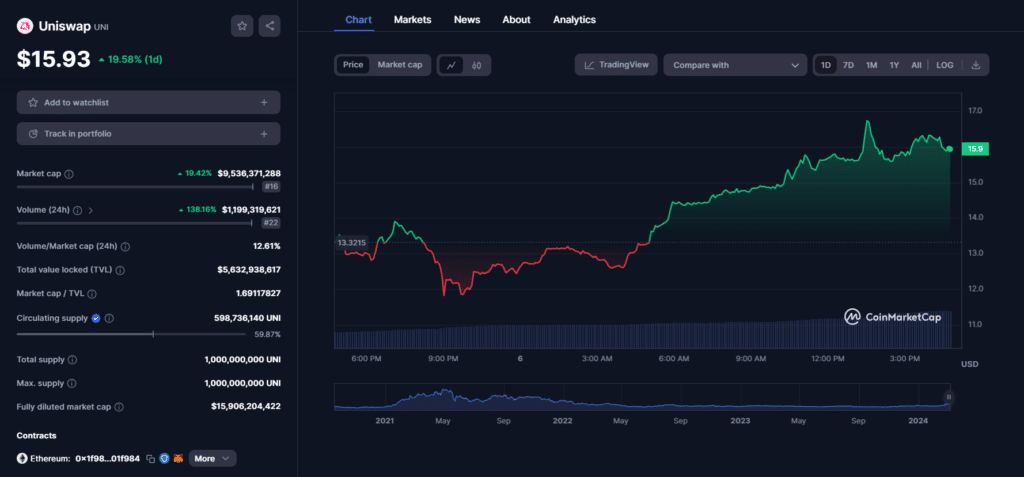

Uniswap’s governance token rose to its highest level in two years on March 6, with the overall altcoin market capitalization exceeding $310 billion for the first time since April 2022.

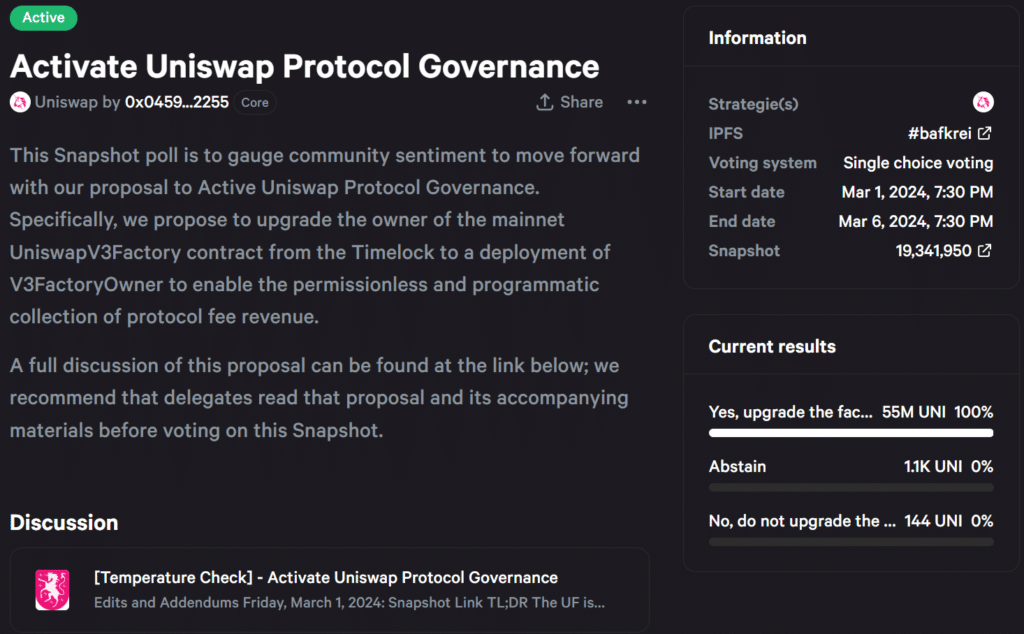

Uniswap (UNI) surged 20% in 24 hours and traded above $15.60 as its proposal to launch protocol rewards for token holders passed a temperature check ahead of an on-chain vote scheduled for March 8.

The last time UNI traded at this price was in early Q2 2022. With the collapse of Terraform and numerous cryptocurrency bankruptcies, the digital asset market was on the verge of a nosedive.

Decentralized protocols use temperature checks to evaluate the community’s views on proposed changes or ideas. A snapshot vote on Uniswap’s DAO forum showed full support for distributing token rewards to UNI holders.

Blockchain advocate Colin Wu estimates that if passed after the first on-chain vote, UNI holders who delegate and stake their tokens could receive a share of $62 million to $156 million in annual income. This is based on Uniswap’s annual protocol revenue.

If the UNI community supports the proposal, other Defi giants like Frax Finance could follow in Uniswap’s footsteps and implement revenue sharing plans. However, 21Shares analysts speculated that these programs could lead to a regulatory crackdown because cryptocurrency assets can meet the security requirements assumed by the Howey test.

Look on chain A large UNI holder said he sold 41,000 tokens as the cryptocurrency price surged to a 26-month high. An on-chain observer said the wallets could be Uniswap team members, investors or advisors.

UNI holders earned $608,000 from the recent sale and still hold over 358,326 tokens, per Etherscan data.