STELLAR’s indigenous token XLM is attracting great attention from traders and investors as it approaches a significant price drop. In late February and early March 2025, assets formed a weak wedge pattern during the recent upward campaign.

XLM technology analysis and price measures

Meanwhile, as market emotions and prices continue to fall, XRP has reached an important lower limit of rising wedge patterns and now seems to be integrated. This continuous XLM price momentum seems to lead emotions in the weak direction.

XLM price prediction

According to the Expert technology analysis, XLM is at a key level of $ 0.285, which is now a configuration of assets. Based on recent price behavior and historical patterns, XLM is likely to reduce 15% to reach $ 0.236 in the future if the candle is close to $ 0.28 or less.

On the other hand, if your emotions change and the price of XLM rises, if you close more than $ 0.31, you can open a way for a huge rise. According to the Daily Chart of XLM, assets continue to increase more than 200 index moving average (EMA) over the daily period, so the assets are increasing.

XLM’s current price momentum

In the press time, XLM has a transaction of nearly $ 0.286, a 1%surge in price in the last 24 hours. However, during the same period, the volume of trading decreased by 10%, reducing the participation of merchants and investors, and is likely to be unclear.

Merchant’s point of view

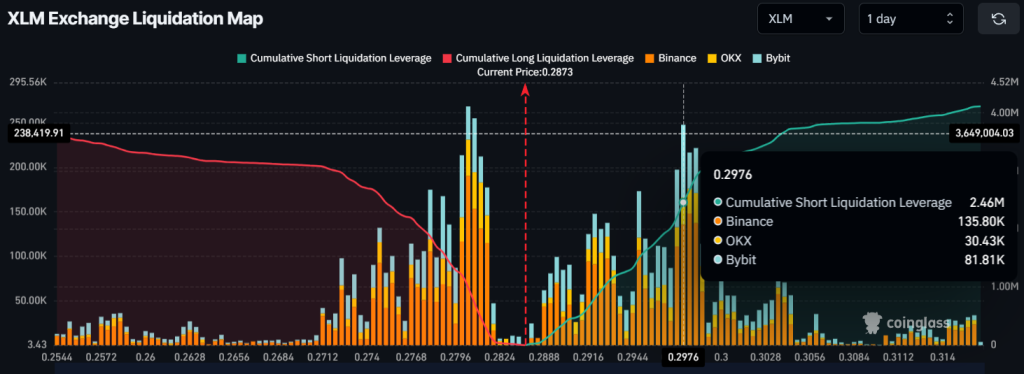

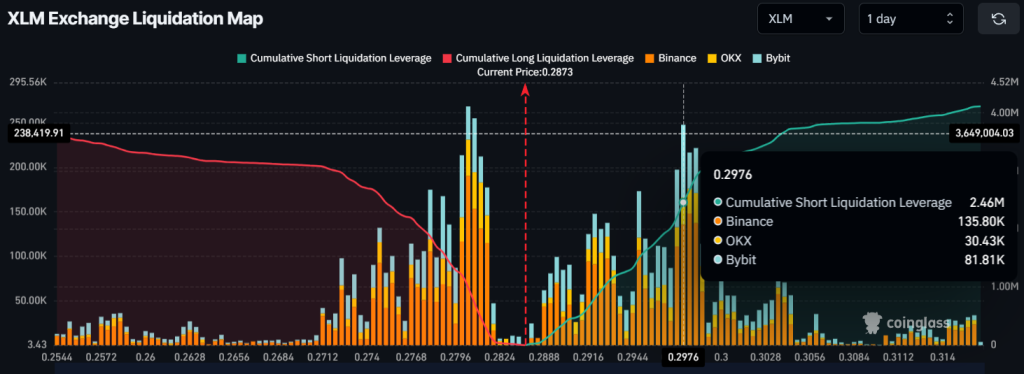

With this weak price behavior and market sentiment, traders are strongly betting in short positions.

According to the data from CoingLass, a whole chain analytic company, the trader has been excessively resolved to $ 0.28 at the bottom, building a long position of 995K. Meanwhile, $ 0.297 is another excessive level, and traders have built a short position worth $ 250 million.

This clearly indicates that emotions for XLM remain weak among merchants.