Franklin TempletonA prominent asset management firm has entered the world of Ethereum spot exchange-traded funds, joining the race to offer Ethereum-based investment products to investors.

Staking Integration: A New Dimension for ETFs

In a notable move, Franklin Templeton expressed its intention to include staking in its proposed Ether ETF, giving shareholders the opportunity to earn additional returns. This innovative approach is consistent with the evolving landscape of cryptocurrency investment strategies.

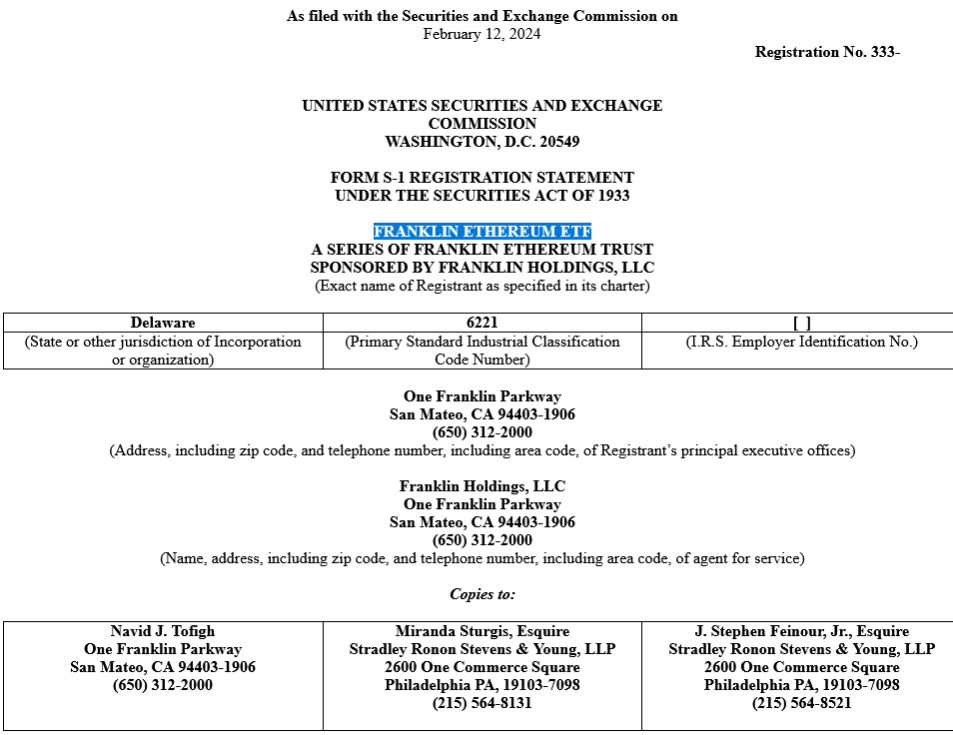

Franklin Templeton officially filed its S-1 application with the U.S. Securities and Exchange Commission on February 12, signaling its ambitions to introduce a “Franklin Ethereum ETF” on the Chicago Board Options Exchange, if regulatory approval is granted.

The company outlined plans to stake a portion of the ETF’s Ethereum holdings through trusted providers, potentially including affiliates. This staking mechanism is designed to generate staking rewards, which are treated as supplementary income for the trust.

Competitive Environment and Regulatory Outlook

Franklin Templeton’s entry into the spot Ether ETF market has intensified competition among industry giants seeking SEC approval for similar products. Competitors include BlackRock, VanEck, Fidelity, Invesco Galaxy, Grayscale, and Hashdex, all vying for a piece of the fast-growing Ethereum ETF market.

Here is the latest table of the different filers I have: pic.twitter.com/xCRRMwK76r

— James Seyff (@JSeyff) February 12, 2024

The SEC faces a series of deadlines to evaluate pending applications, with decisions expected at certain dates throughout the year. Analysts predict that a comprehensive ruling on all applicants could be issued by May 23, similar to the regulatory process for spot Bitcoin ETFs earlier this year.

Also Read: Ethereum Could Hit $4K With ETF Approval Pending

Market speculation and investment outlook

Despite growing interest in spot Ether ETFs, market analysts have tempered expectations regarding the regulatory approval timeline. Bloomberg ETF analysts downgraded their odds of approval, reflecting the degree of uncertainty surrounding the regulatory environment.

Franklin Templeton’s investment in the Ethereum ETF follows recent recognition of the strong fundamentals that underpin blockchain networks such as Ethereum and Solana. This positive sentiment suggests that it is likely to extend beyond Bitcoin-based investment products in the future.

We are very excited about ETH and its ecosystem. Despite the mid-life crisis we have recently experienced, we see a bright future with many strong tailwinds to advance the Ethereum ecosystem.

-EIP 4844

-Low DA

– Community revitalization

– Reshoot— Franklin Templeton (@FTI_US) January 17, 2024

As the race for approval of a spot Ether ETF intensifies, investors await regulatory decisions that could shape the trajectory of cryptocurrency investment products in the United States.