It was not desirable for Popcat (Popcat), a popular SOLANA -based MEME COIN over the last few weeks, but the current price measures seem to be changing. As of February 9, 2024, POPCAT is receiving considerable attention from encryption enthusiasts and is preparing for a huge rise.

40% rally in popcat

POPCAT is currently dealing with nearly $ 0.305 and has experienced a surge of more than 40% over the last 24 hours. This large -scale rally has been a remarkable participation from traders and investors by moving the current price behavior to the stronger. As a result, the trading volume of Meme Coin has soared 38% over the same period.

This participation does not follow the large -scale price surge, but after the price is optimistic.

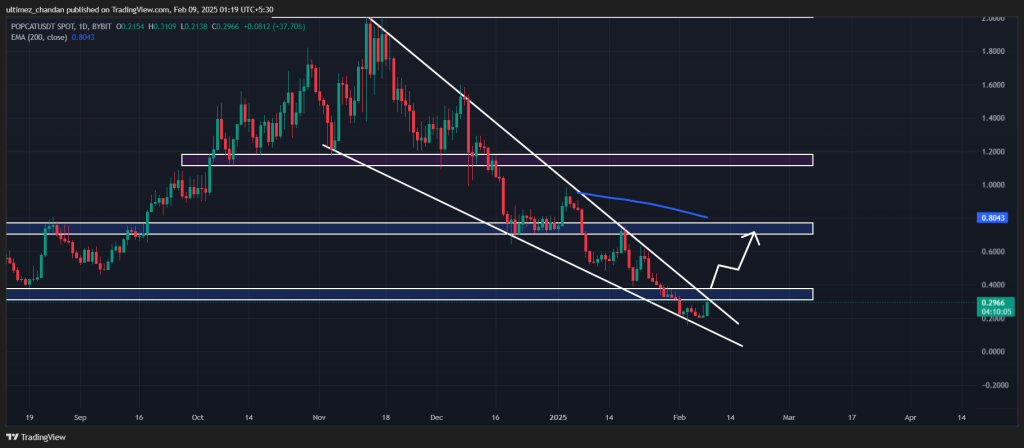

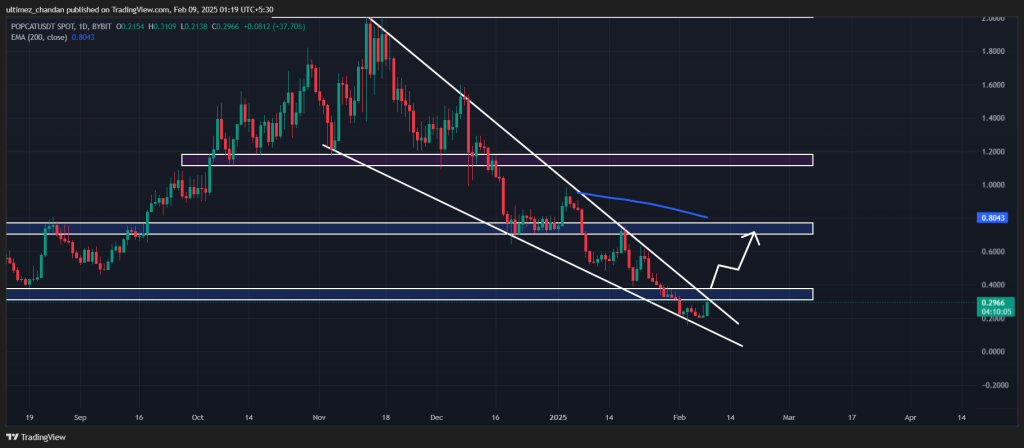

POPCAT technology analysis and upcoming level

According to the expert’s price behavior, POPCAT has successfully formed a long -standing wedge price behavior pattern in a daily time and is now just before the breakout. In recent prices, MEME COIN has lost some important support levels, including $ 1.12, $ 0.70 and $ 0.30.

However, with a 40%rising exercise, MEME COIN seems to have recovered from the support level and is preparing for a strong escape.

Based on the recent price measures, if POPCAT maintains this profit, violates this pattern, and closes the candle of more than $ 0.40, the meme coin increases by 80% and reaches $ 0.70, and then gradually $ 1.12 and gradually $ 1.12. more.

Currently, MEME COIN is traded below the EMA (E) index moving average (EMA) for a daily period, indicating that it is in a decline.

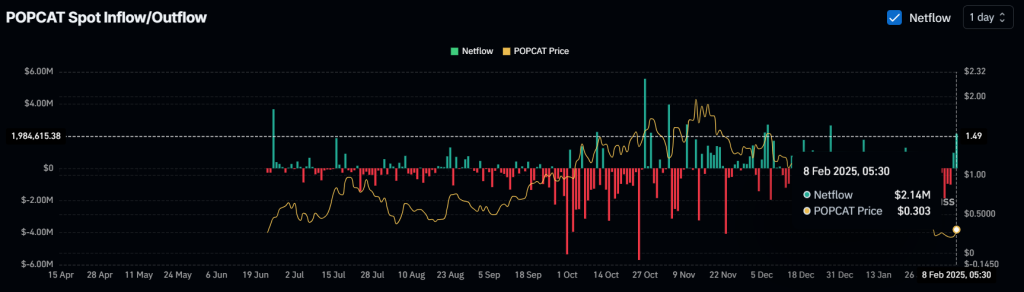

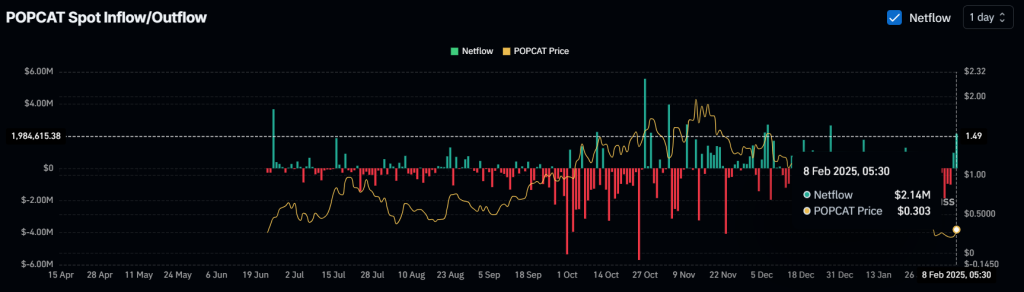

$ 21.5 million in popcat inflow

With this optimistic price behavior, some whales and long -term owners, as reported by the whole chain analyst company, reported, some whales and long -term holders are abandoning their exchanges on their exchanges. According to the data of the spot inflow/outflow, the exchange of the encryption environment has witnessed the inflow of more than $ 2.15 million, which indirectly suggests the potential selling of profits.

However, this inflow of exchange after the rally can cause sales pressure and price drops, but the market did not respond much, which also suggests the sustainability of traders and investors.