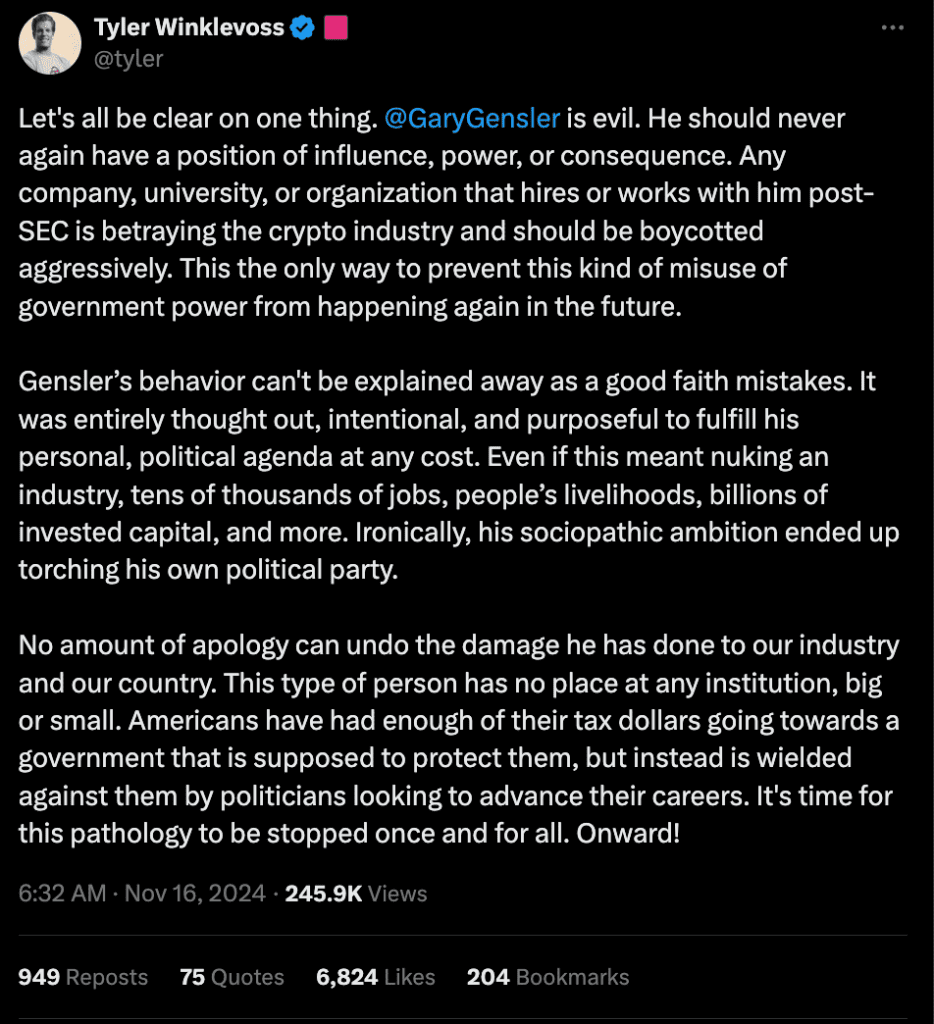

Gemini co-founder Tyler Winklevoss has publicly criticized U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler for what he described as intentional harm to the cryptocurrency sector. Winklevoss expressed his displeasure on social media, calling Gensler’s actions “evil” and accusing him of prioritizing his personal and political agenda over the well-being of an emerging industry. This is an important part of Gensler’s ongoing cryptocurrency critique.

Winklevoss’ comments come amid growing speculation that Gensler could resign following Donald Trump’s Nov. 5 presidential election victory, potentially ushering in changes to the regulatory environment.

Tyler Winklevoss criticizes Gary Gensler’s cryptocurrency legacy.

Winklevoss did not mince words in his criticism of Gensler, saying the damage done during his tenure at the SEC was not due to mere oversight or “good faith” mistakes. According to Winklevoss, Gensler’s regulatory stance was “intentional and purposeful” aimed at suppressing the cryptocurrency industry, regardless of collateral damage. This has led to significant criticism of the Gensler cryptocurrency from industry leaders.

Under Gensler’s leadership, the SEC often targeted major cryptocurrency companies such as Binance, Coinbase, and Ripple with enforcement actions. Winklevoss criticized this approach as “regulation by enforcement”, which he argued had destroyed jobs, livelihoods and significant financial investment in the sector. Gensler’s criticism of cryptocurrency reflects widespread dissatisfaction with his methods.

widespread industry backlash

Winklevoss is not alone in his frustration. ConsenSys CEO Joseph Lubin expressed similar sentiments, accusing the SEC of creating a hostile environment for blockchain innovators. Lubin said the SEC’s actions are casting a long shadow over the industry, creating uncertainty and delaying innovation.

Michael Saylor, founder of MicroStrategy, emphasized the importance of finding the right leadership to replace Gensler if he resigns. Saylor suggested that a more supportive regulatory approach could greatly benefit digital assets and restore confidence in the industry.

Legal Issues Against the SEC

Adding to the pressure, 18 US states recently filed a lawsuit against the SEC and Gensler, accusing the agency of exceeding its authority and unfairly targeting the cryptocurrency industry. States like Texas, Nebraska and Wyoming joined forces to fight the SEC’s action, labeling it “government overreach.” This reflects another dimension of Gensler’s cryptocurrency criticism.

The lawsuit further deepens the debate surrounding the SEC’s role in regulating an industry that continues to evolve at a rapid pace.

optimism about change

As calls for Gensler’s resignation grow, the cryptocurrency community is hoping for a more constructive regulatory environment. The report singled out Dan Gallagher, former SEC commissioner and Robinhood’s legal chief, as a leading candidate to replace him.

As the industry anticipates change, Tyler Winklevoss emphasizes the need for balanced oversight to encourage innovation without hindering growth.