Solana (SOL) was the best performer among the top 10 digital assets by market capitalization. What caused this rapid growth after a significant decline?

In 2023, Solana has demonstrated outstanding success, in stark contrast to Ethereum (ETH). SOL surged over 1000%, but ETH only increased by 90%.

To better understand the size of Solana’s ecosystem and the pace of recovery, let’s look at important blockchain metrics at the time of the FTX collapse on November 11, 2022.

FTX Bankruptcy

When the cryptocurrency exchange filed for bankruptcy on November 11 last year, Solana’s metrics had already fallen significantly from their all-time highs.

For example, the price of SOL fell from $62 to $17, and daily trading volume decreased from $6.7 billion (108 million SOL) to $2.2 billion (130 million SOL).

The departure of major investors and the risk of coin sales triggered Solana’s downfall, leading members of the cryptocurrency community to predict the company’s imminent demise.

Solana co-founder and CEO Anatoly Yakovenko acknowledged that the sharp decline in SOL due to the FTX collapse was a “bitter pill to swallow.” Nevertheless, these unpleasant moments are insignificant compared to the damage caused by ecological projects.

About 20% of Solana-based projects have received funding from cryptocurrency exchange FTX or its subsidiary Alameda Research, while only 5% of startups in the ecosystem have funding on this trading platform. Yakovenko expressed sympathy for the project’s creators, who worked hard to raise capital and trusted FTX as the custodian of their funds.

project rise

Despite negative predictions, Solana survived and began her recovery. Experts credited the project’s “viability” to the team’s use of stress testing to fix bugs.

Solana’s robust growth occurred while the court ruling in the FTX case was announced. Cryptocurrency exchange founder Sam Bankman-Fried was found guilty on all charges.

Now freed from the pressure of powerful partners, Solana’s fate appears clearer and its investment appeal increases. Crypto industry representatives have begun discussing Solana’s potential to lead the next bull market. This is evident in the large number of open long positions, demonstrating investor confidence in Solana’s positive trajectory.

Solana’s development and impact on the ecosystem

Despite the pessimistic outlook and the overall decline in network activity following the FTX bankruptcy, Solana developers responded proactively. Blockchain has gone through several significant technological updates and innovations over the past year. Starting in the summer of 2023, Solana will introduce new DeFi services including a lending platform, LSD protocol, and decentralized exchange (DEX). The developers aim to create a next-generation platform with “healthy” token economics and high-quality UI/UX.

The validator will migrate to client version 1.16 in late September 2023, optimizing memory usage, expanding support for zero-knowledge proofs (ZKP), and incorporating confidential transfers with the new token standard. The update also increased the stability of the network and reduced hardware requirements for validators. Version 1.17 is expected to add more ZKP integration features.

Another major improvement is the introduction of state compression in April 2023. This solution uses on-chain hashes to prove the authenticity of data, allowing for cheaper storage of data outside of the main network.

Meme Coin provided by Solana

The end of the year saw notable excitement surrounding Solana-based memecoins. One token that stood out was Bonk. Bonk, a meme coin that runs on the Solana blockchain and depicts a Shiba Inu, is similar to the biggest meme cryptocurrencies such as Dogecoin (DOGE) and Shiba Inu (SHIB).

Launched in early January of the same year, Bonk initially generated short-term excitement, followed by systematic price declines until the end of October, when it began to experience rapid growth. The rise in value of the Solana blockchain token may have triggered a surge in coin prices, generating interest in assets within this network, including BONK.

Sales of Solana developers’ Saga smartphones surged tenfold due to increased demand for the token’s rising value. Individuals who own the device can distribute BONK tokens for free in a quantity that covers the price of the smartphone at the current rate. The company limited sales to one device per person.

What lies ahead for Solana?

VanEck analysts published a report giving some predictions for SOL prices until 2030. The pessimistic scenario predicts the coin price to be $9.81, while the most optimistic scenario puts it at $3211.28.

Experts suggest that Solana could potentially become the first blockchain to accommodate applications with more than 100 million users. However, VanEck believes Solana’s monetization will only be about 20% of Ethereum’s due to “fundamental differences in the philosophies of the two project communities.” This could result in Ethereum having less than half of its market share.

Experts also predict that the market share of decentralized exchanges will hit an all-time high as high-performance networks like Solana improve user trading experiences. They predict that Solana blockchain will be in the top three in terms of market capitalization, TVL, and active users.

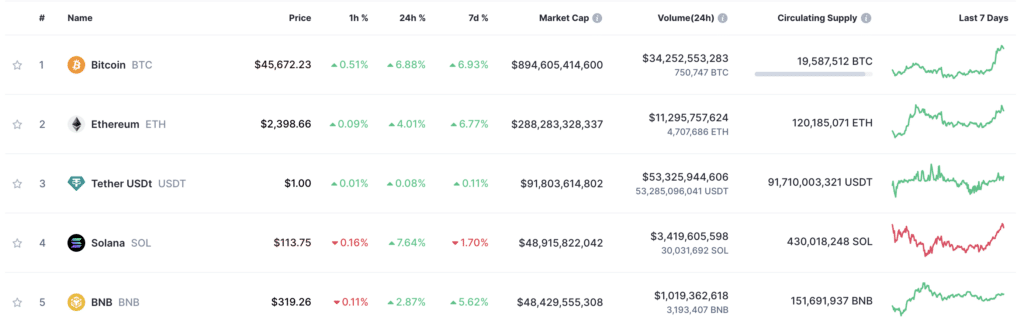

Our initial prediction regarding the token price may be difficult to achieve given the current token value, but our second prediction seems reasonably realistic. In January, SOL ranked among the top five cryptocurrencies by market capitalization, surpassing Ripple (XRP) and BNB.