Ethereum re-staking presents a promising way to grow the network, but analysts warn of hidden risks associated with the new monetization mechanism.

Challenges of Restaking Protocols

Coinbase analysts highlight the following potential risks: Intrinsic Layer Protocol The issuance of Liquidity Re-Staking Tokens (LRT) highlights the complexity of allocating staked tokens to multiple validators.

Concerns about concentration and competition

Adding LRT could create concentration among high-yield providers, potentially amplifying the risk profile associated with re-staking. Additionally, competition between LRT providers and decentralized autonomous organizations (DAOs) could lead to excessive re-staking, raising concerns about market stability.

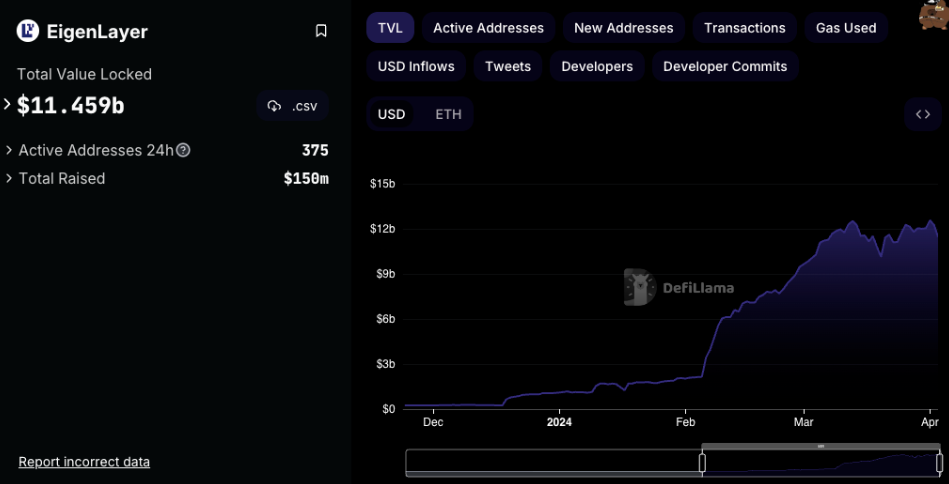

The re-staking landscape on Ethereum is rapidly evolving, with the Eigenlayer protocol emerging as a pivotal player. The protocol promises to underpin Ethereum’s new services and middleware, but analysts are careful not to overlook the inherent risks. Despite the short-term difficulties, rebid proponents remain optimistic about the potential rewards for validators and the broader Ethereum ecosystem.

Also read: What could be the consequences if the SEC classifies ETH as a security?