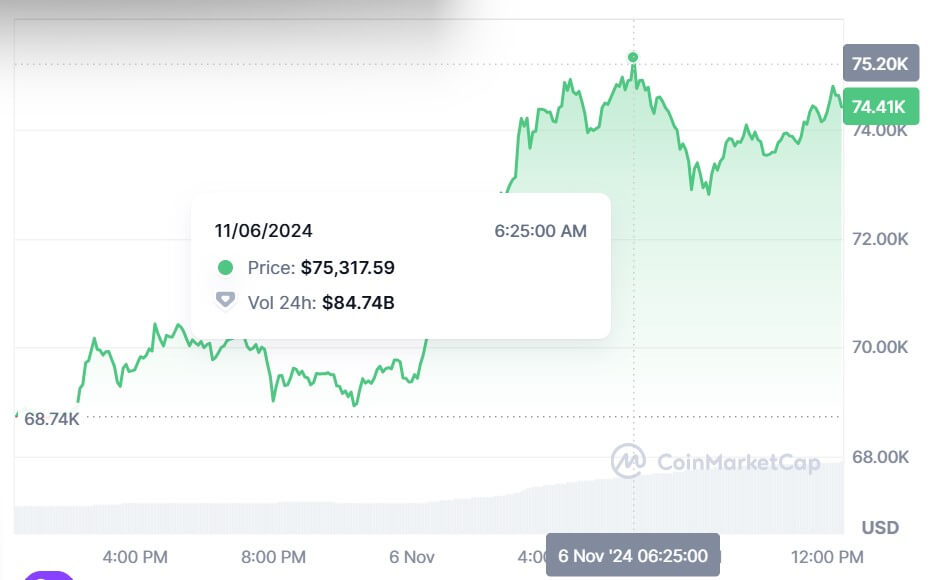

- Bitcoin reached a high of $75,317 in the early hours of this morning.

- Last September, Bernstein analysts predicted that if Trump wins, Bitcoin will reach $80,000 to $90,000 by the end of 2024.

- “It would be disingenuous to say that Trump winning the US election was the only reason the price of Bitcoin rose,” Unity’s COO told CoinJournal.

Bitcoin hit an all-time high of over $75,000 early this morning as the poll results signaled Donald Trump’s victory in the White House.

Bitcoin reached a record high of $75,317 around 6:25 this morning, according to data from CoinMarketCap. Before the election results came out last night, Bitcoin was trading around $69,000.

However, as the evening wore on and into the early morning, Bitcoin continued its upward trajectory before reaching a new all-time high.

Bitcoin’s last all-time high was in March, when it reached $73,000.

Trump received 277 votes during the election, while Vice President and presidential candidate Kamala Harris received 224 votes, according to data from AP News.

Will price rises continue?

With the US presidential election results hitting new highs, many will be wondering whether this upward trend will continue. Last September, Bernstein analysts predicted that if Trump wins the presidential election, the price of Bitcoin could reach between $80,000 and $90,000 by the end of 2024.

According to James Toldeano, COO of self-custodial wallet Unity, people should realize that data based on the 2012, 2016, and 2020 US elections does not show a consistent pattern in the cryptocurrency market regarding election results.

“Some people looked at the 2020 election and saw the price rise from $13,760 before the November 1 election to $19,698 after the December 1 election and immediately claimed that it went up because of the election,” Toldeano told Coinjournal.

In fact, Toldeano added that several factors have contributed to the price rise, including US stimulus payments, increased interest in Bitcoin purchases from companies like MicroStrategy, and people viewing Bitcoin as a safe investment during the COVID-19 pandemic.

“Even though elections were held during this time, it would be disingenuous to say that has directly caused price increases,” he said.

What will drive cryptocurrency markets in the long term will not be elections, but rather “broader macroeconomic events, technological developments, changes in market sentiment, and factors beyond the incoming president’s control,” Toldeano explained.

Pro-Cryptocurrency

Former US President Donald Trump appeared to be more friendly to cryptocurrency than Harris.

Last May, Trump promised to release Silk Road founder Ross Ulbricht if he is re-elected. Ulbricht has already served 11 years in prison. Last August, Trump promised to make the United States the “crypto capital of the Earth.”

Last September, Trump became the first US president to use the Bitcoin network. He achieved this after sending a Bitcoin transaction from PubKey, a cryptocurrency-themed bar in New York, ahead of a campaign rally on Long Island.

Harris, on the other hand, has been quiet about her position on cryptocurrencies, despite saying that her administration would support a cryptocurrency regulatory framework if she becomes the next US president.

“President-elect Trump has the power to save cryptocurrency in an America that needs urgent change,” Jesper Johansen, CEO and founder of Northstake, an Ethereum staking marketplace, told Coinjournal. He said.

“The first priority of the new administration will be to define staking as an opportunity for American investors,” Johansen continued. “The question still remains: Are you staking commodities or are you staking securities?”

Johansen said $6 billion is uninvested in Ethereum exchange-traded funds (ETFs), meaning investors are missing out on an economic opportunity. According to Johansen, this may be one of the reasons why the use of Ethereum ETFs is not as popular as Bitcoin ETFs.

He added, “Once these core issues are resolved, we need change within the SEC so that cryptocurrencies are seen as a vehicle for innovation rather than something to be feared.”

Ahead of the election, Trump said he would fire Gary Gensler, chairman of the Securities and Exchange Commission. However, it is not yet known whether this will happen because the SEC is an independent federal agency.

At the time of publishing, Bitcoin is trading around $74,000.