The discussions between the SEC and Franklin Templeton come as cryptocurrency proponents remain bullish on the Bitcoin ETF even amid market declines.

The $1.5 trillion asset management firm reportedly met On December 8, there were further discussions with the Securities and Exchange Commission (SEC) regarding the company’s bid for a spot Bitcoin ETF. This ETF is a product that many potential issuers are hoping to introduce to the US market.

The SEC has held conversations with several issuers, including BlackRock and Grayscale, in recent weeks, but details of the meetings have not been made public. Additionally, discussions with Franklin Templeton are likely to indicate progress on the company’s application.

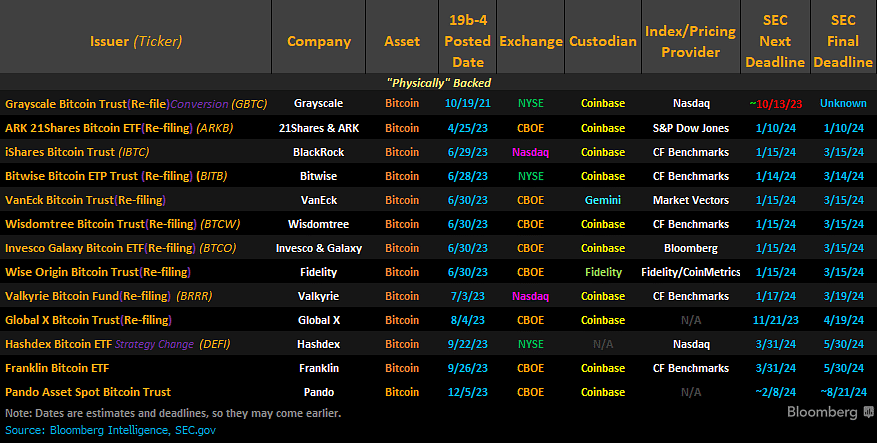

Franklin Templeton entered the September 2023 Bitcoin ETF race, joining a list of issuers that would later grow to 13 as Pando submitted a bid. The SEC previously postponed its verdict and instead decided to extend the comment period for the company and several other issuers, crypto.news reported.

Supporters believe the SEC could approve multiple filings by January 2024, but another update on Franklin Templeton’s application is not scheduled until March 31, with a final deadline of May 30.

Bitcoin ETF Inch Ahead of SEC Approval

In other Bitcoin ETF news, experts believe the final laps are now underway before SEC-approved issuers list the funds. Talks between the securities watchdog and the potential issuer have reportedly moved to a key stage, with the two sides discussing details of an agreed buyback plan.

Analysts said the SEC would likely prefer a cash-generating system over alternative spot models. However, a final decision on the matter has not yet been announced by the Gary Gensler Committee.

A spot ETF investing in Bitcoin (BTC) would attract billions of dollars in investments and serve as a guarantee for institutional investors, according to Galaxy Digital CEO Mike Novogratz and ARK Invest’s Cathie Wood. Cathie Wood, CEO of Galaxy Digital, expects to hear back from the SEC early. next month.

Sunny Lu, CEO of L1 network VeChain, agreed with both Novogratz and Wood regarding the influx of institutional assets if the SEC approves the application. Lu told crypto.news that this news could have a bigger impact on the market than BTC’s halving.

The ETF will open the door for the world’s largest institutional investors to enter the cryptocurrency market. Major progress on the regulatory front, such as MiCA in Europe, will pave the way for mass adoption of blockchain and cryptocurrencies in the real world.

VeChain CEO Sunny Lu