Solana (SOL), the world’s fifth-largest cryptocurrency by market cap, is expected to see a massive price surge in the coming days following a major breakout. After struggling for nearly two weeks near the strong resistance level of $138, SOL broke through this level today on the daily timeframe with a strong bullish candle.

Solana (SOL) Price Prediction for September 14

According to the technical analysis of experts, SOL looks bullish despite trading below the 200 exponential moving average (EMA) on the daily time frame. In trading or investing, the 200 EMA is a technical indicator that indicates whether an asset is in an uptrend or downtrend.

Based on past price momentum, if SOL closes its daily candle above the $138 level, it is likely to surge 20% to $163, and if the bullish sentiment continues, it is likely to surge to $185.

SOL’s bullish on-chain indicator

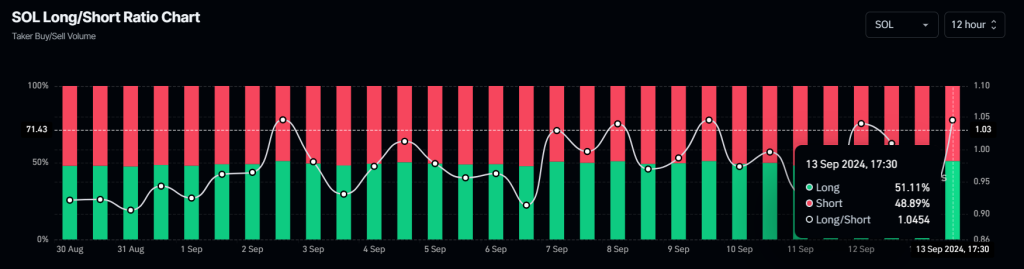

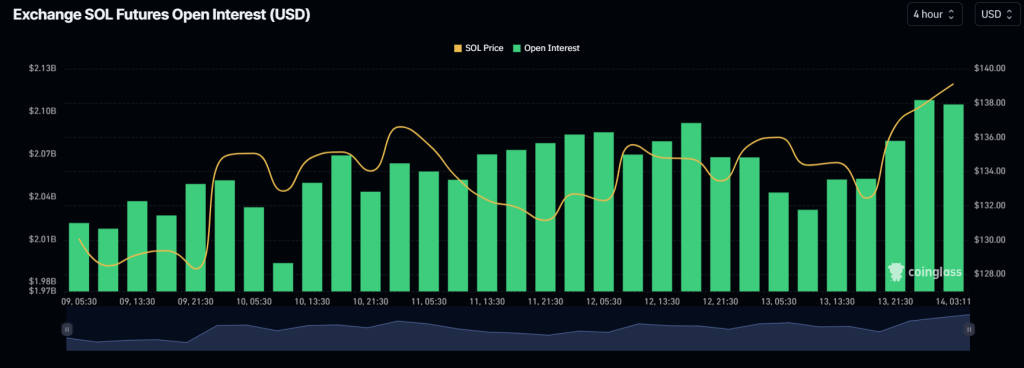

The bullish outlook for SOL is further supported by on-chain metrics such as long/short ratio, futures open interest, and OI-weighted funding ratio.

Coinglass’s SOL long/short ratio is currently at 1.0454, indicating bullish market sentiment among traders. This on-chain indicator helps traders and investors gauge market sentiment. At the time of writing, 51.11% of top traders are long SOL, while 48.89% are short.

Meanwhile, SOL’s future open interest has increased by 4.5% over the last 24 hours and is steadily rising. This indicates that traders are betting more on long positions than short positions. Traders and investors often consider an increase in open interest and a long/short ratio greater than 1 while building a long or short position.

Additionally, SOL’s OI weighted funding ratio currently stands at +0.0024%, suggesting a bullish outlook for Solana.

Current price momentum

At the time of writing, SOL is trading near $139 and has experienced a price surge of over 2.75% in the last 24 hours. Meanwhile, volume has increased by 2.5% in the same period. This increasing volume suggests increased participation from traders and investors following the recent breakout of a key resistance level.

This bullish theory only holds true if SOL closes its daily candles above the resistance level, otherwise it may not hold.