According to the opinion of Jerome Powell, Chairman of the Federal Reserve Bank, the price of Ethereum is having difficulty in verifying a clear trend. On April 16, during the speech in Chicago, Powell emphasized a prudent “waiting” approach that did not rush to lower interest rates and relies on additional economic data. The announcement increased the inflow of the exchange of Ether Leeum to increase potential weakness.

Ether Lee is faced with a weak threat.

Ether Leeum’s price is down and is influenced by the prudent outlook for the economy of the Federal Reserve Bank, which has weakened investor sentiment. According to CoingLass’s data, Ether Lee has been liquidated by about $ 44.6 million over the last 24 hours. The long position was about $ 26 million and the short position was about $ 14.6 million.

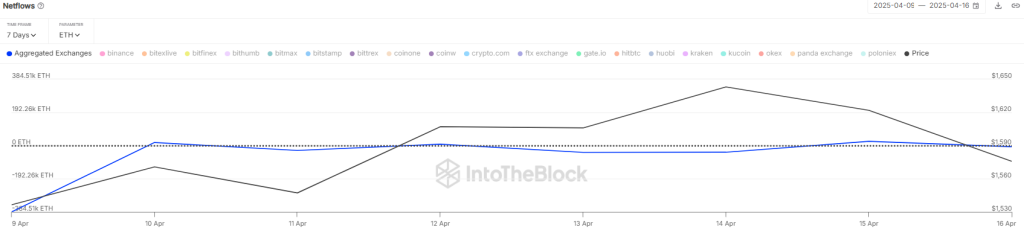

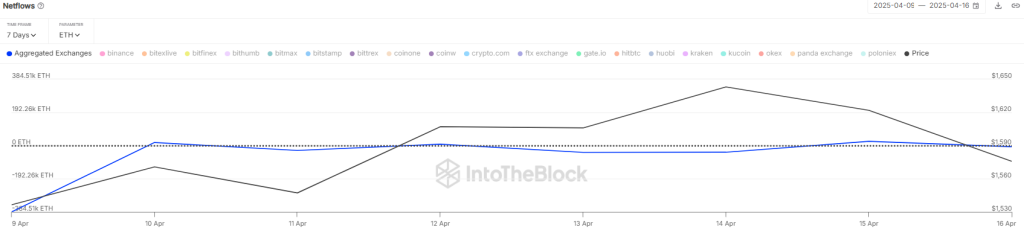

The recent drop in price has matched the rapid increase in exchange reserves. The day before, more than 77,000 ETHs were taken to the derivative exchange, indicating the largest one -day inflow in a few months. If the supply increases rapidly, the possibility of pressure sales will increase.

Also read: The big inflow fits Ether Lee: ETH price falls again?

However, according to the data from Intotheblock, the Netflow metrics are negative at -6,800 ETH. This indicates that the entire outflow exceeds the inflow. This indicates that many investors are accumulating Etherrium due to a drop in prices.

CoingLass also shows that the public interest in Ether Leeum is increasing despite the downward pressure. OI metrics surged more than 3.87%, exceeding $ 18 billion. However, the rate of financing is 0.0015%, which is popular around the negative area. As a result, bears still have control to integrate ETH to immediate FIB support levels.

But the current decline can soon be found to be a strong rebound. According to cryptocurrency analysts, Ether Lee is dealing close to a realized price, which is often a major rebound of the past. The current price of $ 1,585 is considered a powerful point of value purchase.

What is the next price of ETH?

Ether’s attempt to recover price is losing its driving force around the EMA trend line as it strongly defends the EMA20 level. As a result, the price is emerging around the descent line. The current ETH price is $ 1,588, down more than 1.5% over the last 24 hours.

If the seller pushes the price to less than $ 1,400, a serious decrease in the end of the weak channel for $ 1,130. This level is expected to attract a purchase stake, but if the weak momentum is strongly maintained, an additional decline for $ 1K is possible.

Conversely, the decisive rest and more than $ 1,700 are the first signs that the buyer is regaining control. This movement can lead the rally the path to $ 2K. The 50 -day SMA may slow down, but it will surpass if optimistic momentum is established. Strong push of more than $ 2K suggests that the decline may be reversed.