Main takeout

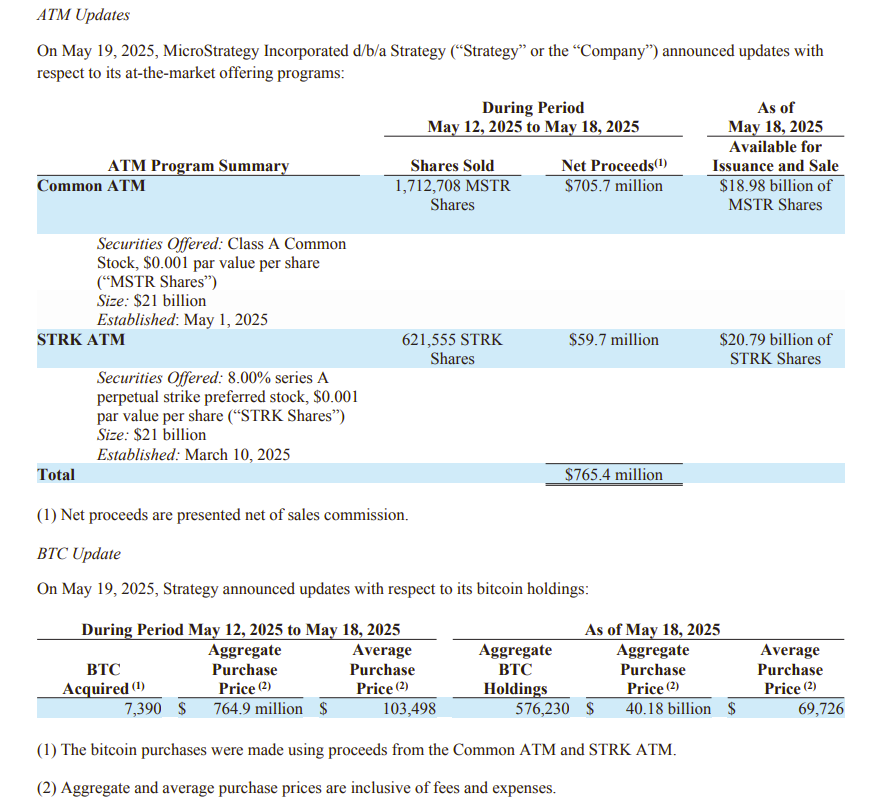

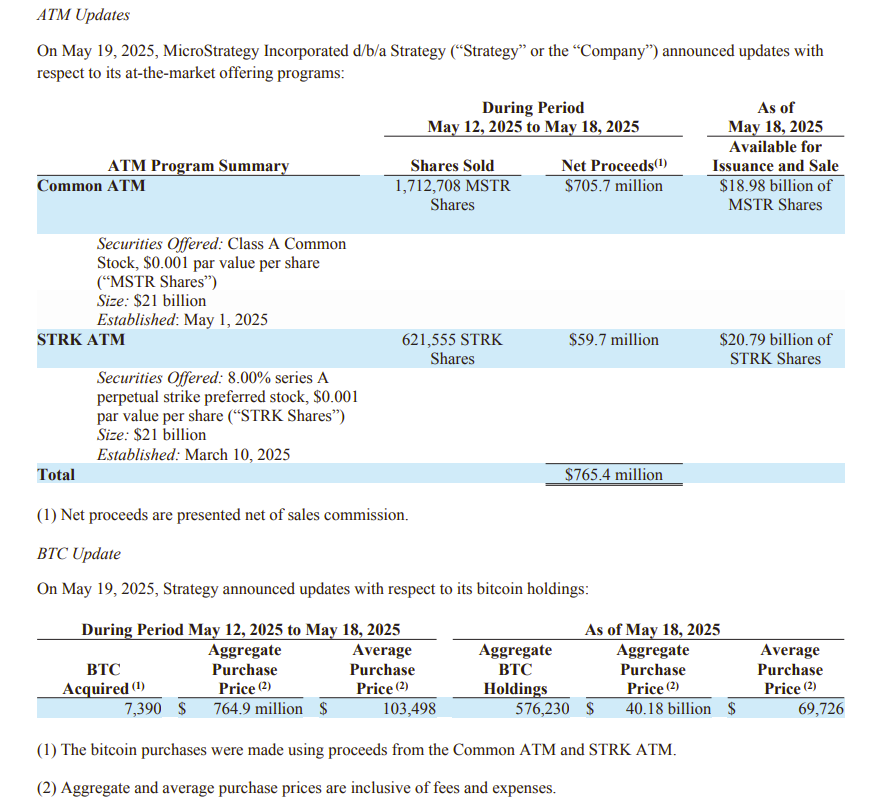

- The strategy was $ 103,498, and I bought 7,390 Bitcoin for $ 550 million.

- The company has $ 42 billion in Bitcoin by 2027 and has accumulated 576,230 BTC so far.

Share this article

Monday, Michael Saylor’s strategy announced that he bought 7,390 Bitcoins between May 12 and 18 and invested about $ 765 million in the acquisition. With this movement, the company has always set a stake in Bitcoin to 576,230 BTC and is currently worth more than $ 5.9 billion.

According to a Monday submitted to the SEC, the software company has funded the latest Bitcoin acquisition through a common ATM equity program and a permanent convertible stock.

Last week’s strategy sold about 1.7 million MSTR stocks and more than 621,555 STRK stocks, generating pure proceeds more than $ 765 million.

The company still owns more than $ 18.9 billion in MSTR stocks and has about $ 25.7 billion of STRK stocks that have been approved for future issuance and sales. Regardless of the market situation, we aim to accumulate $ 42 billion in Bitcoin by the end of 2027.

As Bitcoin’s largest corporate holder, the strategy is now controlled by more than 2.7% of the total BTC supply, followed by Mara Holdings and the newly established Bitcoin Native company Tether-Backed Twenty.

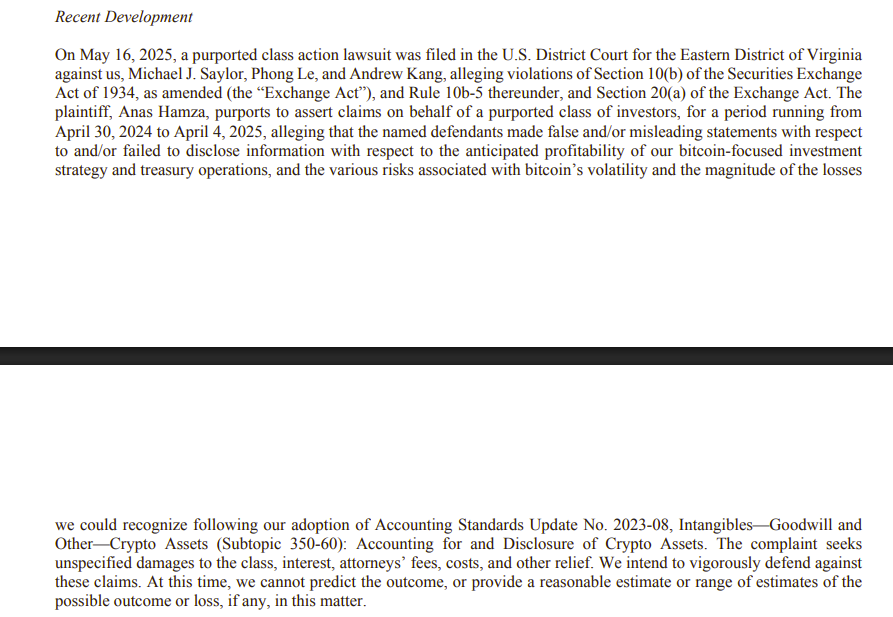

In today’s SEC release, the strategy also said that it is facing a class action filed in the Eastern Court of Virginia on May 16, 2025. The lawsuit argues that strategies and management have made misunderstandings and have not disclosed the risks related to the Bitcoin strategy and the new encryption accounting rules.

The company plans to actively defend the claim and say that it cannot yet estimate the results or potential financial impacts.

Share this article