Price Analysis after Ether Lee Today: ETH’s main short -term goals to consider ETH in Coinpedia Fintech News

- According to the warm chain data, whales show that they have been accumulating ethers for the last few days.

- ETH prices must continue to close $ 1,687 in order to invalidate multi -state governments.

- Ether Lee has bleeded Solana and will continue in the next few months.

Ether Leeum (ETH) prices followed Bitcoin (BTC) in an optimistic outlook on Tuesday, April 22, and potentially ended multiple main market correction. The large cap Altcoin, which has been completely diluted about $ 250 billion, has recorded an average of 36 % of the 24 -hour average trading volume at the time of this writing, reaching about $ 200 billion.

For the first time since April 6, the price of ether exceeded $ 1.7K in the mid -North American American session on Tuesday.

Ether Leeum Whale gradually returns

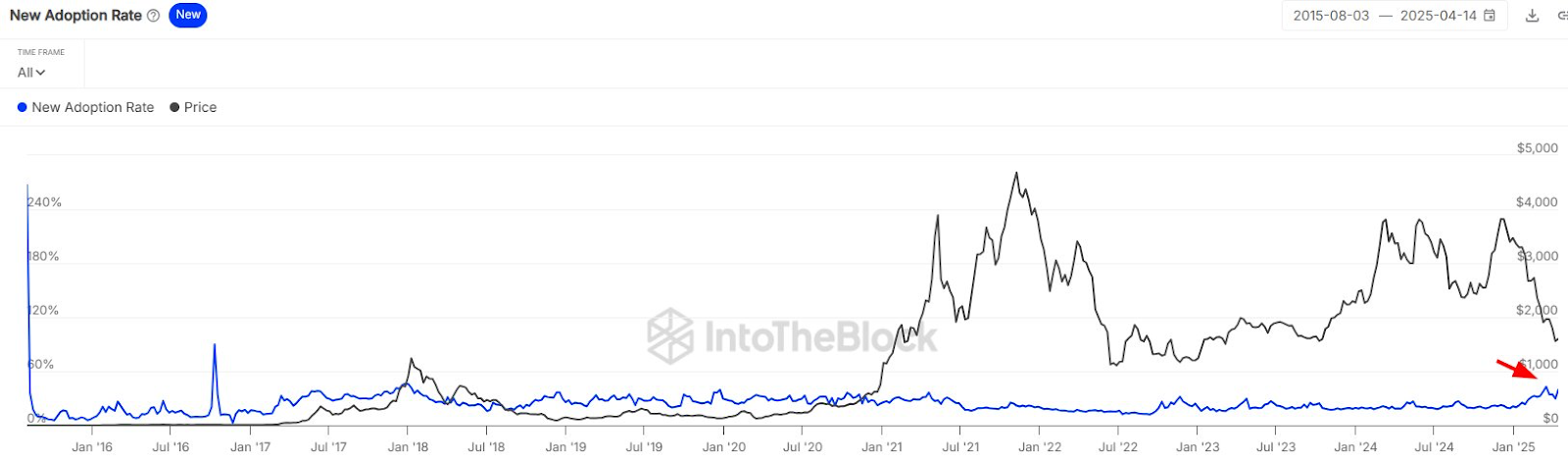

According to INTOTHEBLOCK’s market data, Ether Lee’s adoption rate has grown gradually, and signaled potential separation in crazy speculation. In Ether Leeum network, the tokenization of the actual assets (RWAS) helped to increase chain activities and attract more whale merchants.

According to the chain data of Lookonchain, the whale investor has accumulated 48,477 ETHs on the encryption exchange since February 15 and has now lost about $ 21 million. Meanwhile, the cash leak of the US Spot ether ETF has declined significantly over the last few days, increasing market trust.

Middle ether price target

For the first time since Donald Trump’s second inauguration, ether prices have broken through the daily drop trends for the US dollar. After setting up more than $ 1,500 in the last two weeks, Ether’s price is well prepared for the reversal of the market.

From a technical analysis point of view, the daily MACD indicator is approaching optimistic flip. On the other hand, the daily relative strength index (RSI) forms optimistic radiation, and if the indicator continues to close to 50 % or more, the reversal will be confirmed.