join us telegram A channel to stay up to date on breaking news coverage

Famous YouTuber Steve Courtney has released a new video talking about a mysterious Bitcoin trend known as the “Wave Trend.” Titled “Wave Trend Rejection – What Happens Next”, the video explores the critical moment Bitcoin is currently facing, questioning whether Bitcoin will break through its current barrier or face a complete rejection .

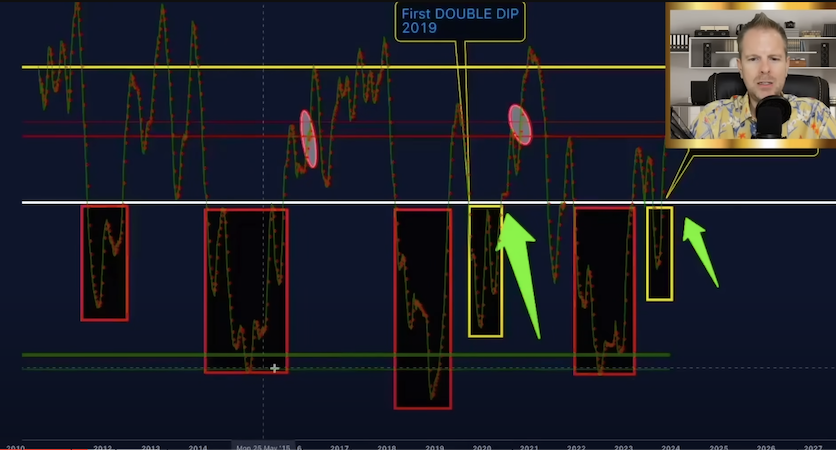

The main focus of the video is a detailed analysis of the weekly chart of Bitcoin against the US Dollar. A thorough explanation of the Wave Trend indicator, a tool used to identify market movements, including its settings and meaning. Steve highlights the green channel within the Wave Trend, an important area historically associated with the bear market bottoms of 2011, 2015, 2019, and 2022. This insight strengthens the tool’s predictive power by providing a strategic perspective on market lows.

It also introduces the concept of “double dip,” shown as a yellow box on the chart. This phenomenon, observed in past Bitcoin cycles, represents a significant buying opportunity, as seen when Bitcoin fell to around $23,000. Wave trends not only help you identify market bottoms, but they also help you identify market peaks. The yellow line, set at around 86 in the Wave Trend setting, serves as a warning of a potential profit-making opportunity, which has been proven on a variety of occasions over the years.

The video highlights the importance of human psychology in market movements, arguing that the predictability of Bitcoin behavior is rooted in the consistent nature of human emotions, especially in the financial context. These psychological aspects, combined with Bitcoin’s rhythmic cycle, form the basis of the presented analysis.

Regarding the current market scenario, the video explains the importance of Stage 1 Rejection and the role of Red Channel in Wave Trends. Drawing parallels to past cycles, particularly the 2012, 2016, and 2019 cycles, Steve focuses on the pivotal yellow line of the second phase of the bull market to suggest potential patterns for the current cycle.

Other Notes on Cryptocurrency

It is a good idea to look more broadly at the overall market trends, including the stock market.

A point that Steve did not discuss but that I think is worth mentioning is the correlation between the stock market and cryptocurrencies. Despite repeated fears of a recession, markets have continued to rise following each recession, suggesting a pattern of resilience. It is best to be careful not to get caught up in media sensationalism about market crashes and focus on concrete data.

Fed interest rate hike and market reaction

We also note that it is important to pay attention to the Fed’s interest rate hikes and their impact on the markets. Historically, whether interest rates are rising, falling, or paused, the market has shown an upward trend. We argue that this pattern is likely to continue and we will not fall into the trap of thinking “this time could be different.”

Related news

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage