S & P 500: Is there a large -scale purchase opportunity? | By mosaic assets | Coinmonks | April 2025

In just two trading sessions The S & P 500 lost 10% of the stock market has a market value of $ 6.6 trillion.. It was the biggest two losses in history.

After the February 19th peak, the stock market withdrawal After President Trump announced a large -scale new tariff, the decline was rapidly accelerated..

In addition to the new 10% tariffs of AA for all imports to the United States, other countries face much higher proportions. for example, The tariff rate for imports from China can account for more than 60% of the latest increase..

As a result of the scope and scale of new tariffs The weighted average tariff rate surpasses the ratio after the Smooth-Hawley Act. It helped to cause the Great Depression (Chart below)

Even before the latest trade war escalation There were signs that the tariff policy affects business spending and consumer sentiment investigation.. The new spell components in the ISM manufacturing report last week have dropped sharply from the previous month 48.6 to 45.2. The new order is the main indicator of economic activity.Here, in the ISM report, less than 50 readings indicate contract activities.

and Investors can wait for a while if they want the help of the Federal Reserve Bank.. During the Friday speech, Jerome Powell, the Fed Chairman, repeated the central bank’s “waiting and watching” approach.

POWELL is also the duty of the central bank We fix the expectation of long -term inflation well And the increase in price level is to prevent continuous inflation problem. ”

This shows inflation effects and concerns caused by more tariffs. at the same time Delay indicators of labor market activities. According to the March payrolls report, 228,000 jobs were created for a month compared to the estimates of 140,000.

Rurges and concerns about inflation prospects and concerns The Fed is currently a side job.

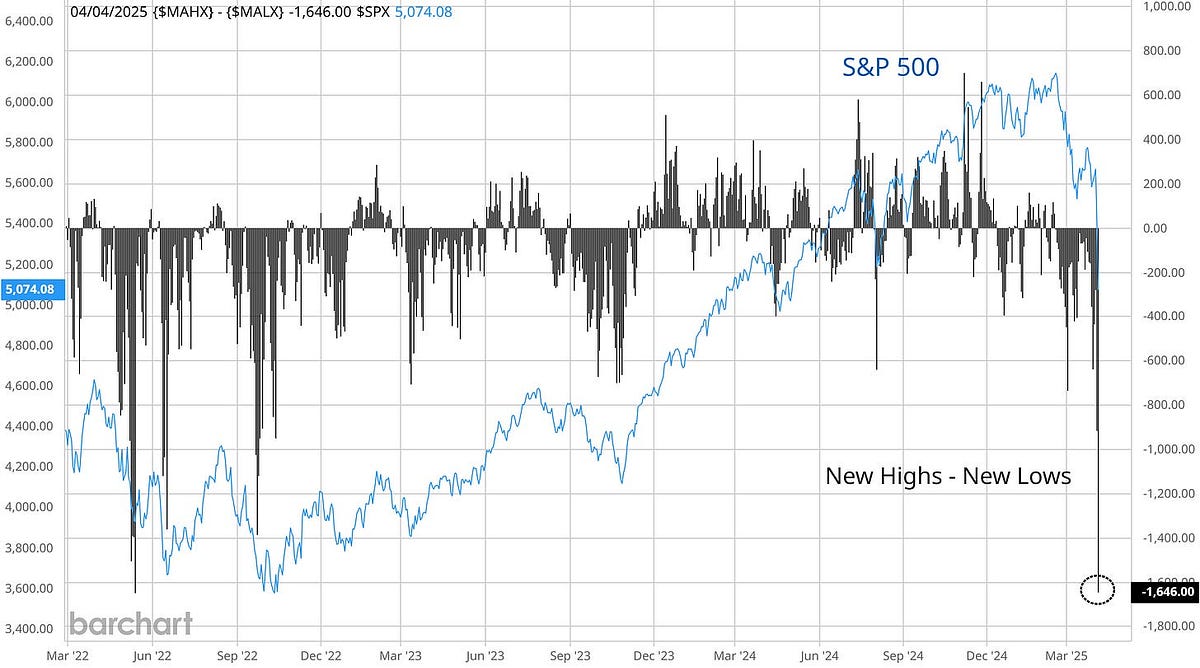

Excellent uncertainty and stocks plummeted Emotions and width indicators hit much more extreme wash levels.. In this week’s update The meaning of various metrics and advanced revenue showing the historical size of decline last week and surrender.