Grayscale Sells $41 Million in Bitcoin Amid BTC’s Struggle to $47,000: Will It Affect the Bull Market?

Grayscale, one of the leading digital asset management companies, has reportedly sold $41 million worth of Bitcoin. This significant transaction comes at a time when the price of Bitcoin is on the rise, with the current momentum stalled near $47,000. Nonetheless, the Bitcoin selling pressure triggered by GBTC’s outflow may lessen as other ETF providers are actively increasing Bitcoin holdings in their portfolios.

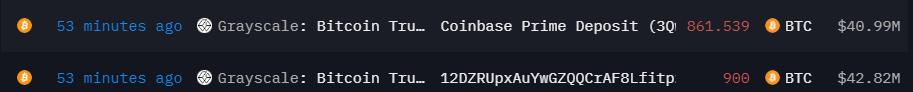

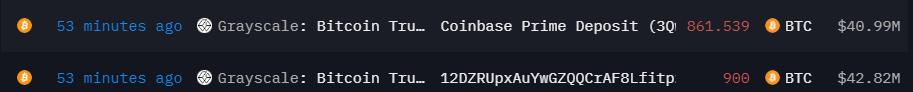

Grayscale moves a total of $83 million in BTC

Bitcoin began a notable rally yesterday, rising to $45,000 for the first time in a month. The positive trajectory continued over the next 12 hours, with the cryptocurrency hitting another monthly high above $47,000. This rapid increase in the value of Bitcoin resulted in the liquidation of positions worth over $155 million.

With BTC prices soaring exponentially, Grayscale strategically redistributed approximately $83 million worth of positions, with $41 million of BTC transferred to Coinbase for sale.

This action contributed to the Bitcoin price fluctuating by $1,000 from the $47,000 level. Notably, the Bitcoin price saw $8.2 million in liquidations in the past hour, mostly by buyers, for a total of $5.2 million. At the same time, the price of BTC is experiencing a correction, falling below $47,000.

Concerns are growing about the potential for additional funds to flow out of GBTC in the future as traders aim for a near-term target of $50,000. Grayscale’s Bitcoin ETF outflows could get worse as companies facing bankruptcy liquidate their holdings and the fund loses its liquidity advantage over its peers.

Genesis plans to seek permission from the U.S. District Court for the Southern District of New York to sell approximately $1.6 billion worth of GBTC stock held by Grayscale. The move comes after FTX repurchased nearly $1 billion from the same fund in January.

Since converting to an ETF on January 11, Grayscale’s GBTC has recorded over $6 billion in liquidations.

Will this affect BTC price?

Grayscale’s dominance ended on February 1, when BlackRock’s iShares Bitcoin Trust (IBIT) and ProShares’ Bitcoin Strategy ETF (BITO) became the first of the nine ETFs to surpass GBTC’s volume.

As Grayscale continues to reduce its GBTC holdings, other ETF providers are actively adding Bitcoin to their portfolios to keep overall net flows in positive territory.

The total amount of Bitcoin sent by Grayscale’s GBTC is approximately 17 million BTC, valued at approximately $83 million. This is one of the lowest figures to date.

In contrast, net inflows into ETFs experienced a significant surge, increasing by $405 million. This marked the 10th consecutive day of net inflows.

If significant inflows continue and netflow remains positive, Bitcoin could avoid a major price correction. Nonetheless, such corrections may cause holders to engage in panic selling.