classes accumulated altcoins even as prices rose. This indicates a possible increase in the price of XRP in the future.

Market movers and Ripple lawsuit

Monday’s inauguration brought about the biggest changes in the cryptocurrency market. However, the growing adoption of RippleNet among institutions, the development of the RLUSD stablecoin, and the SEC’s lawsuit against Ripple are three key market drivers affecting altcoin prices.

Despite U.S. financial regulators filing an appeal against Ripple on January 15, the altcoin continued its upward trend unabated. Judge Analisa Torres’ July 2023 ruling classifying secondary sales of XRP as non-securities is being challenged, and the SEC is seeking to classify these retail sales as sales of unregistered securities.

Ryan Lee, senior analyst at Bitget Research, said in an exclusive interview with crypto.news:

“XRP’s surge can be attributed to the favorable outcome of Ripple’s SEC lawsuit and a more cryptocurrency-friendly political environment in the United States. “Once regulatory uncertainty is resolved, an influx of institutional investors could further solidify XRP’s position in the cryptocurrency market.”

It is not yet known whether the Trump administration will support cryptocurrency regulation or whether that will affect the outcome of lawsuits against companies like Ripple Labs.

Technical analysis and XRP price prediction

XRP is close to its all-time high at $3.40. At the time of writing, XRP is trading at $3.2385. A 22% price rally could push XRP into price discovery at the 141.4% Fibonacci retracement level, rising from a low of $1.9054 to a high of $3.4000.

Technical indicators RSI and MACD support the bullish case for XRP. MACD flashes continuous green histogram bars. Traders should keep an eye on the RSI for signs that the token is overbought or overvalued, currently at 83.

In case a correction occurs, XRP may find support at the 50% Fibonacci retracement level of $2.6977.

James Toledano, COO of Unity Wallet, said in an exclusive interview with crypto.news:

“Given that XRP has been stuck at around $0.50 for literally three years, the recent breakout momentum reflects a new level of investor optimism about regulatory clarity and the potential approval of an XRP ETF next month. “If the

Toledano warns XRP holders to be careful as altcoins are pushing volatility to the next level in the current market cycle.

He said:

“Altcoin ETFs have real potential to attract capital, especially if innovation-friendly policies are supported by the incoming US administration. However, since interest in altcoins appears to be fleeting, their success may be less consistent compared to Bitcoin ETFs.

Take a look at Bitcoin price movements this week. There are many factors. You could say it’s a mix of Trump, seasonality, geopolitics, macroeconomics and sentiment. “To play devil’s advocate, we humans are pattern seekers, but sometimes there are hidden drivers and cause and effect are not always connected.”

Disclosure: This article does not represent investment advice. The content and materials presented on this page are for educational purposes only.