In the ongoing market uncertainty, STELLAR’s indigenous token XLM seems to be weak and is preparing for a drop in price due to 4 hours of weak price behavior. In early March 2025, XLM experienced an impressive rising propulsion, but later the wedge pattern was weak.

XLM technology analysis and coming level

According to expert technology analysis, assets are currently experiencing prices and are important support. Depending on the recent price behavior and historical patterns, if the XLM does not maintain $ 0.288 and closes the candle 4 hours below, the price decreases by 15% and reaches $ 0.23.

In addition to this weak pattern, the price of XLM began to fall after hitting the trend line descending with a strong history of the price reversal. However, this asset is lowering the price of XLM by forming a weak candlestick pattern.

Current price momentum

In the press time, XLM has a transaction of nearly $ 0.288 and has fallen by 2%over the last 24 hours. Despite the decline, the volume of transactions increases by 25%, indicating that the participation of traders and investors increases compared to the previous day.

Weak on chain indicators

This weak price behavior has been further strengthened by the recent activities of whales and long -term holders, as reported by the whole chain analysis company COINGLASS.

Inflow of XLM worth $ 1.4 million

According to the data of the spot inflow/leakage, the exchange has witnessed the inflow of more than $ 1.4 million in the last 24 hours, which suggests the potential selling of these holders, which can lead to a drop in prices.

Weak worth of $ 330 million

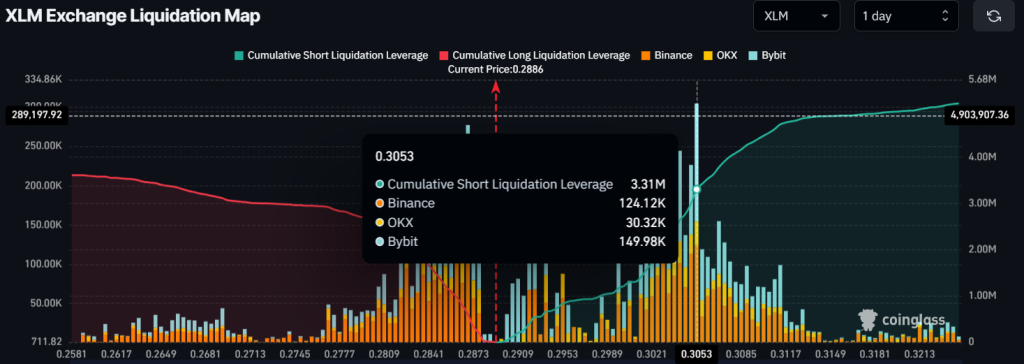

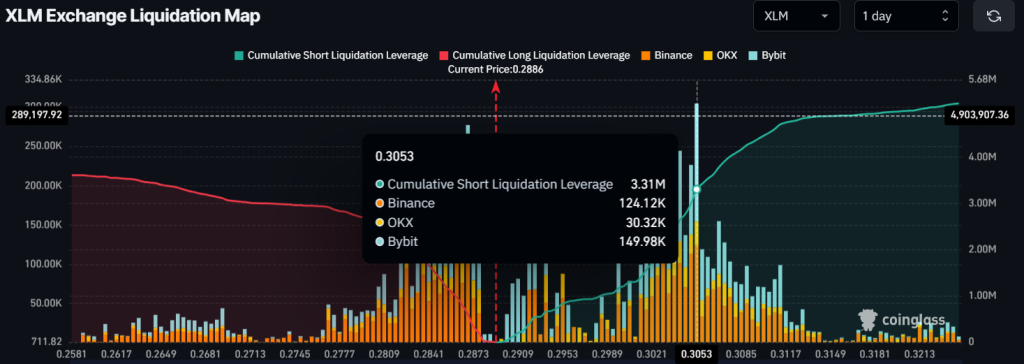

In addition to the activities of the long -term holders, merchants are strongly betting on the shortcomings, so they follow the weak market sentiment. According to the data, the merchant earned excessive profits from the top of the current liquidation to $ 0.305 at the top and $ 0.286 at the bottom. At this level, traders built short and long positions worth $ 3.3 million and $ 61.1 million, respectively.

When combining all these warm -chain metrics with technical analysis, bears appear to be dominant and the price of XLM can no longer decrease in the future.