Main takeout

- Guggenheim, a major DCP publisher, has launched a digital commercial site for the Treasury Support Digital Commercial.

- Guggenheim issued $ 20 million in DCP when it was released in Ether Lee, which received the highest credit rating from Moody ‘S P-1.

Share this article

According to a new report from Bloomberg, Guggenheim Treasury Services, one of the largest and most respected asset -supported commercial paper publishers, is bringing a flagship -on -chain digital commercial paper (DCP) to the XRP ledger. According to the new report.

The DCP, which first started in Ether Lee in September, is a blockchain -driven commercial land known as a short -term and fixed imported debut. The company issues commercial papers when it is necessary to raise cash for immediate operational demands such as benefits or other short -term financial obligations.

Guggenheim has dealt with more than $ 280 million issued as mentioned in the report since he started offering DCP in Ether Leeum. In the case of a new tokenized financial instrument, this number indicates that this blockchain -based asset is true and significant from institutional investors.

The DCP product is completely supported by the US Treasury Bonds, and is provided daily through the Zeconomy platform with a customized maturity of up to 397 days. When it was released in Ether Leeum, I received a credit rating of P-1 from Moody’s.

Markus Infanger, chief vice president of RippleX, said Ripple would invest 10 million dollars in DCP products and explore the use of payment, including the potential purchase with Ripple’s Stablecoin.

According to DEFILLAMA’s data, as of June 9, the total value submerged in XRPL was about $ 61 million, four times higher than $ 14 million in September, and four times increased from $ 14 million after developing in legal battles with Ripple and SEC.

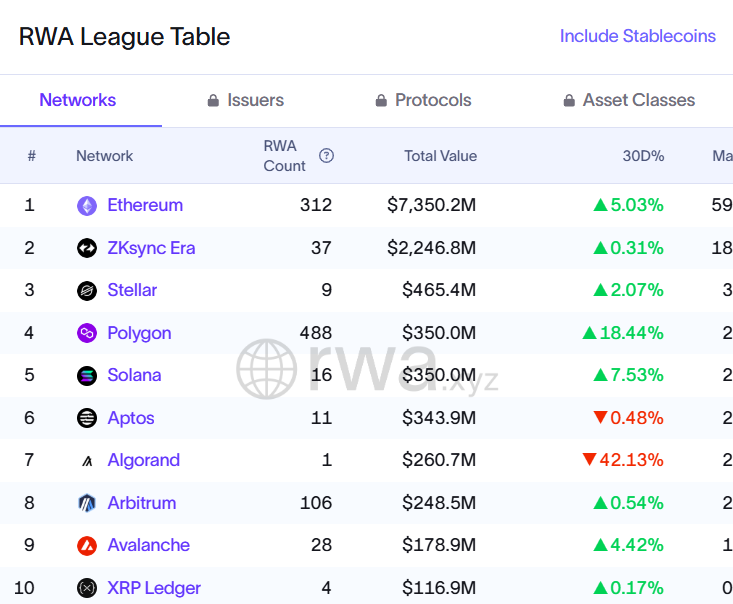

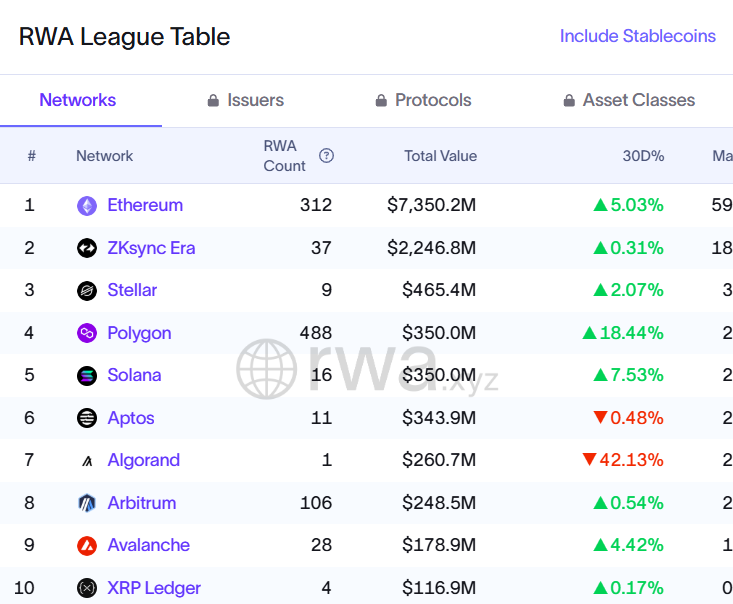

According to the data from RWA.XYZ, the director of XRP currently occupies a small part of the tokenized asset environment, and the stable assets have about $ 110 million token assets except $ 117 million tokenized assets.

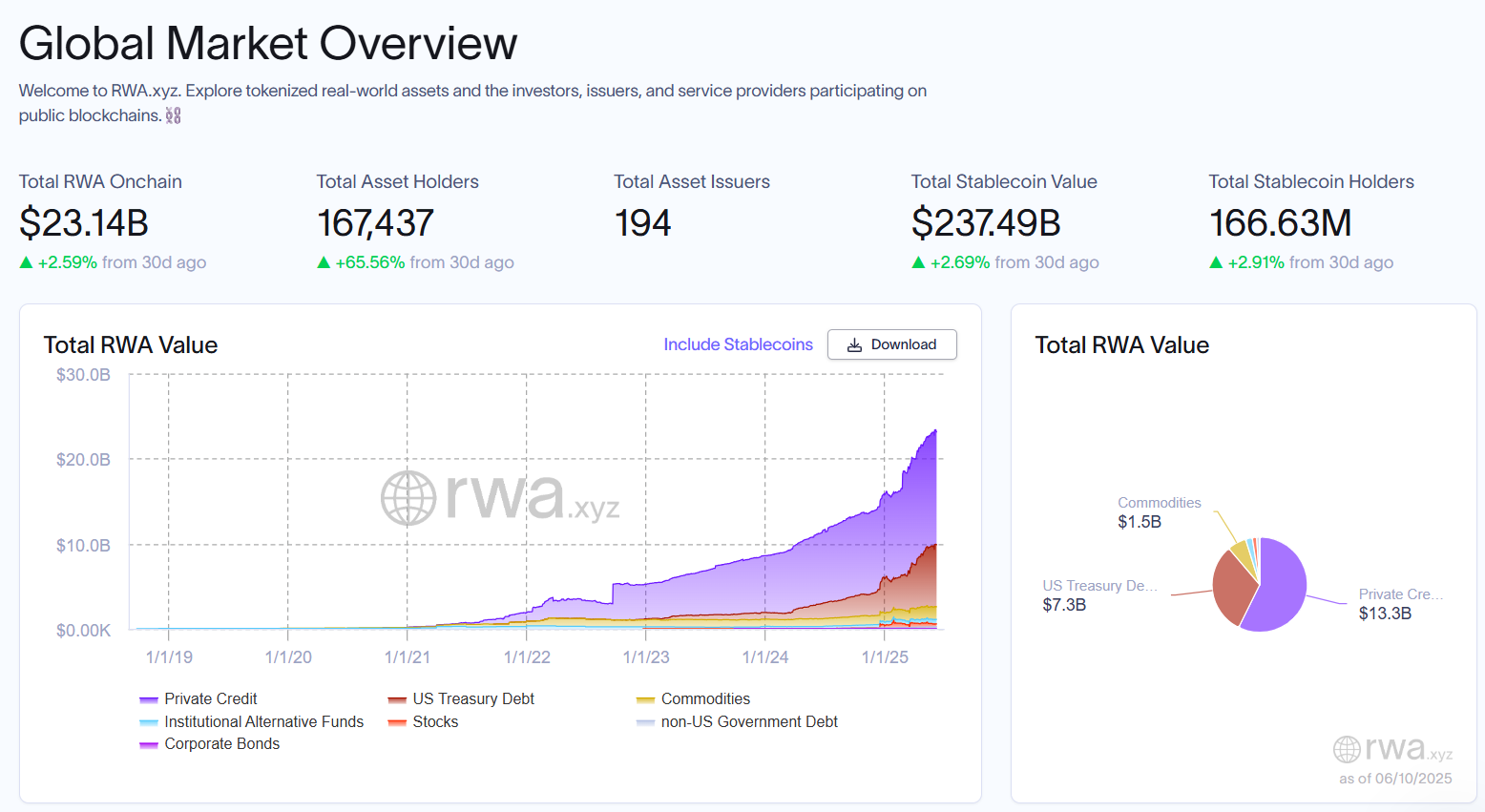

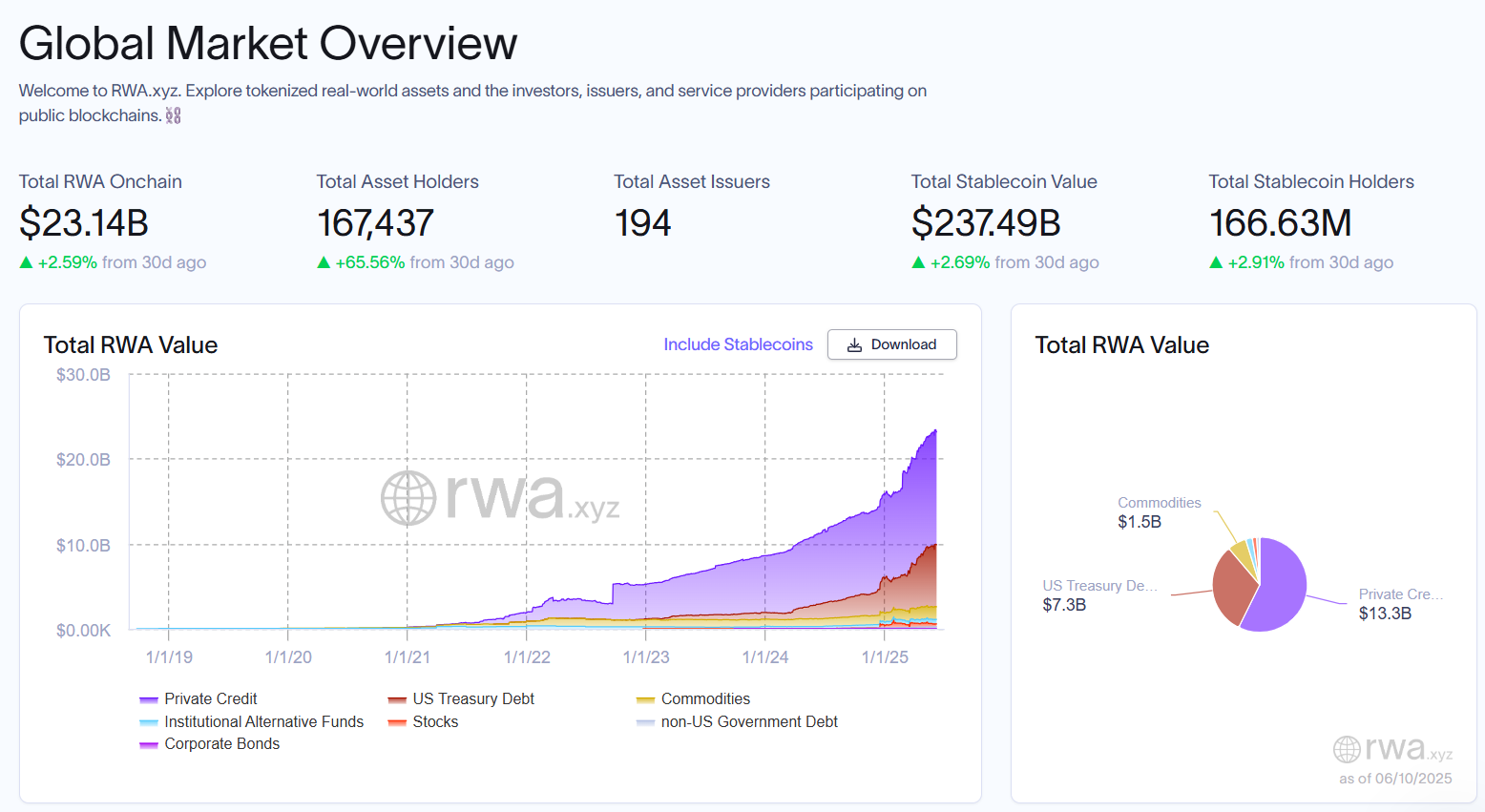

Ethereum remains a leader in Real-World Asset (RWA) token shoes, and BLACKROCK’s Buidl Fund is the main driver of growth.

The total evaluation of RWA tokenization has increased by more than 45% this year, while the number of asset owners has increased by 65%.

Share this article