Render’s native token, RNDR, is making big waves amid the ongoing market correction as it looks poised for notable upward momentum. This speculation is driven by RNDR’s bullish price action pattern, significant participation from traders and investors, and overall positive market sentiment.

Render (RDNR) Technology Analysis and Future Levels

According to CoinPedia’s technical analysis, RNDR has broken out of its recent bullish double bottom price action pattern and is currently targeting the next resistance level of $10. However, this breakout occurred in a shorter period of time (4 hours), moving the token towards the bullish side.

Render (RNDR) Price Prediction

Based on recent price action and historical momentum, it is likely that RNDR will rise 18% to $10 in the next few days. Additionally, on the daily time frame, the altcoin is showing strength, surging 35%, showing the possibility of reaching the $12 level soon.

Bullish on-chain indicators

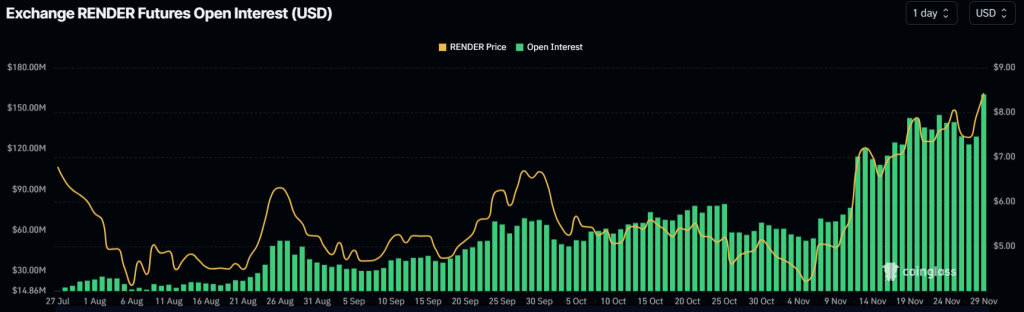

In addition to technical analysis, traders have shown strong interest and trust in RNDR, as reported by on-chain analytics firm Coinglass.

According to the data, RNDR’s open interest (OI) has surged 29% in the last 24 hours and 12.8% in the last 4 hours. This increased trader participation has driven RNDR to a record open interest of $160.3 million.

This increase in interest not only indicates the building of new positions, but also shows traders’ faith and confidence in the token.

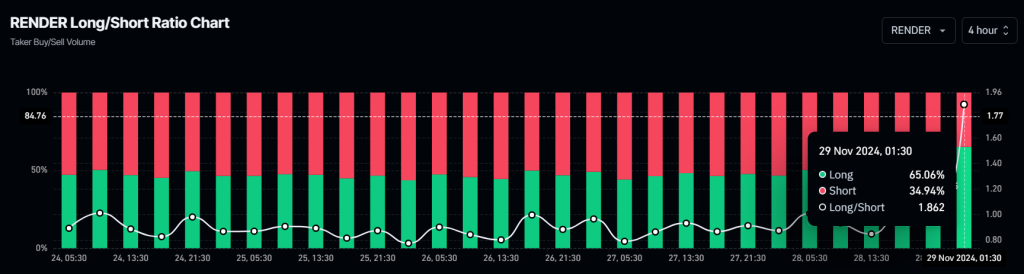

Additionally, RNDR’s long/short ratio is currently at 1.86, indicating strong optimism among traders. Data shows that 65% of top RNDR traders hold buy positions and 35% have sell positions.

Traders and investors often use a combination of increased open interest and long/short ratios above 1 as signals when establishing long positions.

Current price momentum

While most of the top cryptocurrencies are currently struggling to gain momentum, RNDR ranks third in terms of price growth. At press time, RNDR is trading near $8.50 and has recorded upward momentum of over 9.25% over the past 24 hours. Meanwhile, trading volume surged 98% during the same period, indicating notable engagement from traders and investors amid the asset’s bullish outlook.