Uniswap has surpassed Bitcoin in fees paid by cryptocurrency traders for over a week, and on February 14th, the DEX surpassed Bitcoin.

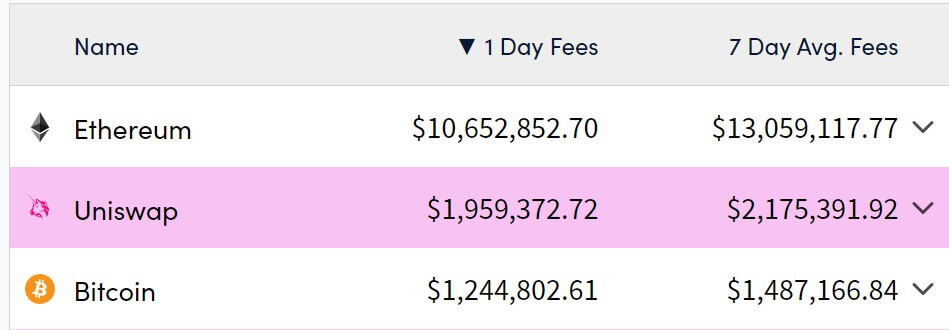

According to data from Cryptofees, Uniswap recorded about $1.9 million in fees on February 25, surpassing Bitcoin’s $1.2 million on the same day. This trend has continued since mid-month, with Uniswap bringing in fees averaging $2.1 million last week compared to BTC’s $1.4 million.

Meanwhile, Ethereum is the overall leader in terms of transaction fees. The blockchain network generated $10.6 million in fees over the past day and an average of $13 million per day over the past week. In particular, Bitcoin held an enviable position early this year and for parts of last year as community interest in Ordinals Inscriptions led to higher network fees.

Uniswap Fees

Uniswap’s lucrative fees come at an interesting time. The DEX Foundation recently proposed a fee compensation mechanism for UNI token holders.

According to DeFillama data, Uniswap is the largest DeFi DEX platform, processing approximately 30% of all transactions in the decentralized finance sector. Specifically, all fees incurred on Uniswap belong to liquidity providers (LPs) who supply assets to the platform. These fees are incurred when users perform asset exchanges on exchanges, indicating increased activity within the decentralized ecosystem.

However, with the new proposal, the DEX will allocate protocol fees to staking and delegated UNI token holders to enable governance participation. Erin Koen, Head of Governance at the Uniswap Foundation, highlighted the potential of this move to strengthen the resilience and decentralization of the protocol.

Devin Walsh, the Foundation’s Executive Director, further emphasized how the upgrade will strengthen Uniswap’s governance. Walsh added:

“If every company built on Uniswap disappeared tomorrow, it would be up to their representatives to leverage their power to ensure that the Uniswap protocol + ecosystem continues to survive and thrive in the future. Encouraging active and participatory delegation in that way is essential to the long-term sustainability of the protocol.”

This proposal awaits preliminary and final on-chain voting before being implemented.

In response to these developments, the UNI token has seen a notable rise, rising nearly 40% to $10.59 in the past week. CryptoSlate’s data.