The International Monetary Fund (IMF) has published a research paper titled ‘ASAP: A Conceptual Model for Digital Asset Platforms’ as part of its ‘Technological Foundations for Digital Finance’ series.

Here, authors Victor Budau and Herve Tourpe introduce a conceptual model called ASAP (Access, Services, Assets, Platform). They explore examples and use cases of tokenized assets and strive to demonstrate the possible uses and advantages of a four-layer digital asset platform.

Problems and Potential Solutions

The ASAP document explains the similarities with the Internet and how the Internet achieved interoperability, noting that the introduction of the 7-layer TCP/IP protocol played a significant role. Recognizing that many of the same problems facing the Internet back then are facing the digital asset ecosystem today, we seek to find a TCP/IP equivalent.

The paper also recognizes how solutions proposed over the years have unintentionally created new problems. The problem is complicated by lack of agreement on the diversity of architectures and design patterns, technologies, protocols, and implementations, as well as architectures and standards.

Introducing the concepts of digital asset platforms and tokenization, this white paper explores how the four-layer ASAP model can be a solution to many of the problems described.

What is the ASAP model?

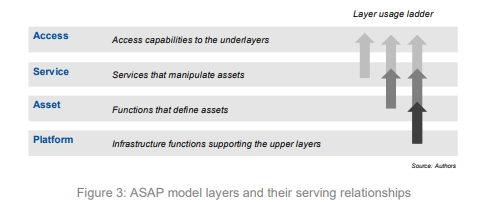

As explained earlier, ASAP stands for Access, Service, Asset, and Platform. These four layers are interconnected and “contain the high-level functional components necessary for interoperability of DAPs.” Each tier meets a separate goal.

Existing models, such as Banco Central do Brasil and the Monetary Authority of Singapore (MAS), inform the ASAP model, which is designed to include all platform types, regardless of technology, governance or asset types they handle. ”

Each layer is multifaceted, but here is a brief overview:

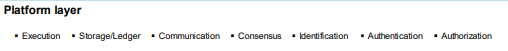

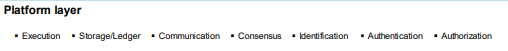

that much platform layer It acts as a settlement layer and is primarily used to implement the transfer of financial assets from the layers above.

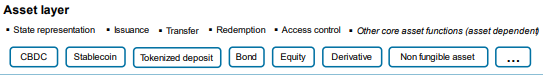

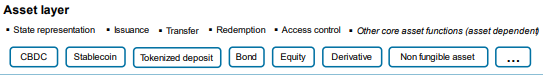

that much asset layer Contains the core features that define a financial asset. Different asset classes require unique features (e.g. bonds are different from currencies) and are defined here.

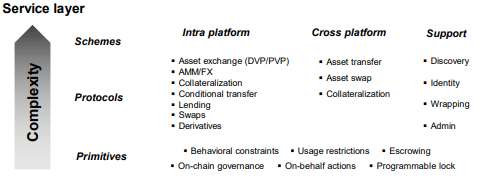

that much service layer Covers the ability to process or leverage financial assets deployed on the platform. These include rules and mechanisms covering services such as swaps and loans.

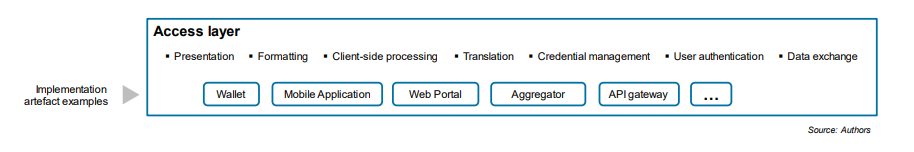

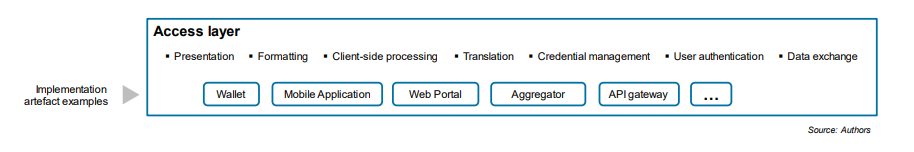

finally, access layer It contains features and interfaces that enable users and other clients, applications, and other marketplace components to interact with other services, assets, and platform layers.

Bitcoin is a TCP/IP protocol for digital assets

While something like the ASAP model can be useful for enabling applications to interact with a variety of tokenized asset types, the fundamental question this paper seeks to answer is: “What is the TCP/IP equivalent of digital assets?” Answered a long time ago.

Bitcoin, as described in a 2008 white paper, is a base layer protocol that enables infinite scalability, interoperability, and complete stability. Bitcoin has had a winding path over the past 15 years and has been fundamentally changed by the wrong developers, but the original protocol has been restored in the form of BSV and provides everything that TCP/IP did for the Internet.

The difference is that Bitcoin does not need to scale layer by layer, it scales unlimitedly from the base layer. While standards must be agreed upon to ensure interoperability between applications, Bitcoin, and only Bitcoin, can serve as a digital asset platform and the base layer for global financial markets.

Tokenized financial assets such as central bank digital currencies (CBDCs), stablecoins, non-fungible tokens (NFTs), stocks and bonds can be stored, transferred and exchanged directly on the Bitcoin blockchain. Interacting with these assets requires building applications and defined rules and standards to allow this, but the base layer protocols are already in place and firmly established, unlike BTC, Ethereum, and other competing blockchains. .

With the advent of Teranode, the BSV blockchain can scale to 1.5 million transactions per second with fees of less than 1 cent. Each transaction is timestamped and recorded on the blockchain, allowing all transactions and tokenized assets to be tracked. Protocol rules are clearly defined and firmly established, so developers can build with confidence that things will not change in the future.

The question of what serves as TCP/IP for digital assets has been resolved a long time ago. BSV is now waiting for the world to catch up and build the world’s most scalable public blockchain.

Watch: Dr. Mohamed Essaaidi – BSV’s expansion will transform governance, banking and agriculture

Are you new to blockchain? To learn more about blockchain technology, check out CoinGeek’s Blockchain for Beginners section, our ultimate resource guide.