Crypto Market’s recent recovery disappeared when a sharp selling on Friday gained almost every week. Investors have changed carefully, with the core PCE data expected on April 2 and President Trump’s upcoming tariffs scheduled for April 2. As Bitcoin faces sales pressure of less than $ 85,000, it will be held in the worst quarter since 2018, and analysts can guess whether March will be finished below $ 80,000.

Bitcoin has faced the worst Q1 since 2018.

The price of Bitcoin has fallen sharply over the last few hours. According to CoingLass data, almost $ 995 million in BTC positions, including $ 79.3 million from buyers and about $ 12.5 million from sellers.

This recent price drop has the worst Q1 performance since 2018. According to CoingLass’s data, Bitcoin fell approximately 11.86% in the first quarter of 2025 and is slightly worse than 10.83% loss in the first quarter of 2020.

Bitcoin’s public interest has decreased by 4.5% over the last 24 hours, closer to about $ 54 billion. Disclosure and decrease in the reduction of trading activities among BTC traders, which can lead to a decrease in volatility in the short term and causing more careful market behavior.

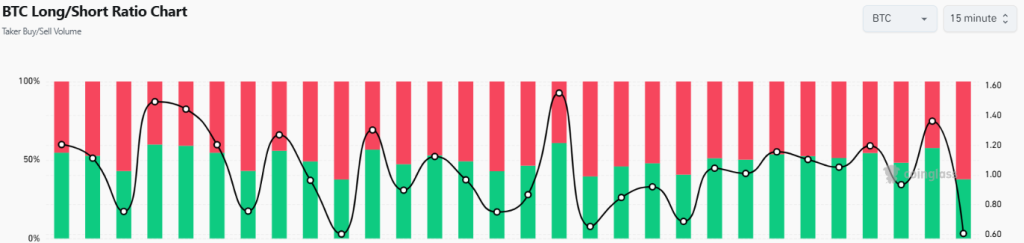

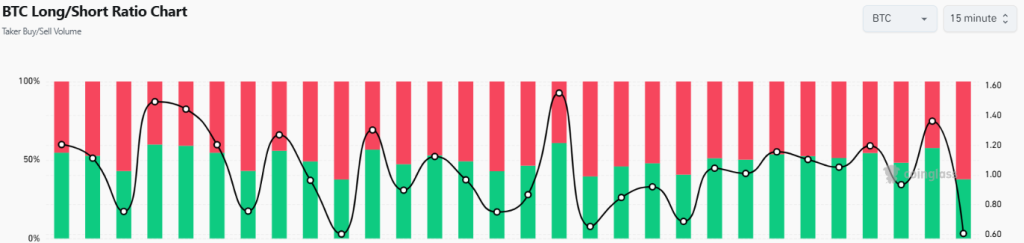

In addition, the long and short ratio has experienced a noticeable decline in 0.6051. This metric is about 62.3%of merchants betting on the additional price cut of Bitcoin, while only 38%hope for potential rebounds. Overall, this figure points out the weakness of the increase among merchants.

Also read: Bitcoin ETF 10 days after surge

Bitcoin ETFS adds to the weakness of the weakness to experience a notable leak and push the BTC closer to the $ 80K level. The FIDELITY’s FBTC fund alone has leaked $ 91.6 million on Friday, with the longest 10 -day inflow of this year. In particular, the FBTC received $ 91.4 million in the previous day, depending on the Sosovalue. On Friday, the US Bitcoin ETF’s trading volume is slightly increased on Friday, a total of $ 22.2 billion.

What is the BTC price?

BITCOIN has recently experienced an increase in sales pressure, lower than the level of Pivonacci support, reaching $ 81,644. Bitcoin is currently nearly $ 82,289, down 1.7% over the last 24 hours.

The seller actively holds an important resistance to $ 85,000 to prevent the price from splashing. Nevertheless, the buyer still makes a decision and prepares another push that can reclaim this core level.

If a buyer can recover $ 85,000, market feelings can be moved positively, potentially nearly $ 90,000, and then packed higher momentum toward major resistance.

However, if the buyer fails to overcome this important barrier, Bitcoin can return the price to the support area between $ 80,000 and $ 78,000, facing an increase in sales pressure.