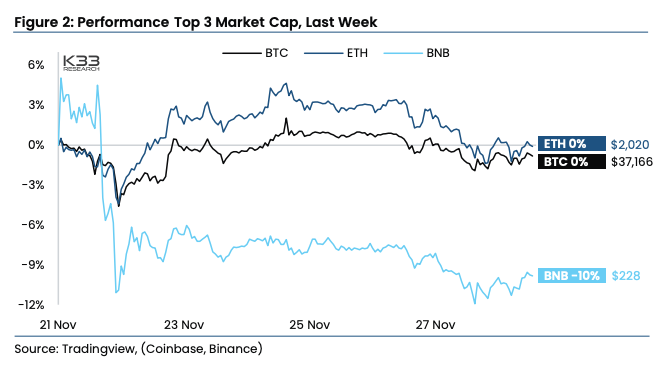

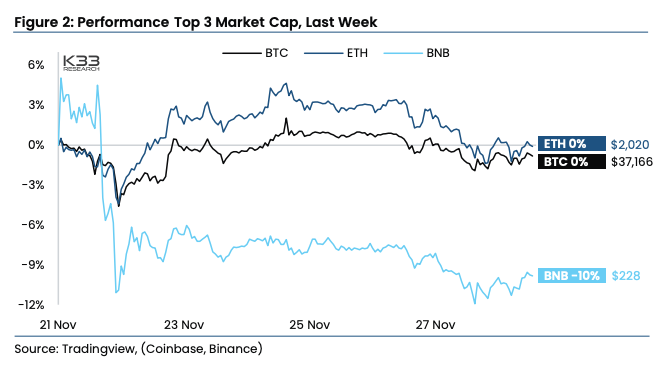

Major cryptocurrencies such as Bitcoin and Ethereum were flat over the past week even after cryptocurrency exchange giant Binance agreed to a record $4.3 billion settlement with U.S. authorities, according to an analysis by research firm K33.

Analysts said the landmark settlement, made public on November 21, revealed sanctions violations and illegal fund transfers but found no mishandling of customer funds. Therefore, there is little risk of the contagion spreading throughout the digital asset market as it did during the FTX crash last year.

“This settlement has nothing to do with mishandling customer funds and is unlikely to have any contagious impact going forward,” K33 senior analyst Vetle Lunde and vice president Anders Helseth wrote in a recent market update.

Bitcoin and Ethereum prices remain strong around $38,000 and $2,000, respectively, days after regulators announced a multi-year investigation into Binance’s compliance with anti-money laundering procedures and sanctions. The relatively quiet impact confirms that Binance’s transgressions appear to be isolated rather than systematic.

BNB plummets amid Binance drama

However, the company’s BNB token fell nearly 14% after the costly agreement was announced, cementing a turning point in US markets. Binance founder Changpeng Zhao also stepped down as CEO, retaining a significant ownership stake.

However, Lunde and Helseth argue that Binance, which boasts more than 120 million users globally, still represents a pillar of the cryptocurrency infrastructure that is likely to rebound in 2024 despite its shrinking US business.

“Binance’s strong user base suggests that it will remain a cornerstone of the cryptocurrency market structure through 2024,” the K33 report concluded.

That said, researchers highlighted that Binance has already experienced a decline in market share in 2022 amid heightened regulatory attention. The share of trading volume on non-U.S. exchanges has fallen to less than 45% from about 70% previously, according to data from research firm The Block.

For now, the cryptocurrency market seems to be comfortable with the scope of the punishment imposed solely on Binance, rather than predicting another existential crisis. Despite its lofty status and still unrivaled scale, the coming months will reveal whether the exchange itself has become unstable due to depleted consumer confidence or frozen assets.