XRP and Solana prices have fallen since the pump, but analysts are supporting that these altcoins will explode next.

After explosive performance this week, XRP and Solana found strong resistance and retraced 4.48% and 6.48%, respectively.

However, as the SEC approaches its January 10 deadline for approving Bitcoin spot ETF applications, analysts remain bullish on the Bitcoin ETF token presale.

XRP and Solana reject macro levels, but trading volumes remain high.

With XRP and Solana rising significantly over the past month, a recent downturn was inevitable, giving market participants time to re-evaluate their positions amidst the massive volatility.

However, this downturn occurs at an important macro level, opening the door to a more prolonged downturn if momentum turns bearish.

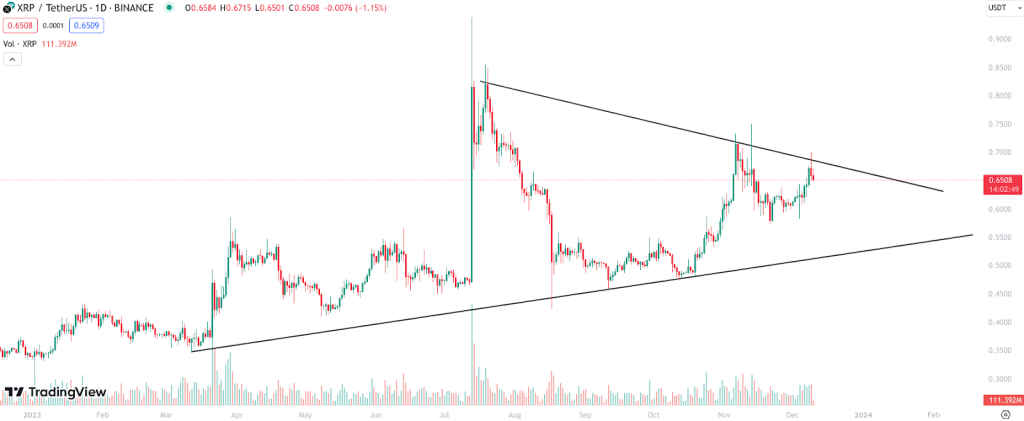

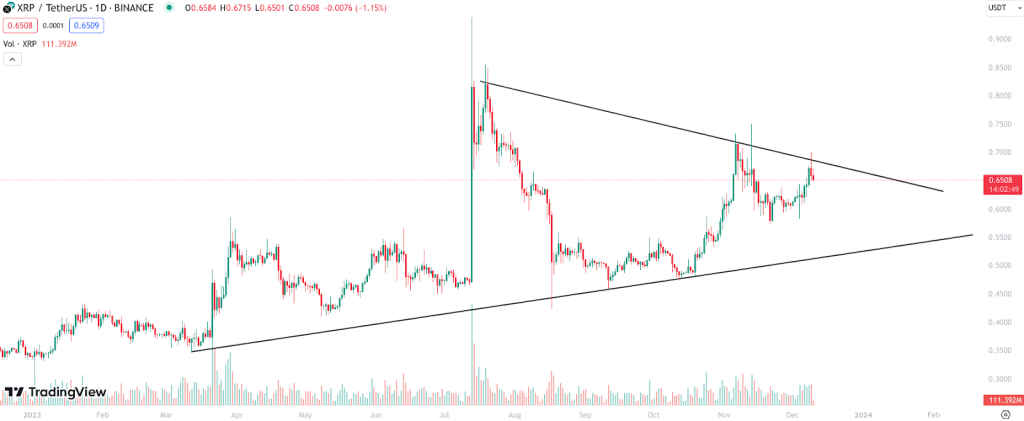

Starting with XRP, a retracement occurred at the trendline resistance starting in July, after which the price moved lower.

XRP tested resistance again on Saturday but closed significantly lower, forming a bearish candle with a long upper wick.

However, after forming trendline resistance, it also developed trendline support consisting of higher lows.

As a result, XRP is trading in a wedge chart pattern. This suggests that a breakout is likely to lead to a significant upside, but the recent decline could lead to a move towards support levels first.

Analyst Cryptoes also noted that the rejection occurred due to resistance in the “cup and handle” pattern. Traders labeled this a “sign of weakness” but are awaiting the next move to understand the longer-term trajectory.

Moving towards Solana, there has been a pullback from the resistance level that was established as support during the early stages of the bear market. Prices have nearly doubled since the 2022 rebound, indicating this is a significant level of interest among market participants.

A rejection from this level would set Solana’s macro trading range between $47 and $77, although a breakout would be quite bullish.

X Commentator FisherV noted that Solana faces “strong resistance” at $78. However, the analyst also said that with technical indicators still remaining strong, it is possible for the trend to continue towards $90.

One thing to consider about XRP and Solana is that volume is noticeably high despite these key resistance levels. This means increased interest and liquidity in the market, increasing the likelihood of a resistance breakout.

But regardless of the medium-term trajectory of XRP and SOL, analysts are firmly optimistic about the trend for Bitcoin ETF tokens, which are currently experiencing explosive pre-sales.

Deflationary Bitcoin ETF Token Is Ready to Soar After Raising $2.7 Million in One Month

The SEC’s deadline for approval of the first Bitcoin ETF is January 10. Many speculators believe that the application will be approved, creating huge bullish momentum in the market.

According to CryptoQuant, the approval of a Bitcoin spot ETF could inject $1 trillion of liquidity into cryptocurrency markets, with $155 billion moving into Bitcoin and the remainder into altcoins. Considering that the overall market capitalization of cryptocurrencies is only $1.7 trillion, many projects will see explosive growth with the added liquidity.

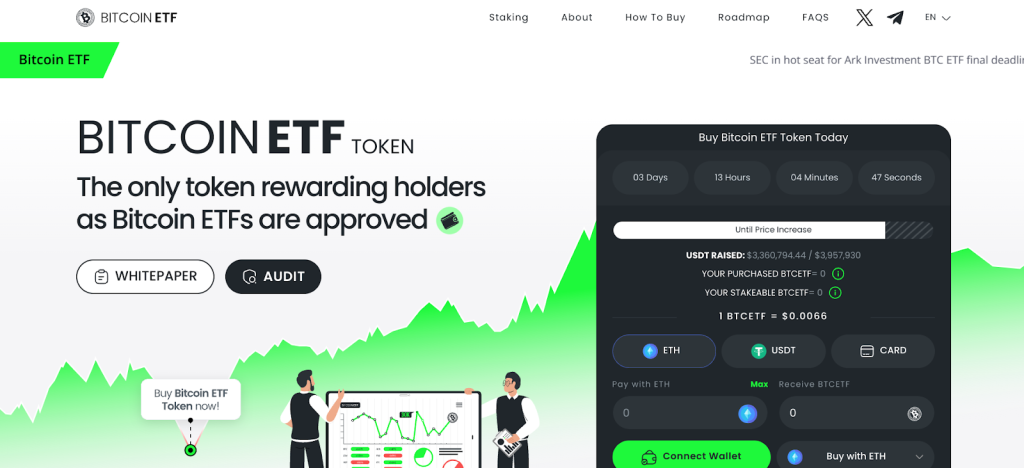

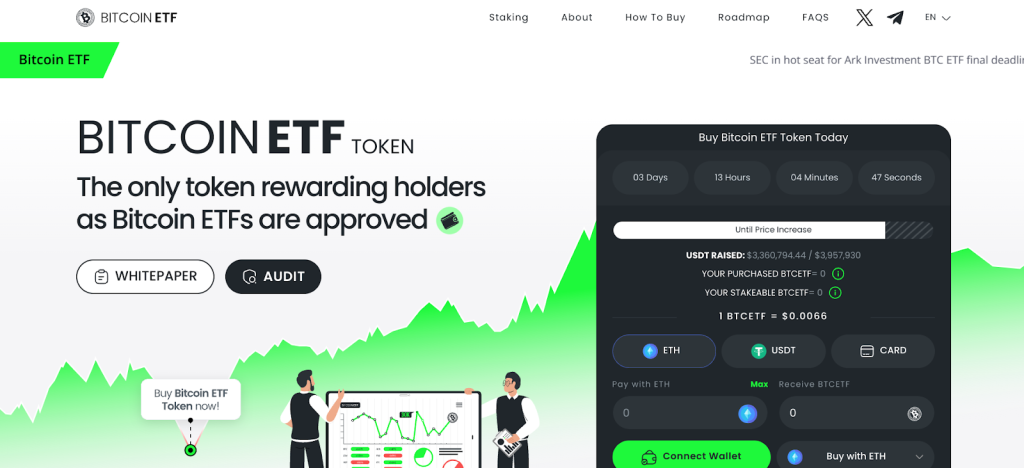

However, there is one cryptocurrency that could benefit the most from ETF approval. The project is a popular pre-sale Bitcoin ETF token that raised over $2.7 million in one month.

If a Bitcoin ETF is approved, holders will be rewarded. This means that $BTCETF buyers are betting on the SEC’s decision.

The team allocated 25% of total supply to be burned across five Bitcoin ETF milestones, creating scarcity and peaking excitement. It also features a 5% combustion tax that decreases by 1% at each milestone.

There is also a staking mechanism that offers users an 82% APY. However, this decreases as more tokens are staked, so investors must act quickly to maximize profits.

Lastly, we provide Bitcoin ETF notifications that update users with the latest Bitcoin news in real time.

Investors can purchase Bitcoin ETF tokens for $0.0066, but the price increases after 3 days.