quick take

The recent surge in Bitcoin holdings among short-term holders (STHs), defined as investors who have held Bitcoin for less than 155 days, represents a notable increase. Since December, STH has strengthened its Bitcoin portfolio to approximately 450,000 BTC. However, contrary to general market behavior, soft indicators such as Google Trends suggest that despite the aggressive accumulation of STH, we are nowhere close to market euphoria.

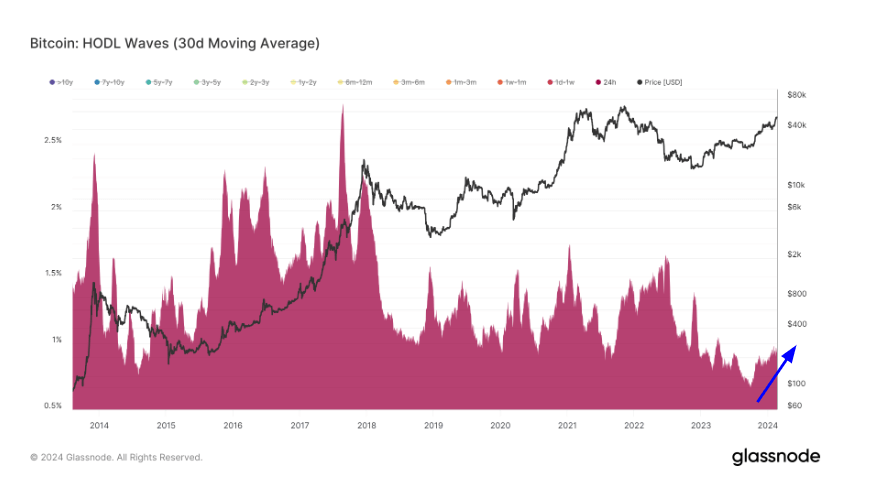

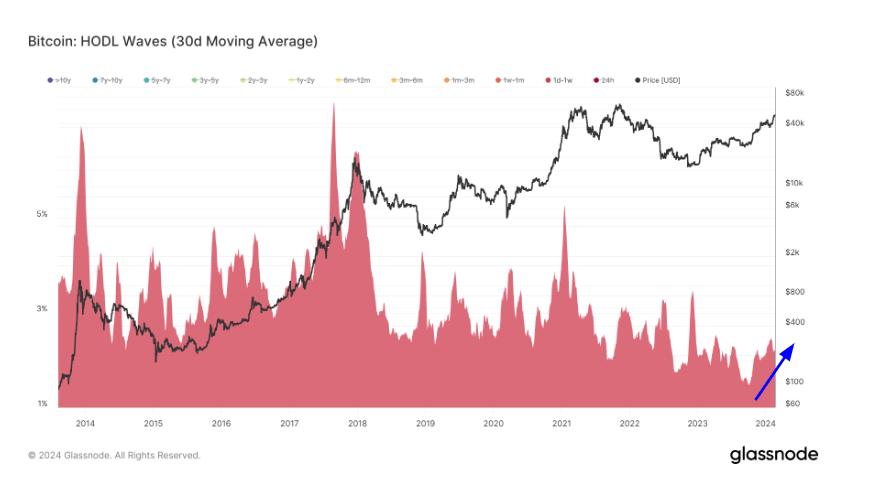

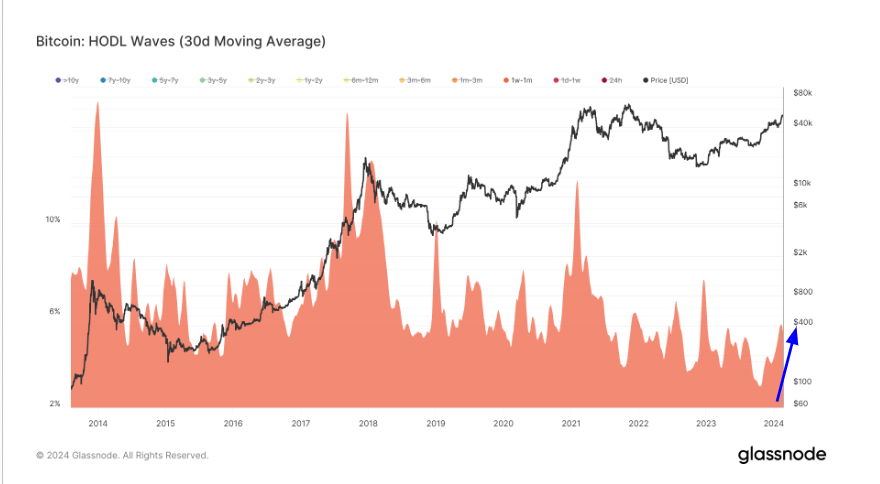

This interesting pattern is further revealed by examining the HODL wave, an indicator of the different ages of active supply. The HODL wave on the extremely short-term speculative bands of 24 hours, 1 day to 1 week, and 1 week to 1 month, where Bitcoin began its journey from $25,000 to $53,000, hit an all-time low in October 2023.

Despite significant growth in these cohorts, they still represent extremely low rates compared to historical data. This indicates a distinct lack of extreme short-term speculation.

Moreover, these groups typically exercise a much larger percentage of supply at the peak of a bull market when speculation is highest. This particular data suggests that there is significant room for growth in this cycle.

The post Analysis of HODL Waves Shows Speculative Markets appeared first on CryptoSlate.