Posted: March 8, 2024 5:19 AM Updated: March 8, 2024 5:21 AM

Correction and fact check date: March 8, 2024, 5:19 AM

briefly

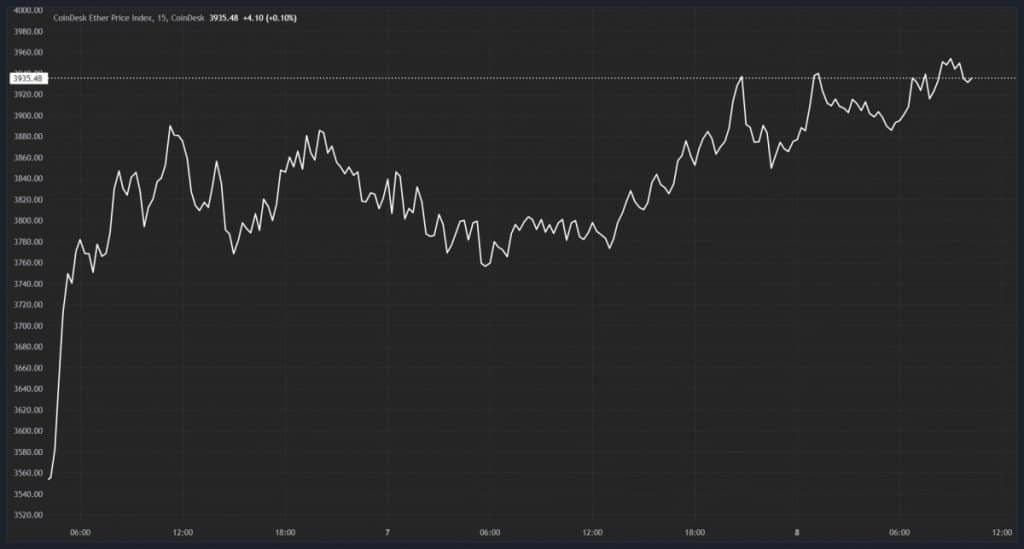

Ethereum price is expected to cross the $4,000 threshold soon given the continued bullish movement on the charts.

The price of Ethereum (ETH), the second largest cryptocurrency by market capitalization, is currently trading at $3,954, reflecting a growth of more than 4% in 24 hours. The cryptocurrency is expected to cross the $4,000 threshold soon, given its continued strength on the charts.

Following the notable rally in the price of Bitcoin (BTC), surpassing its 2021 all-time high of $69,000 earlier this week, Ethereum is expected to experience a similar trend. January 5, 2022. Ethereum is currently trading about 20% below its peak value.

Ethereum has performed strongly, rising from a low of $2,267 early last month and is expected to potentially reach $4,000. This is because ETH recently surpassed $3,800 and stabilized at $3,894, with a notable trading volume of $40.13 billion observed two days ago, a rebound after 21 months of relative decline.

Factors driving a potential Ethereum surge

Analysts are predicting that a new rise in the price of Ethereum is likely in March. However, analysis depends on a variety of factors and may be affected by market volatility and trends.

Two major factors that could contribute to Ethereum rising to $4,000 are the upcoming approval of an Ethereum spot exchange-traded fund (ETF) and prevailing bullish market conditions. Several applications for spot Ethereum ETFs from asset management firms such as Franklin Templeton, Ark 21Shares, VanEck, and Grayscale are currently pending approval by the U.S. Securities and Exchange Commission (SEC), with growing expectations that they will be approved soon.

ETFs represent funds that reflect specific assets traded on an exchange with a reduced potential for loss. Spot Bitcoin ETFs hit the market earlier this year and quickly achieved significant success. Recently, the spot Bitcoin ETF achieved a notable daily trading volume of $1 billion even amid the market downturn. Moreover, Bitcoin’s recent success in surging to all-time highs is often attributed to activity related to spot Bitcoin ETFs, and similar results are expected for Ethereum upon approval of a spot Ethereum ETF.

Another important factor is the current bullish market situation, driven by greed in the cryptocurrency market, which is pushing cryptocurrencies higher. The current fear and greed index is 81, indicating ‘excessive greed’.

Ethereum has been bullish for several months and is on an upward trajectory. If market conditions continue, a favorable scenario could emerge for Ethereum, potentially pushing it up to the $4,000 level.

disclaimer

In accordance with the Trust Project Guidelines, the information provided on these pages is not intended and should not be construed as legal, tax, investment, financial or any other form of advice. It is important to invest only what you can afford to lose and, when in doubt, seek independent financial advice. We recommend that you refer to the Terms of Use and help and support pages provided by the publisher or advertiser for more information. Although MetaversePost is committed to accurate and unbiased reporting, market conditions may change without notice.

About the author

Alisa is a reporter for Metaverse Post. She focuses on everything related to investing, AI, metaverse, and Web3. Alisa holds a degree in Art Business and her expertise lies in the fields of art and technology. She developed a passion for journalism through her work with VCs, notable cryptocurrency projects, and science writing. You can contact us at (email protected).

more articles

alice davidson

Alisa is a reporter for Metaverse Post. She focuses on everything related to investing, AI, metaverse, and Web3. Alisa holds a degree in Art Business and her expertise lies in the fields of art and technology. She developed a passion for journalism through her work with VCs, notable cryptocurrency projects, and science writing. You can contact us at (email protected).