Key Takeaways

- Michael Saylor will present his Bitcoin investment strategy to the Microsoft board of directors.

- The board previously claimed that Microsoft is already evaluating a variety of assets, including Bitcoin, and that its current focus is on stability and risk minimization.

Share this article

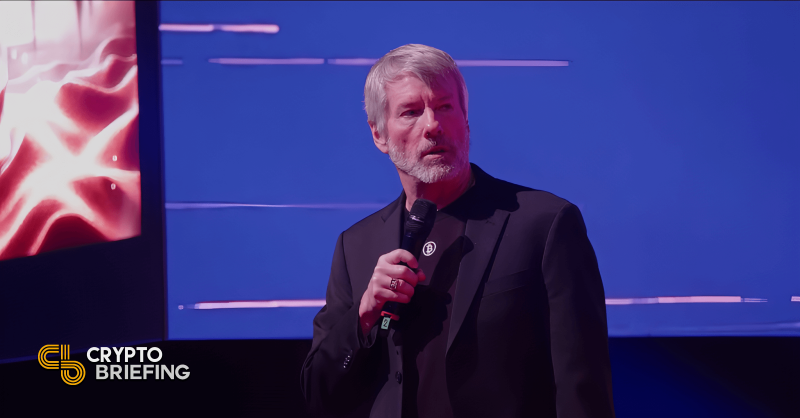

Michael Saylor will share insights on his Bitcoin investment strategy in a three-minute presentation to Microsoft’s board of directors, following a suggestion from the National Center for Public Policy Research (NCPPR), which urged Microsoft to consider investing in Bitcoin. .

“The activist who put that proposal together contacted me to present to the board and I agreed to give a three-minute presentation,” the MicroStrategy co-founder said at an X Spaces event hosted by VanEck. “I will submit it to the board of directors.”

Saylor has publicly encouraged Microsoft to consider adding Bitcoin to its treasury. He believes this could generate “the next trillion dollars” for Microsoft shareholders.

Companies like Berkshire Hathaway, Apple, Google and Meta (formerly Facebook) should discuss and evaluate Bitcoin as a potential investment, Saylor suggested. “Because they all have huge amounts of cash and they are all burning shareholder value.”

Microsoft shareholders are scheduled to vote on a proposal considering adding Bitcoin to its balance sheet on December 10th. Top shareholders include major financial institutions such as Vanguard Group, BlackRock, State Street, and Fidelity Management & Research.

Known as a cryptocurrency skeptic, Vanguard has invested in MicroStrategy’s stock (MSTR) as well as stocks of other cryptocurrency companies such as Coinbase and MARA Holdings. As of September 30, the asset management giant reported holding about 16 million shares of MSTR stock.

MicroStrategy’s Bitcoin strategy has resulted in massive stock price gains that have outpaced the performance of Microsoft stock (MSFT).

Shares of MicroStrategy hit a record high at market close Tuesday, according to data from Yahoo Finance. So far this year, its stock price has soared 581%, and Microsoft’s stock price has risen about 12% over the same period.

NCPPR previously used MicroStrategy’s Bitcoin strategy to convince Microsoft leadership about its Bitcoin buying strategy. They noted that the company’s stock price has surpassed that of Microsoft.

Microsoft’s board initially recommended a vote against the proposal, saying it was “evaluating a wide range of investable assets,” including Bitcoin. Although there is interest from certain shareholders, artificial intelligence is Microsoft’s top priority.

However, Ethan Peck, deputy director of NCPPR’s Free Enterprise Project, decided not to invest in Bitcoin and warned that the valuation could trigger shareholder lawsuits if the asset subsequently rises in value.

Share this article