The Cardano price quickly recovered to $0.54 after hitting a 50-day low of $0.43 on January 23, and speculative traders are betting high on further upside.

After two weeks of active Bitcoin ETF trading, the dreaded news selling cycle that saw the global cryptocurrency market cap fall by more than $270 billion between January 11 and January 23 appears to have cooled. Last week’s $180 billion rise sparked optimism across the altcoin market.

Layer 1 altcoins lead the cryptocurrency market resurgence

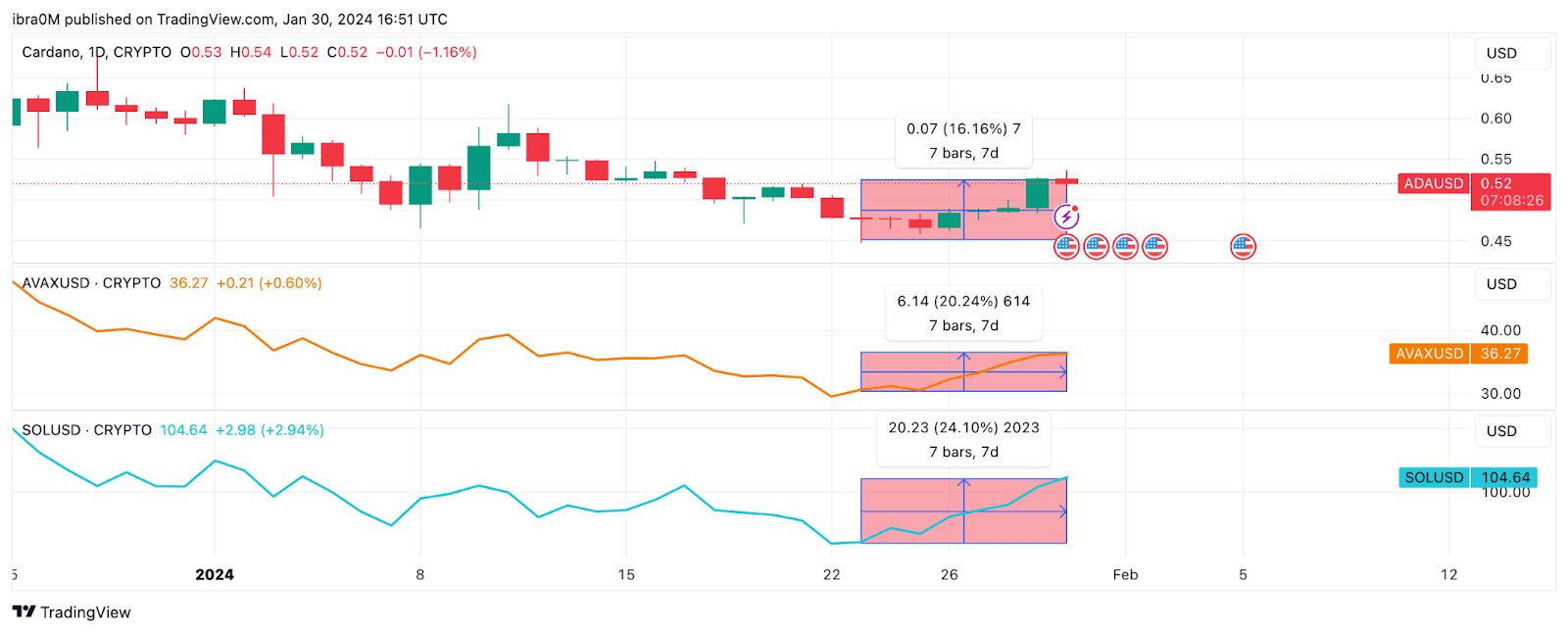

As the cryptocurrency market entered recovery mode this week, major layer 1 coins such as Solana (SOL), Avalanche (AVAX), and Cardano (ADA) led the gains.

Avalanche and Solana added $14.9 billion in market capitalization from January 23 to January 30, with gains of 24.1% and 20.2%, respectively.

The chart below specifically shows that ADA price is lagging with a 16% lower jump.

While Cardano’s market cap increase of 16.2% over the past week to $2.2 billion is nothing to scoff at, significant derivatives market data trends observed on January 30 suggest that ADA price could be on its way to the next big breakout. do.

Cardano records 800% surge in funding rate

Cardano and rival megacap layer 1 coins have been gaining traction in cryptocurrency spot markets this week, adding billions of dollars to their market capitalization. But looking beyond the price charts, derivatives traders appear to be placing unusually large bullish bets on an imminent ADA price breakout.

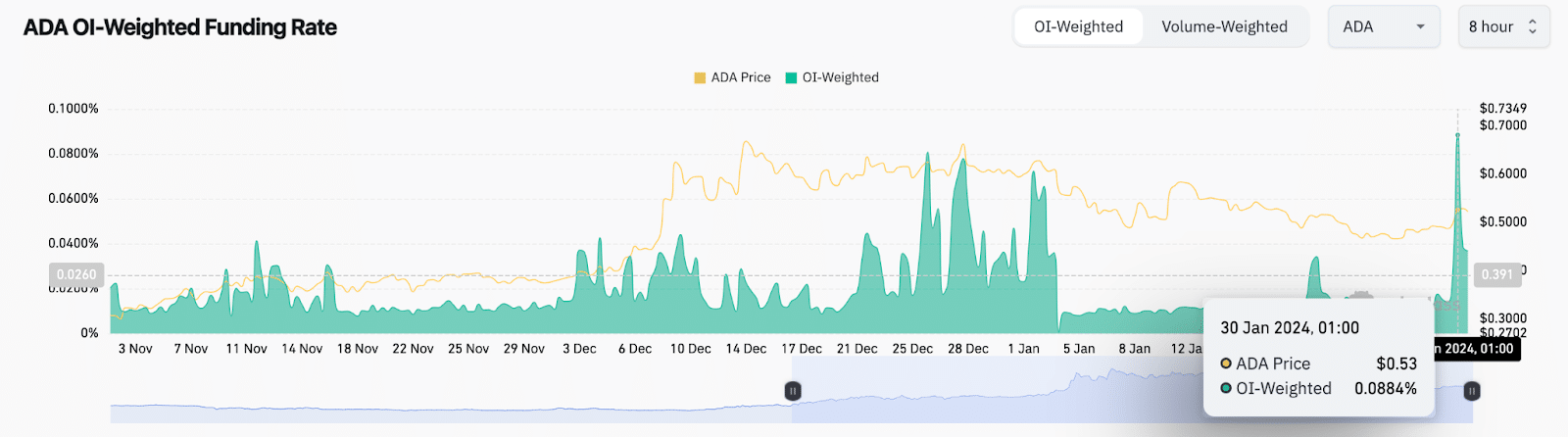

CoinGlass’ Money Rate Indicator tracks changes in the fees futures contract holders pay to their counterparties, providing insight into market dynamics and prevailing sentiment among traders.

A positive funding ratio means that LONG position holders are paying short traders to hold their positions and expect the price to rise, resulting in larger profits.

Looking at the chart below, you can see that Cardano’s open interest weighted funding ratio has maintained an average of 0.01% since January 2, but has risen 800% to 0.09% on January 30.

The chart above shows bullish speculative traders paying record fees to keep LONG ADA positions active. These sudden increases in positive funding ratios often occur when speculative traders react quickly to a bullish catalyst.

Given the dominant bullish momentum observed in the competitive layer 1 altcoin market this week, this could indicate that traders are betting big on ADA price and potentially catching up with AVAX and SOL, which have both delivered outperformance.

The historical data trends in the chart confirm that the ADA price has often risen whenever Cardano funding rates have recorded similar spikes.

Cardano Price Prediction: All Eyes on $0.60 Resistance

From an on-chain perspective, the current Cardano price upward trend can be attributed to the bullish headwinds surrounding the altcoin market, which could be further fueled by rising funding rates.

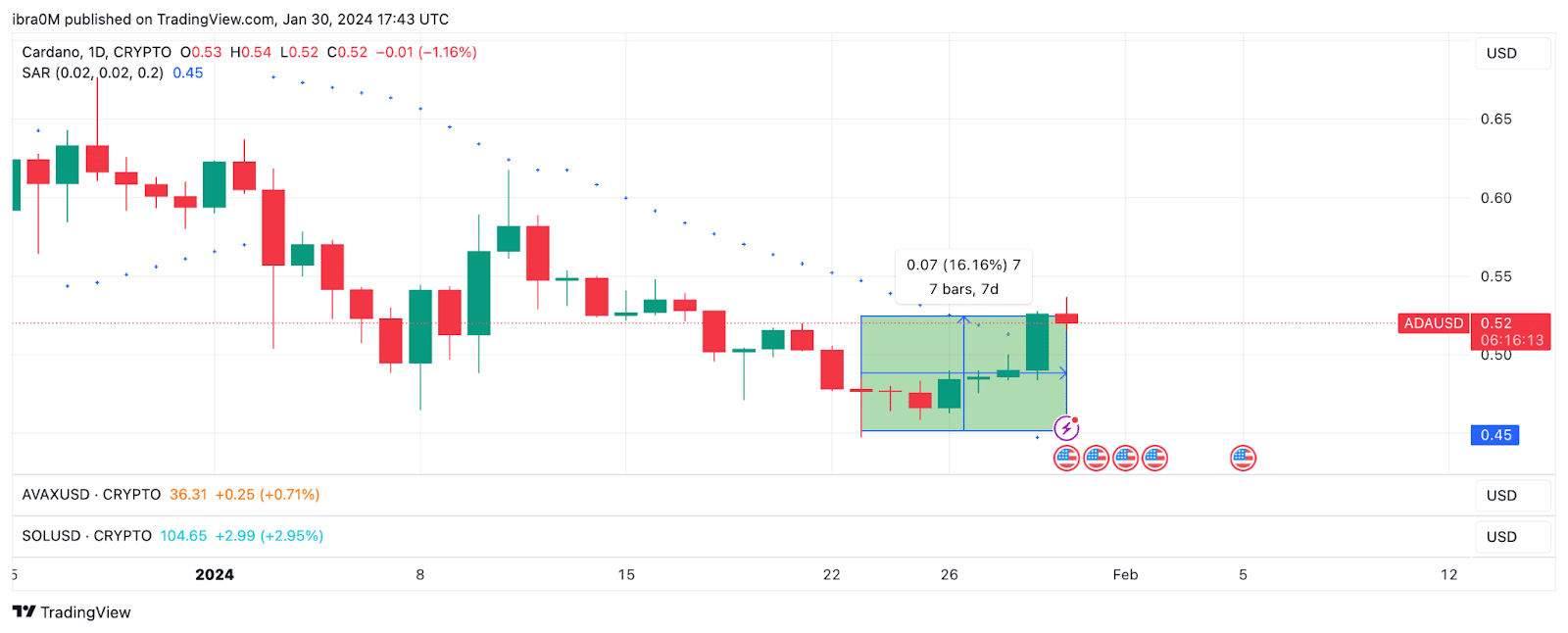

The Parabolic Stop and Reverse (SAR) technical indicator supports these Cardano price predictions. When a parabolic SAR point points below the current price of an asset, it indicates growing bullish momentum.

In this case, the ADA Parabolic SAR points to $0.45 while the current price is $0.52, which is consistent with the bullish on-chain prediction.

Traders may interpret this as a buying opportunity or a signal to buy in the derivatives market, expecting the Cardano price to rise further.

If this scenario is predicted, the bears may find initial resistance at the $0.55 milestone price. However, a decisive breakout could trigger margin calls and short squeeze warnings, pushing the ADA price above $0.65 for the first time in 2024.

Conversely, the bears could invalidate these optimistic price predictions if the price falls below $0.40.

However, support at $0.45 may be elusive, as illustrated in the SAR chart. Traders taking highly leveraged positions may buy frantically to avoid large losses once the price approaches the $0.45 area, which will likely trigger another price bounce.