quick take

Bitcoin ended March with its highest monthly and quarterly closing price of $70,000. Major digital assets by market capitalization have experienced significant growth, with annual gains of more than 57% in 2024, driven by increased institutional adoption and investor interest.

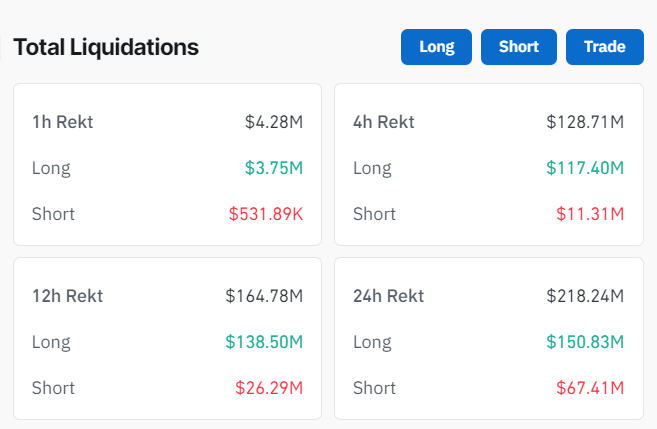

However, the new quarter started with a sharp downturn, with Bitcoin falling to $69,000 on April 1, causing more than $218 million in liquidations in the digital asset market in the last 24 hours, according to a report by Coinglass.

According to Coinglass data, of the $218 million liquidated, $151 million was due to the liquidation of long positions and the remainder was due to the liquidation of short positions. Liquidation occurs when an exchange terminates a trader’s leveraged position due to partial or total loss of the trader’s initial margin.

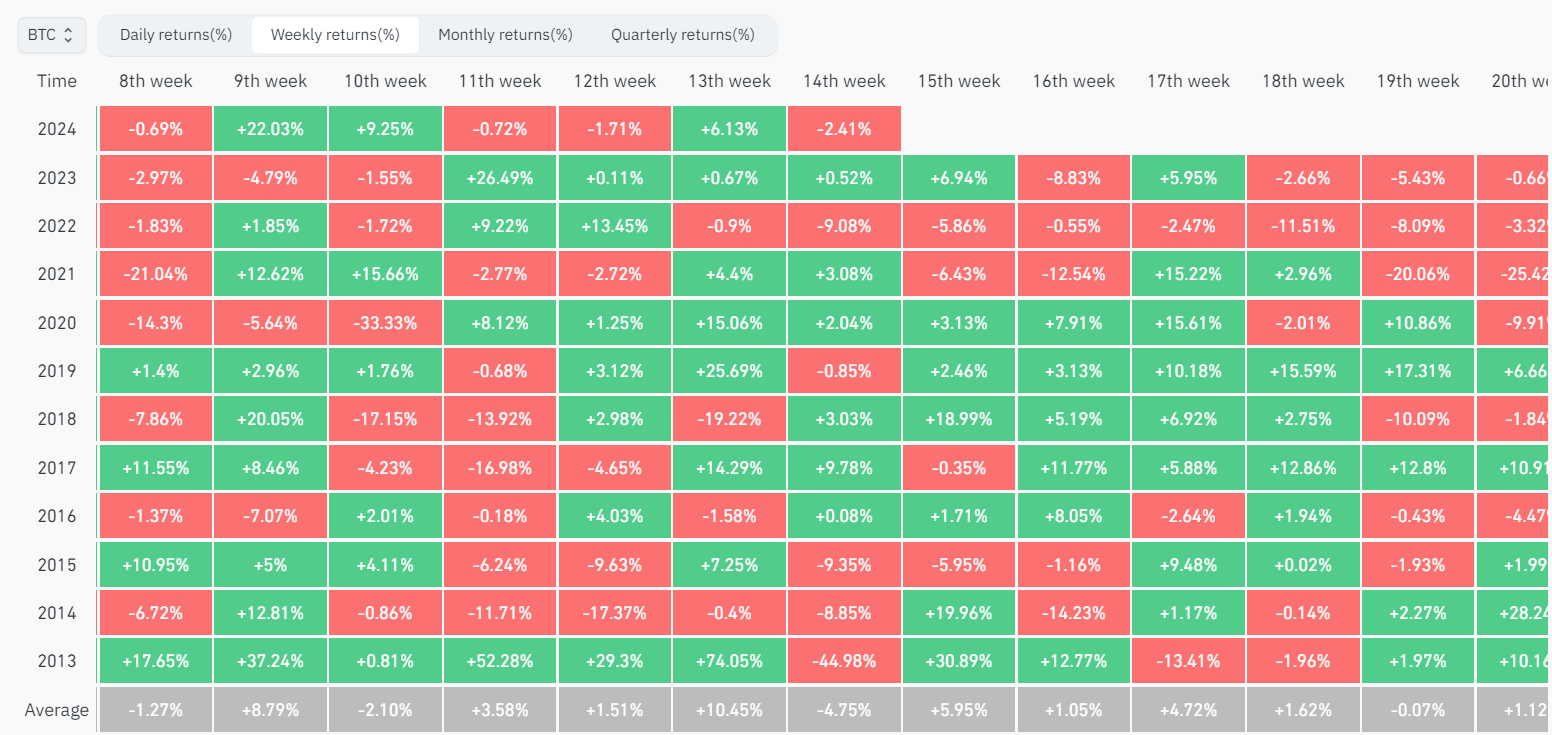

Bitcoin is currently down just 2.4% so far in week 14 of 2024, according to Coinglass data. However, historically this week has been Bitcoin’s worst performance compared to any other week on the calendar. Data shows that since 2013, Bitcoin has lost an average of 4.75% over 14 weeks, which has consistently been the most unfavorable week of the year for the benchmark digital asset. Most of these negative returns were concentrated between 2013 and 2015.

The post’s historical data shows Bitcoin’s Achilles’ heel in the first week of April appeared first on CryptoSlate.