Israel is evaluating an interest-bearing digital shekel, according to a new report from the Bank of Israel.

The Bank of Israel (BOI) published the report ‘Logical Architecture for a Digital Shekel System’. We explore a variety of central bank digital currency (CBDC) design and implementation options, some of which differ significantly from those of other central banks.

One notable difference is the BOI’s proposal to have a digital shekel with interest payment options. Most central banks have proposed designs where CBDCs do not pay interest, as this would put them in direct competition with commercial banks.

Some banks, such as the European Central Bank (ECB), have acknowledged that paying interest on CBDC holdings could lead commercial banks to raise interest rates, leading to an increase in bank deposits. As deposits increase, banks’ loans increase and profitability increases.

BOI also proposed new designated solutions for CBDC ramps and ramps. For most central banks, CBDCs are designed to be linked directly to bank accounts.

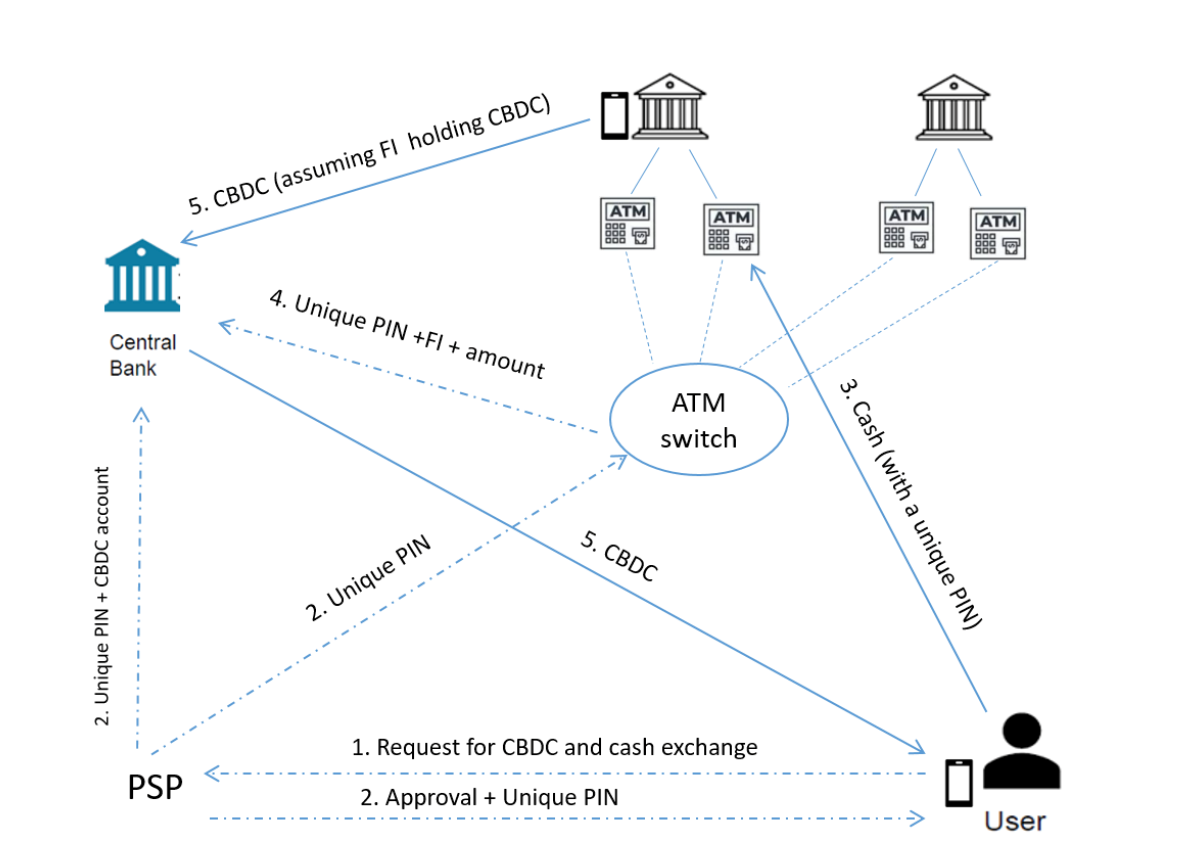

However, Israel proposes a new system that would allow end-users to deposit and withdraw funds from their wallets through payment service providers or banks. Users can deposit funds into an ATM using a unique code, and the central bank withdraws funds from the institution and deposits them into the user’s wallet. These transfers could also be made directly without the involvement of a parent bank, but this “could raise privacy and AML compliance issues for the institution.”

The BOI maintains that it remains agnostic about the technology underpinning CBDC, noting that it could consider either blockchain technology or traditional database technology at this stage.

Like other central banks, the BOI has reassured users that it will not have access to their personally identifiable information. Privacy has been one of the biggest topics surrounding CBDCs, with critics denouncing them as surveillance coins that governments will use to control the public.

To learn more central bank digital currency Read on for some design decisions to consider when creating and getting started. nChain’s CBDC Playbook.

See: CBDC: Like it or not, the rules will apply.

Are you new to blockchain? To learn more about blockchain technology, check out CoinGeek’s Blockchain for Beginners section, our ultimate resource guide.