With tax date approaching in the United States, it's time for cryptocurrency holders and expats in the United States to make sure their finances are in order. To shed light on how to tackle tax complexity, we gathered insights from four tax experts.

Benefits of an Extension: Filing Your Taxes

Tax attorney Robert W. Wood advises taxpayers to consider requesting an extension and file their returns by Oct. 15. Contrary to popular belief, filing for an extension does not increase your chances of being audited. In fact, it can reduce audit risk by giving you additional time to accurately prepare returns.

Expat Tax Strategy: Excluding Foreign Earned Income

Justin Wilcox, partner at FML CPA, highlights the potential benefits of the foreign earned income exclusion. (sweep) For foreigners. By meeting certain criteria, expats can exclude a portion of their foreign income from U.S. taxation. Understanding residency tests and exclusions can have a big impact on the tax obligations of expats living and working abroad.

Navigating International Taxation: FEIE vs. FTC

Crystal Stranger, CEO of Optic Tax, highlights the differences between FEIE and Foreign Tax Credit (FTC) for expats. The FEIE excludes foreign earned income from U.S. taxes, while the FTC offsets U.S. taxes by foreign taxes paid. Switching from FEIE to FTC comes with fines and a lot of misinformation in this complex area, so choosing between the two requires careful consideration.

Cryptocurrency Profits and Tax Implications

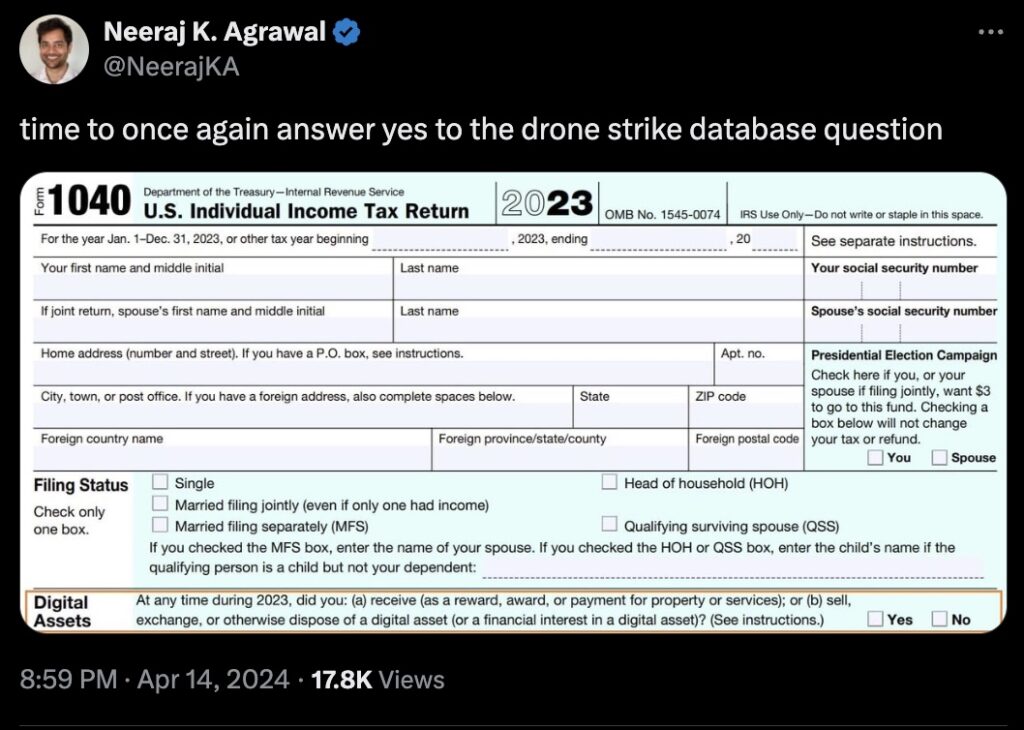

CPA Tyler Menzer warns against default settings in online tax preparation software, especially when it comes to cryptocurrency earnings. Although these tools can simplify calculations, default methods such as highest in, first out (HIFO) can unintentionally increase your tax liability. Choosing a specific identification method can help minimize your tax burden, especially for long-term cryptocurrency holdings.

In summary, dealing with the tax obligations of expats and cryptocurrency holders requires careful planning and understanding of the available strategies. By seeking professional advice and staying informed, taxpayers can optimize their financial position while remaining compliant with tax laws.