Over the past three years, the cryptocurrency industry has experienced tremendous upheaval. With the boost from the 2021 stimulus package, venture capital (VC) firms have invested. $33 Cryptocurrency and blockchain startups are worth $1 billion.

The following year, the Federal Reserve triggered a domino of cryptocurrency bankruptcies with a cycle of interest rate hikes, starting with the collapse of Terra (LUNA) and leading to the collapse of the FTX Ponzi scheme.

The promise of DeFi has been overshadowed by the loss of more than $3 billion due to DeFi hacks in 2023. The ongoing Bitcoin bull market shows a lack of trust in so-called altcoins. Altcoin Season It hasn’t appeared yet.

In June 2023, Joseph Chalom, head of strategic partnerships at BlackRock, said: famous Institutional adoption of DeFi will take “years and years and years”. However, there are instances where the emerging AI narrative can merge with blockchain technology and its applications.

Learning from previous cycles, what will the AI-to-crypto landscape look like?

Building an AI foundation through cryptocurrency composability

In retrospect, it is no exaggeration to say that “DeFi” has been subsumed by companies on top of a tokenized layer, such as Celesius Network or BlockFi, rendering DeFi into CeFi. These companies successfully drove cryptocurrency adoption, but ultimately tarnished the word “cryptocurrency.”

The renewed DeFi v2 should focus on a good user experience that does not trigger demand for centralized companies. Most importantly, DeFi security must be strengthened. The most promising solution in that direction is the Zero Knowledge Ethereum Virtual Machine (zkEVM).

By abstracting chain transactions through zero-knowledge proofs (ZKPs), zkEVM increases network throughput and reduces gas costs. Additionally, zkEVM simplifies the user experience by facilitating alt token payments for gas fees. In other words, solutions like zkEVM pave the way toward the scalability needed for AI applications.

AI applications inherently involve large amounts of data, which can create bottlenecks in blockchain networks. Ahead of these hurdles, Polygon zkEVM allows you to generate AI artwork through the Midjourney image generator. in this processThe results can be tokenized into NFTs with low fees.

By further developing other types of smart contracts, the cryptocurrency space has laid the foundation for AI with composability and permissionless access. Combined, this creates an autonomous and efficient infrastructure for financial markets. Composability brings innovation across three composability layers, as any market activity can be decomposed into a smart contract.

- Morphological – Components that communicate between DeFi protocols, creating new meta-functions.

- Atomic – The ability of each smart contract to function independently or in combination with smart contracts from other protocols.

- Syntax – The ability of a protocol to communicate based on a standardized protocol.

In practice, this translates to Lego DeFi blocks. For example, Compound (COMP) allows users to provide liquidity to smart contract pools. This is one of the innovative pillars of DeFi because users no longer need permission from others to lend or borrow. A smart contract that acts as a liquidity pool allows borrowers to leverage it by providing collateral.

Liquidity providers earn cTokens in return for interest. If the supplied token is USDC, the resulting token is cUSDC. However, these tokens can be integrated into any protocol compatible with the ERC-20 standard across DeFi boards.

This means that composability creates opportunities to generate multiple returns, so smart contracts are never left idle. The challenge is how to deal with this increased complexity efficiently. This is where AI comes into play.

Amplify efficiency with AI

When thinking of artificial intelligence (AI), the first feature that comes to mind is superhuman processing. Financial markets have long become too complex for the human mind to handle. Instead, humans have become dependent on predictive algorithms, automation, and personalization.

At TradFi, this usually translates into a robo-advisor asking users about their needs and risk tolerance. The robo-advisor then creates a profile to manage the user’s portfolio. In the realm of blockchain composability, these AI algorithms can gain much greater flexibility in siphoning returns.

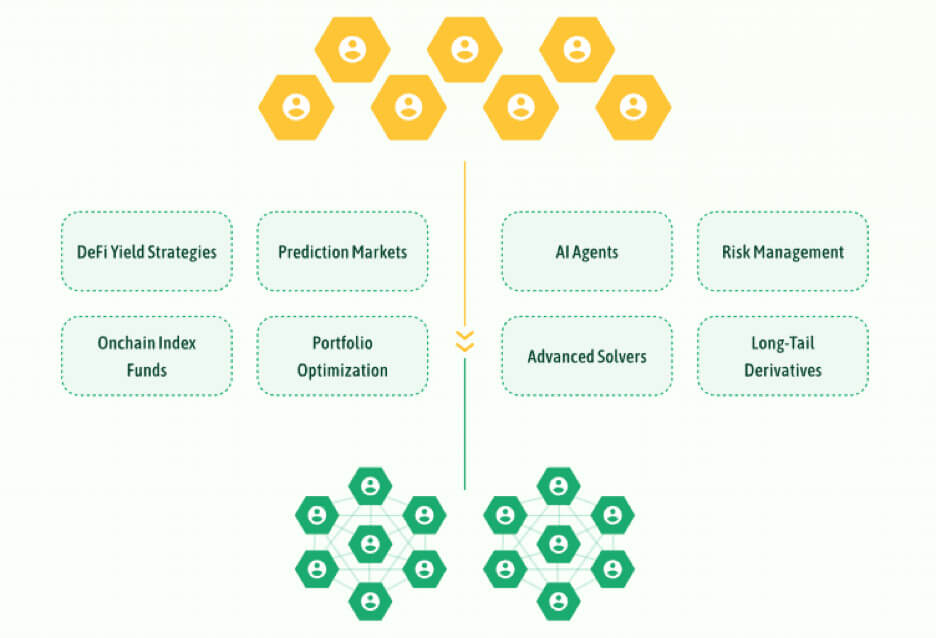

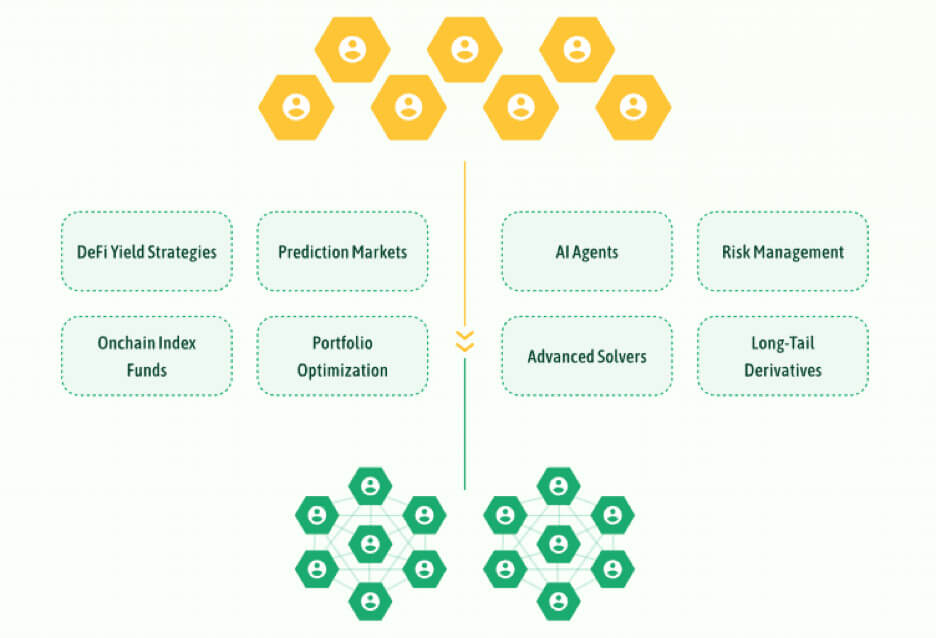

AI agents have the potential to reduce market inefficiencies, reduce human error, and enhance market coordination by reading market conditions on the fly while accessing transparent smart contracts. The latter already exists in the form of automated market makers (AMMs) that provide asset price discovery.

By analyzing order flow, liquidity and volatility in real time, AI agents are ideally suited to optimize liquidity provision and combat DeFi. Flash loan exploit Through coordination between DeFi platforms and limits on transaction sizes.

Inevitably, as AI agents increase market efficiency through real-time market monitoring and machine learning, liquidity deepens, and new prediction markets may emerge. The human’s job is then to set up the bot to arbitrate against other bots.

In ~ $42.5 billion At 2,500 equity rounds in 2023, AI investment has already surpassed the 2021 cryptocurrency high. But which AI-crypto projects are showing this trend?

Spotlight on AI-Crypto Innovators

AI has been in the spotlight since OpenAI launched ChatGPT in November 2022. Previous interest in memecoins has shifted to AI advancements in reasoning, art creation, coding, and most recently, text-to-video creation with Sora.

Across the spectrum of human interest, everyone relies on the expansion of data centers. Unlike cryptographic tokens, which are smart contracts, AI tokens are basic text blocks that an AI agent decomposes into relationship units. Depending on the tuning of each AI model, these tokens represent a contextual window into the relationships between concepts.

It is difficult to allow maximum processing capacity for each user prompt. When an AI model divides text into tokens, the output depends on the token size. As a result, the token size determines the quality of the generated content.

Obviously, the larger the token size, the more likely it is that the AI model will consider a larger number of concepts when generating content. Given these inherent limitations, AI tokens are a natural fit for blockchain technology.

Just as Web3 Gaming tokenizes in-game assets for decentralized ownership, tradable currencies, and reward incentives, AI can do the same. For example, Fetch.AI (FET) is an open access protocol that connects autonomous economic entities to the Fetch Smart Ledger through an open economy framework.

FET tokens aim to monetize network transactions, pay for AI model deployment, reward network participants, and pay for other services. And just as people connect to DeFi services through wallets, Fetch Wallet can be used to connect to Fetch.AI’s agent bus to leverage deployed AI protocols.

For example, one of the many AI agents currently in beta is agent verse PDF summary agent.

As a future path to democratizing AI agent access and deployment, the FET token has gained 300% in value since the beginning of the year. According to Market Research Future, the AI agent market is $110.42 billion From $6.03 billion in 2023 to 2032. This represents a compound annual growth rate (CAGR) of 43.80%.

Ultimately, we will see an ecosystem of AI agents interacting with DeFi protocols and other services that can benefit from real-time decision automation. This could extend to AI agents that support self-driving EVs or help perform delicate surgeries and patient care. pediatric surgeon Dr. Danielle Walsh, of the University of Kentucky College of Medicine in Lexington, said:

“A patient who wakes up at 1 a.m. two days after surgery can contact the chatbot and ask, ‘I have these symptoms. Is this normal?’”

In the medical diagnostics space, Massachusetts-based Lantheus Holdings (LNTH) has already deployed its PYLARIFY AI imaging agent for early prostate cancer detection. AI crypto projects like Fetch.AI allow many of these services to be fully tokenized.

The Way Forward: Challenges and Opportunities

Prior to AI integration, blockchain platforms face the same challenges of institutional adoption. Is there a chance for smaller protocols to break into the mainstream, or is this just for institutions?

DeFi may have paved the way for tokenized financial markets, but large players are more likely to instill public trust.

for example, canton networkthis is With the support of Big Banks and Big Tech, it could replace smaller DeFi fish. In the end, convenience is Same-day bank transfer It can be seamlessly integrated into blockchain networks. This is especially relevant considering that Microsoft is powering the Canton Network with the Azure cloud while developing its AI products.

At the same time, many users prefer to ride the valuation of AI cryptocurrency tokens and remain in an open ecosystem. Moreover, cryptographic protocols do not need to be directly tailored to AI agent deployments. For example, The Graph (GRT) can be used as a blockchain data indexing service for AI apps.

Based on these speculations, this “Google of blockchain” has achieved a 103% increase to date. One of the most promising AI-enabled cryptocurrency projects may be Injective Protocol (INJ). Injective aims to simplify and automate complex DeFi operations by “injecting” AI algorithms into the aforementioned DeFi market activities.

The base layer of the AI-encryption intersection includes: Then networkBuild AI apps for augmented DeFi experiences using zero-knowledge machine learning (zkML) and federated learning.

If the rollout of these open apps is successful, it will make institutional networks like Canton less attractive. These dynamics will largely depend on regulators who have yet to flesh out their rules for the cryptocurrency space.

conclusion

AI is ready to make data more understandable, actionable, and relevant to specific users. Blockchain technology, on the other hand, formalizes and decentralizes the logic of human behavior into self-executing smart contracts.

When the two realms meet, you get AI agents with new purposes. A next-generation tokenized robo-advisor that takes full advantage of DeFi composability. And as AI agents explore new possibilities, new markets will emerge.

From predictive analytics to injecting liquidity into on-chain markets, AI agents are poised to create a hyper-financialized future. Starting with Bitcoin As such, humans will encounter many components that can be utilized.