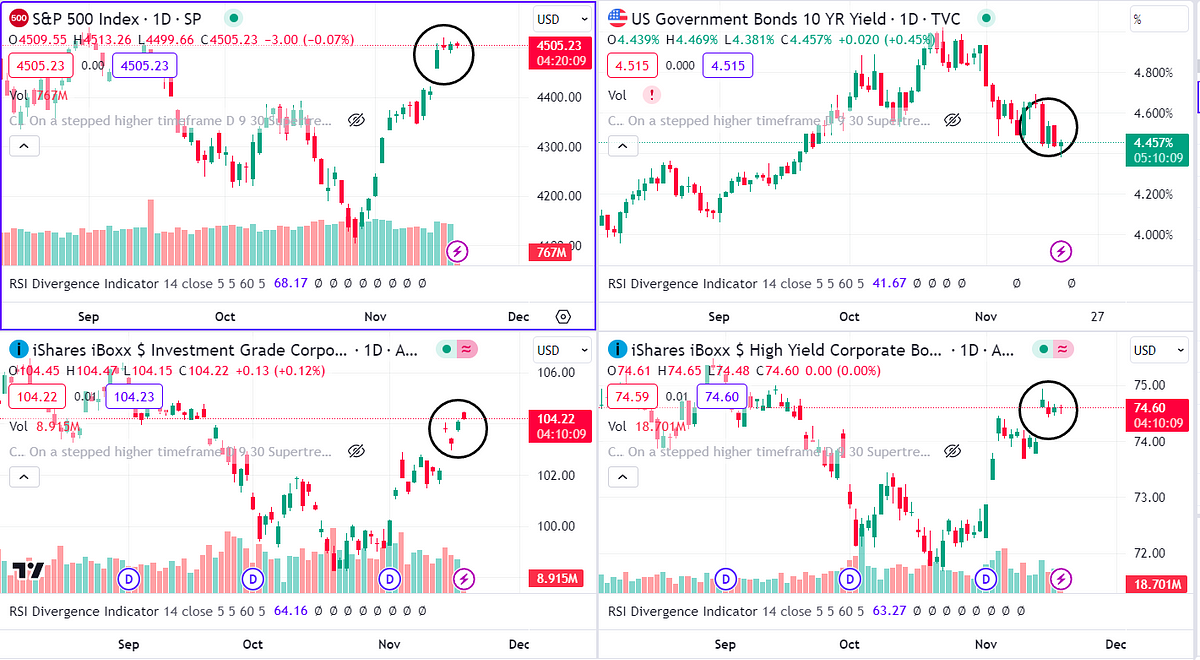

The release of cooler-than-expected CPI data on Tuesday (3.2% vs. 3.3% forecast) reinforced the market view that the hiking cycle is over and fueled an ongoing cross-asset rally. Bond yields have plunged from their first 20 basis point rise in five years, while the 10-year yield has fallen to 4.46%, up about 60 basis points over the past few weeks. Higher yields and higher-rated corporate bonds created a credit gap that ended the week higher. SPX also gapped higher and held on to 4500, erasing most of its losses since September, while the dollar index (DXY) fell the most in a year to a 104 handle, significantly easing financial conditions. This yield decline combined with DXY was rocket fuel for the small cap stock, which rose ~7% before taking profits.

Thursday’s jobless claims data was also slightly higher than expected, increasing market optimism about the soft landing story (the labor market is cooling enough to keep inflation under control, but not enough to cause a deep recession). Producer prices (PPI) also fell more than expected, amplifying the impact of the CPI report. Now that inflation data is on a more manageable track, monetary policy appears to be working with lag as expected and markets are pricing in a soft landing. In fact, the market is pricing in a ~32% probability at the March meeting. interest rate reduction !

The concern among some participants is that the market is overestimating the FED’s response and prices in a very dovish way, which will lead to a reversal move later. The market is pricing ‘possibility’.insurance cutsIn 2024, the FED took steps to ease policy to maintain a more restrictive policy setting and prevent accidental excessive tightening as inflation falls. How tight or loose monetary policy is is determined by the level of real interest rates, which automatically rise when inflation falls (real = nominal inflation). To keep real interest rates at the same level and policy settings at the same level, the FED must: Stand still and cut. But markets are also considering the possibility that the Fed will panic over a full retreat from restrictive policy settings and rising unemployment if the economic slowdown deepens, especially in an election year.

Powell wants to push back on this story and keep the two-way policy risk alive by insisting that further rate hikes are possible. But the FED is also trying to thread the needle and make sure policy isn’t too tight. recession. The further trajectory will depend on the data, and at this point, based on the trajectory of inflation and other economic indicators, it appears to indicate that the hiking cycle is over.

The furious cryptocurrency rally took a brief stifle this week as Bitcoin consolidated in the monthly range of 35-37,000. Additional catalysts are needed to break out and head towards 40,000 with market expectations that the ETF narrative win will provide momentum.

The controversy over the ETF narrative took a huge hit when fake news about the XRP ETF caused the price of This has tempered sentiment and expectations for altcoin ETFs and brought the focus back to the ‘real’ narrative, which is the Bitcoin ETF, which is almost certain to be approved before January 10th, while altcoin ETFs have a much longer time horizon. It will take.

Ethereum

ETH has retreated below $2000 and the market awaits the next catalyst as expectations regarding the ETH ETF approval timeline ease. ETHBTC has also fallen and is trading around 0.053, while BTC dominance has been regained as the rally in ETH and alts has cooled.

Solana

Solana continues to outperform the rest of the major markets, maintaining a solid 45th place in approval rating. With multiple ecosystem project airdrops and token launches expected, the narrative remains positive and we remain optimistic as the rally cools and Sol consolidates a bit. As long as the support area remains.

Another important development is that CME’s futures volume surpassed Binance for the first time. This heralds a subtle structural shift underway in the market, with tradfi likely to see significant amounts of new capital flowing into the space. This is overall optimistic!