The possible approval of a Bitcoin ETF in the United States sparks widespread speculation about Bitcoin’s future. The Bitcoin ETF’s potential green light reaches 90%, sparking a variety of price predictions and market expectations.

Evolution of institutional entry and exchange

The impact of Bitcoin ETFs goes beyond price prediction and is poised to transform institutional participation and cryptocurrency exchange operations. The approval of ETFs could provide a seamless path for institutions to enter the cryptocurrency space, revolutionizing market liquidity and dynamics.

Various Predictions: Bitcoin Price Forecast

Predictions for the Bitcoin price following ETF approval range from conservative estimates to massive surges, reflecting a variety of expert opinions and market dynamics.

The cryptocurrency industry is abuzz with anticipation as the possibility of a US-approved Bitcoin ETF approaches. Analysts predict that this move could have a major impact on Bitcoin’s valuation, with predictions ranging from conservative to wildly optimistic.

If approved, place Bitcoin ETF It could signal a fundamental shift in institutional participation in cryptocurrencies. This regulatory approval will pave the way for U.S. companies to become compliant, potentially attracting significant trading firms and improving market dynamics and liquidity.

Moreover, the introduction of ETFs could promote restructuring of cryptocurrency exchanges, promoting competition and cost efficiency in trading. The prediction that Bitcoin will unlock $30 trillion worth of assets represents a huge base of potential investors who have not previously been able to participate in Bitcoin.

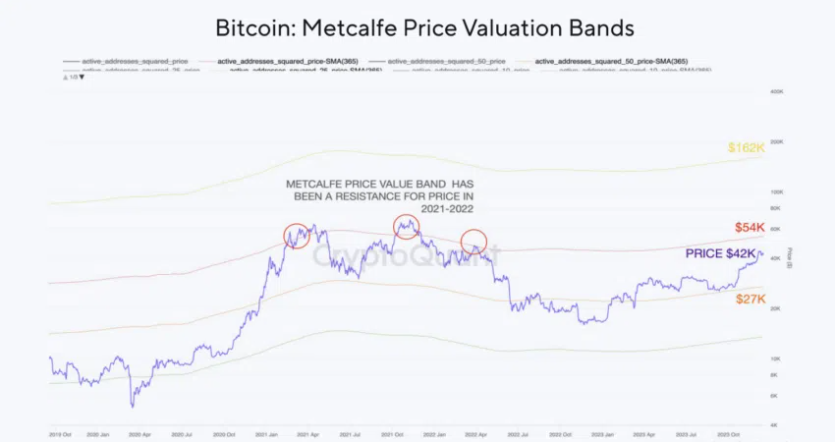

Price predictions following ETF approval vary widely. Conservative estimates range from $42,000 to $100,000, while more optimistic estimates range from $160,000 to $1 million. These forecasts are shaped by a variety of factors, including institutional inflow and supply considerations.

Some experts predict a surge to $100,000, while others predict CryptoQuantCiting increased demand from multiple ETFs, the Bitcoin halving event, and broader market trends, we expect Bitcoin to surpass $160,000.

Amid these varied predictions, caution remains paramount. The speculative nature of these forecasts highlights the need for thorough research and caution, considering the inherent volatility of cryptocurrency markets and the unpredictability of regulatory decisions.