Ripple’s legal team has been advocating for Revak v. It relied on the SEC Realty case to support its position against the Securities and Exchange Commission (SEC) and exposed the SEC’s attempts to undermine cryptocurrencies.

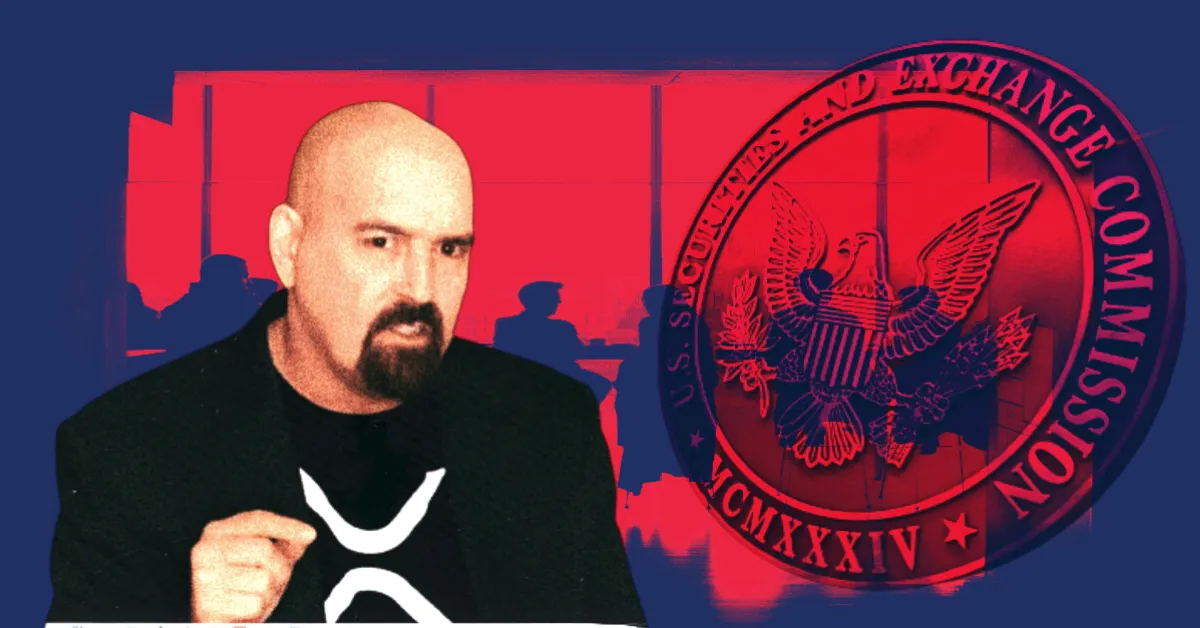

In a recent discussion, Paul Grewal, Coinbase’s Chief Legal Officer, and John Deaton, a prominent lawyer for XRP holders, weighed in on important aspects of the Ripple case, focusing on the 1994 Revak case.

Expert Insight: Deconstructing the SEC’s Ecosystem Argument

Grewal referred back to the Revak case, saying it showed how foolish it is to view investment deals through the lens of an “ecosystem” approach.

He reaffirmed the court’s Howey test position, saying that a simple link between the investor’s wealth and the promoter’s activities does not easily meet the requirement. The court must hold that a partnership must inherently rely on the expertise of its promoters to make investments that depend on luck.

The SEC’s Digital Asset Analysis Framework on its website notes that federal courts require “horizontal commonality” or “vertical commonality” to satisfy the “joint enterprise” aspect of the Howey test.

However, the Commission itself does not explicitly require this commonality and does not treat “joint ventures” as a separate element of “investment agreements.”

John Deaton agreed with Grewal and said that the Revak case is similar to the ongoing legal battle between LBRY, Ripple, and Coinbase. He focused on jurisdictional details, noting how the Revak case heard in the Second Circuit relates to the Ripple and Coinbase cases.

Latest updates on SEC vs. Ripple, Coinbase lawsuit

Looking at the current scenario, the SEC’s legal battle with Ripple Labs and Coinbase has significant implications for the current digital assets.

The recent ruling allowed the SEC to proceed with its case against Coinbase, but narrowed the scope, giving Coinbase a partial victory. The SEC is challenging Ripple’s dismissal, arguing that the company failed to do so in preparing its most recent financial statements.

The outcome could have implications for the XRP ecosystem and could potentially open the door to a spot XRP ETF as a positive solution for Ripple. Meanwhile, Ripple’s strategic adoption into institutional DeFi signals a move to expand its presence in the cryptocurrency ETF space.