Victoria d’Este

Posted: Oct 6, 2024 10:00 AM Updated: Oct 4, 2024 5:11 PM

Correction and fact check date: October 6, 2024, 10:00 AM

briefly

AI is revolutionizing the insurance industry, improving operational efficiency and providing personalized service, with more than a third of customers now ready to interact with AI in high-stress scenarios.

Artificial intelligence is gradually changing fields around the world, and the insurance industry is no exception. AI is transforming the way customers interact with insurers by increasing operational efficiency and providing faster, more personalized service. AI in insurance is becoming increasingly popular among customers around the world. It is no longer just a theoretical perspective.

A recent study found that more than a third of global insurance customers are ready to interact with AI, especially in high-stress scenarios such as claims processing. This change in customer behavior marks a new era in insurance services and marks a significant turning point for the sector.

Status of AI in Insurance

Due to complex operations and legal frameworks, the insurance sector has historically been hesitant to adopt new technologies. But AI is removing these obstacles by providing solutions that can handle both operational challenges and customer demands. Nowadays, leveraging AI technology is considered necessary to remain competitive.

Insurance companies are realizing that customers want seamless service and are growing more comfortable with digital interactions. Therefore, introducing AI into the insurance sector is not only a progressive step, but also a necessary step to meet changing customer needs.

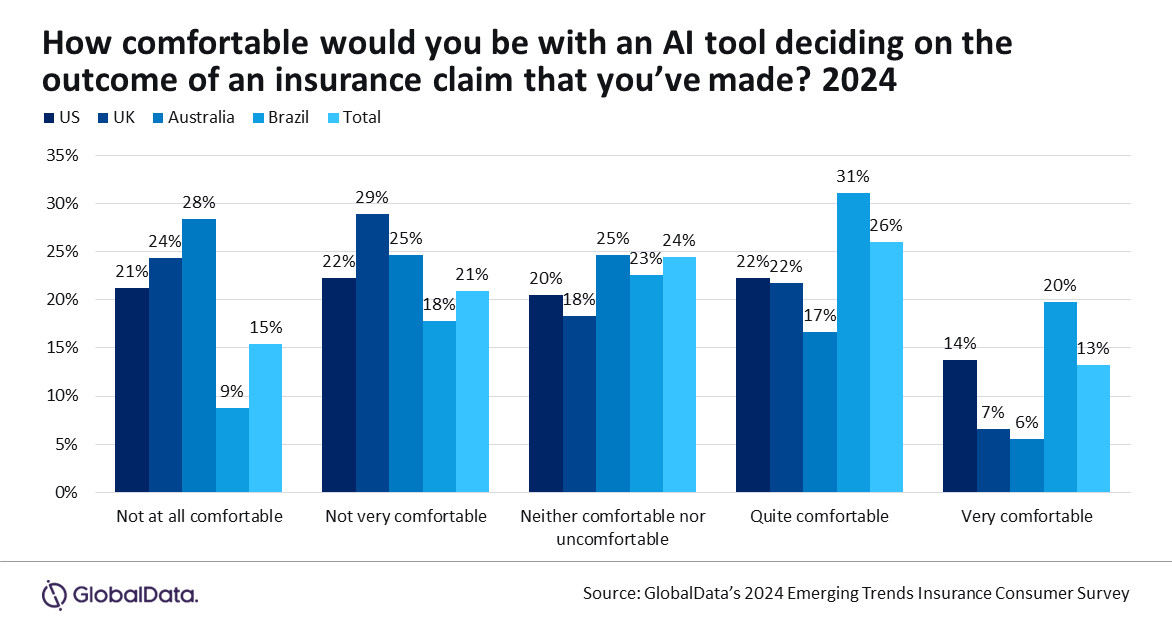

According to GlobalData’s ‘2024 Emerging Trends Insurance Consumer Survey’, a significant number of customers may interact with their insurers through AI. Conducted in 11 countries and receiving responses from more than 5,500 participants, the survey provides insight into how AI is viewed in the global insurance industry.

Photo: Global Data

According to the study, 39% of respondents globally said they would be comfortable letting AI manage insurance claims resolution. This statistic is noteworthy considering that filing a claim is often a stressful process for policyholders. But many people are ready to trust AI with such important judgments.

AI has a variety of uses in the insurance industry, from streamlining claims processing to providing personalized policy recommendations to automating administrative tasks. For example, AI systems such as chatbots can answer customer questions, provide real-time policy information, and assist customers through the claims process more quickly and effectively than traditional technology. These technologies are invaluable to insurers who want to make data-driven choices because they allow them to quickly sift through massive amounts of data.

Additionally, by identifying trends that human evaluators may overlook, AI can help detect fraudulent claims more efficiently. Ultimately, these developments reduce costs, increase accuracy, and improve response times for insurers and customers.

The fact that more than a third of consumers feel comfortable using AI in the insurance claims process highlights a fundamental shift in trust. In the past, the insurance sector has largely relied on human intermediaries to build and maintain relationships with policyholders. And AI systems are starting to gain traction as they increase in sophistication and reliability.

Regional differences in AI acceptance

Not all areas of the insurance industry are ready for AI. Survey results show that consumer acceptance of AI varies greatly across countries. While some regions are excited about artificial intelligence in insurance, others remain hesitant. For example, according to the report, only about one in five consumers in Australia want to leverage AI for claims processing.

This means that consumer opinions about AI will be greatly influenced by cultural, governmental, and market-specific variables. Insurance companies must take these changes into account when rolling out AI-based products and services in various geographies. A one-size-fits-all strategy is unlikely to succeed, so insurers should tailor their AI plans to address the needs and concerns of customers in each region.

Drivers for AI adoption in the insurance industry

Although there are regional differences in AI uptake, general trends are clear. Customer acceptance of AI in insurance is growing, presenting a huge opportunity for insurers to stand out in a crowded industry. Companies that successfully incorporate AI technology will increase customer satisfaction by providing faster, more accurate, and more convenient services while increasing operational efficiency.

Customers who value simplicity and speed will find it particularly appealing because claims can be processed quickly and automatically without human intervention. Insurance companies that do not use AI may be at a competitive disadvantage as competitors that do use AI technology are likely to gain market share.

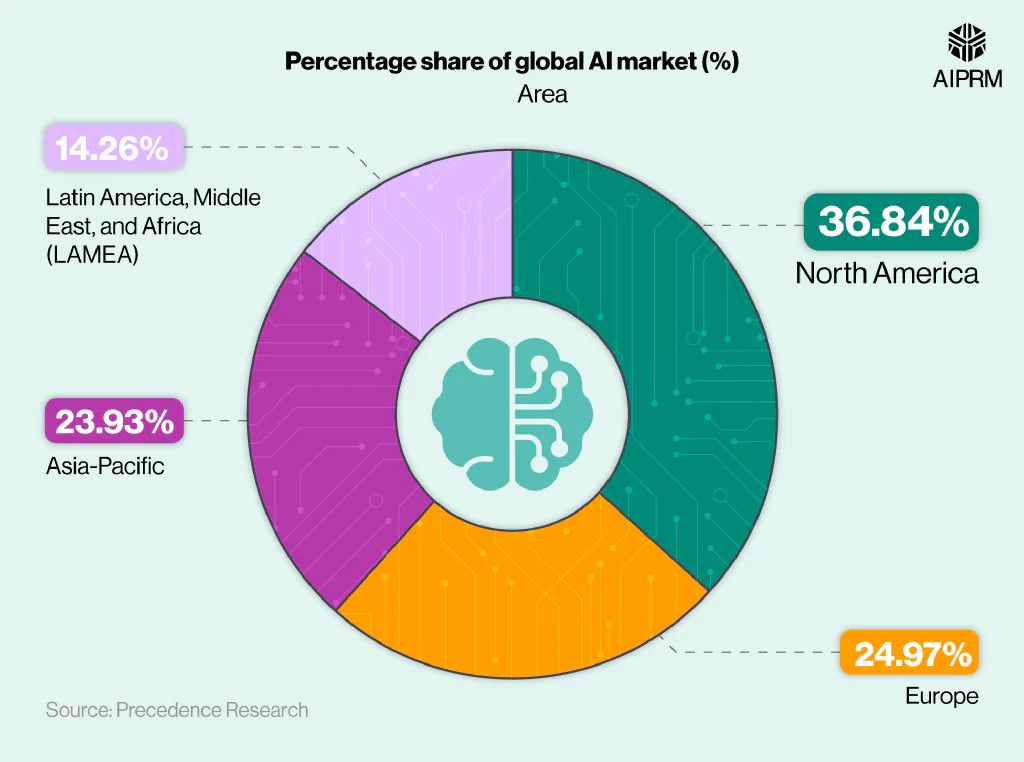

Photo: AIPRM

The potential for a better customer experience is one of the main reasons consumers are embracing AI in insurance. In the past, consumers often experienced lengthy and tedious processes when processing insurance claims. Long wait times, paperwork, and unpredictable results can be stressful.

AI has the ability to eliminate many of these pain points by streamlining the claims process and providing policyholders with faster, more transparent settlements. For example, it only takes a short time for a human adjuster or AI system to quickly assess the details of a claim and cross-reference it with policy information to make an accurate decision. This speed and efficiency can significantly improve the overall client experience.

Nonetheless, the use of AI in the insurance sector is still in its infancy. Many AI solutions currently in use, including chatbots, are not yet sophisticated enough to fully satisfy customer expectations. Many customers have expressed frustration with AI solutions that fail to answer complex queries or provide the personalized support they want.

Potential benefits of AI in insurance

In addition to improving customer experience, AI can help insurers address some of the most critical issues facing the sector today. Among these challenges is fraud. A major problem that costs insurers billions of dollars annually is insurance fraud. Artificial intelligence methods are particularly suited to solving this problem due to their ability to quickly analyze data and identify trends that point to fraudulent activity.

For example, AI systems can compare claims to historical data and identify differences or unusual trends that require more research. This helps insurers reduce fraud-related losses while avoiding penalizing honest policyholders with increased premiums due to false claims.

Risk assessment is another area where artificial intelligence can be very useful. In the past, insurance companies used statistical models and historical data to assess risk and set rates. But AI can advance risk assessments by looking at real-time data from sources such as Internet of Things (IoT) devices.

For example, in car insurance, artificial intelligence (AI) can monitor driving habits and leverage data from connected cars to provide individualized insurance premium suggestions based on actual risk. This level of customization allows policyholders to take safer measures and allows insurers to offer more affordable rates.

disclaimer

In accordance with the Trust Project Guidelines, the information provided on these pages is not intended and should not be construed as legal, tax, investment, financial or any other form of advice. It is important to invest only what you can afford to lose and, when in doubt, seek independent financial advice. For more information, please refer to the Terms of Use and any help and support pages provided by the publisher or advertiser. Although MetaversePost is committed to accurate and unbiased reporting, market conditions may change without notice.

About the author

Victoria is a writer covering a variety of technology topics, including Web3.0, AI, and cryptocurrency. Her extensive experience allows her to write insightful articles for a wider audience.

more articles

Victoria d’Este

Victoria is a writer covering a variety of technology topics, including Web3.0, AI, and cryptocurrency. Her extensive experience allows her to write insightful articles for a wider audience.