that much Bitcoin The sell-side risk ratio is calculated by dividing the sum of all profits and losses realized on-chain by realized capitalization, and provides a comparative view of daily investor activity against total market capitalization adjusted for real-time inflows and outflows.

A rise in this indicator means that sell-side pressure is likely to increase, potentially increasing market volatility.

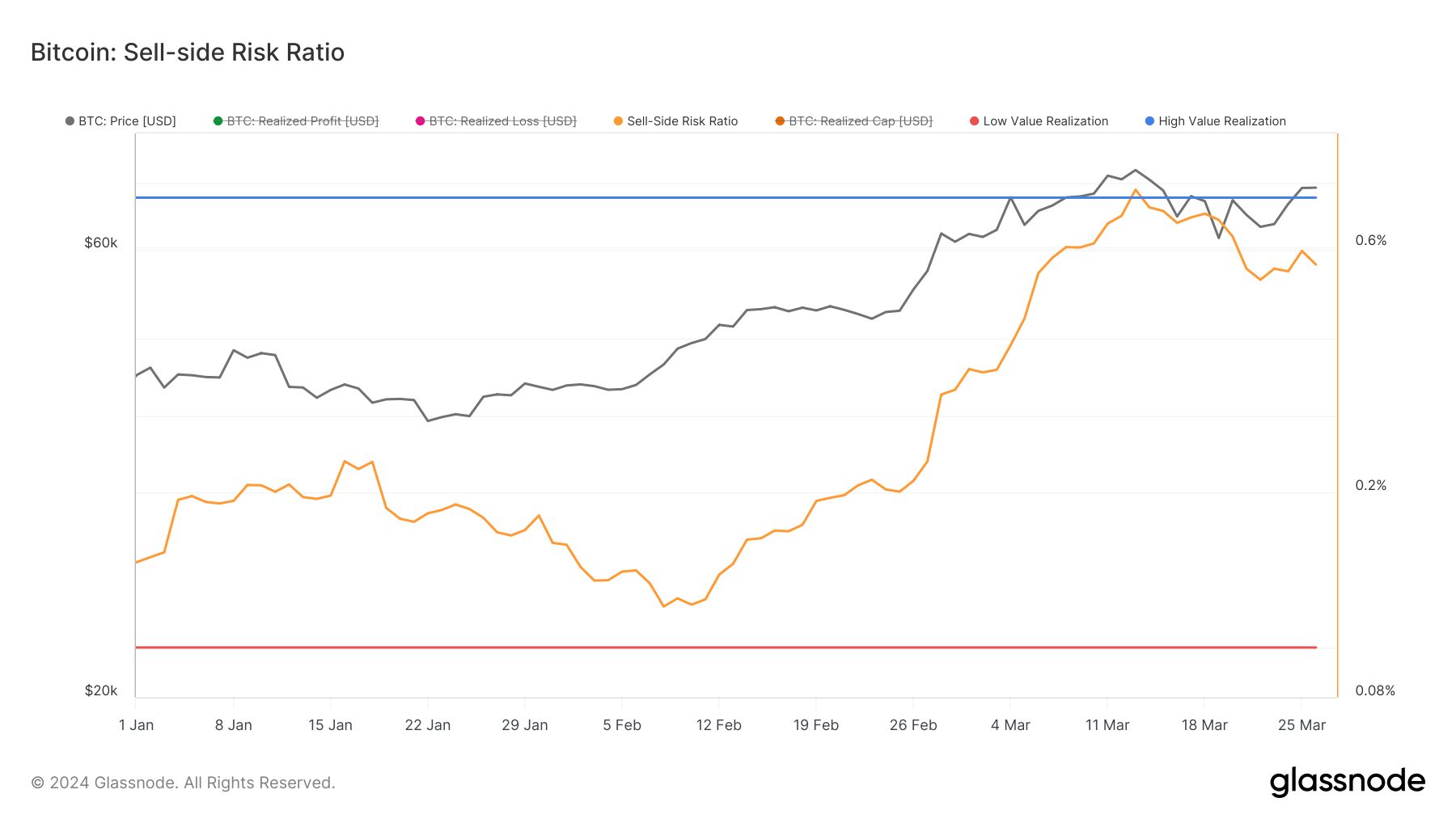

Between February 8 and March 13, the Bitcoin sell-side risk ratio rose significantly from 0.12% to 0.777%. This increase follows a significant increase in the price of Bitcoin from $45,330 to $73,104. This period saw the highest sell-side risk ratio, with the ratio exceeding the 0.75% threshold for the first time since March 9, 2021.

After this peak, BTC fell to $61,860 by March 19th. recovering March 26 $70,000. The sell-side risk ratio was adjusted to 0.556%.

The periods during which the sell-side risk ratio increases above the upper limit are: High value realized This is often observed in the later stages of a bull or bear market capitulation event. However, spikes like this can also occur at the beginning of a bull cycle, especially when the market goes through an initial correction.

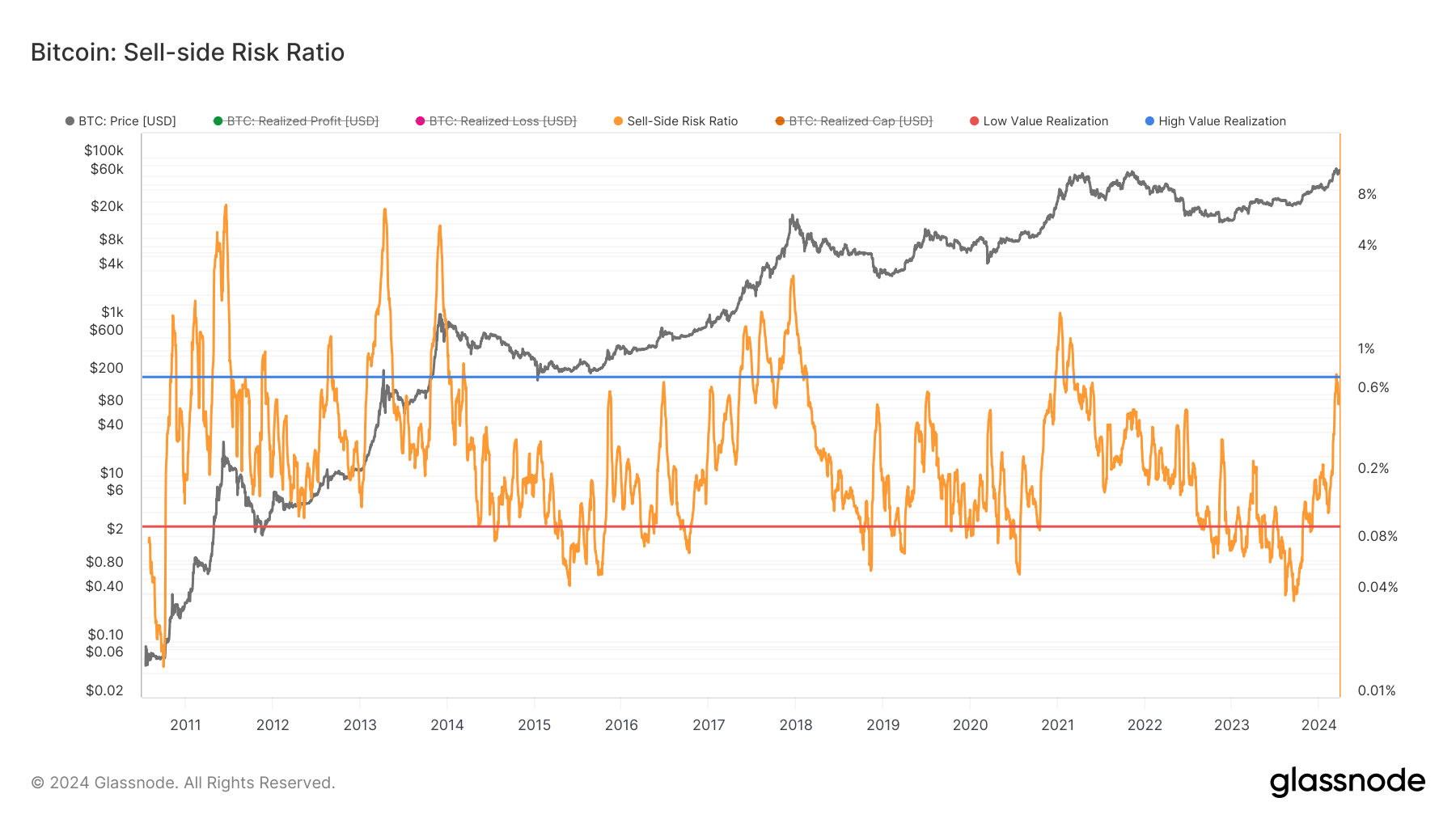

Subsequent revisions in Bitcoin price and sell-side risk ratio indicate volatility. However, this volatility is not unprecedented. Since 2011, returns have tended to decline with each market cycle, leading to lower peaks in sell-side risk ratios. This is consistent with the observed pattern of investors realizing smaller profits each cycle, suggesting a maturing market.

The fact that the rate will remain consistently above 0.1% after November 29, 2023 further emphasizes the transition away from traditional approaches. Very low value realized It was observed on September 18, 2023 at 0.039%. This transition marks a move from a market bottom and accumulation phase to a more active and speculative trading phase.

Breaking the cap marks a significant turning point driven by investor optimism and profit taking. However, the historical trend of lower peaks in this ratio may indicate a gradual stabilization of the market, with peaks in value realization becoming less pronounced as the market matures.

As Bitcoin surpasses $73,000, sell-side risk ratios hit a three-year high. First appeared on CryptoSlate.