join us telegram A channel to stay up to date on breaking news coverage

The price of Ethereum has surged 4% over the past 24 hours, trading at $2,947 as of 4 a.m. ET, while trading volume has surged 41% to $36 billion.

The Ethereum price hike comes as weak US inflation has fueled positive market sentiment despite the Bank of Japan (BOJ) raising interest rates. The US consumer price index rose 2.7% in the 12 months to November, down from 3% in September, surprising analysts and signaling a slowdown in price pressures.

🚨Breaking News: US CPI was lower than expected at 2.7% compared to 3.1% expected.

This indicates that inflation is cooling.

The FED now has more room to cut interest rates and ease monetary policy.

This is really positive news for the market. pic.twitter.com/ZWrzqwNBaA

— Bull Theory (@BullTheoryio) December 18, 2025

Falling hotel, milk, clothing and housing prices and holiday discounts strengthened investor confidence. This means that as inflation eases, the chances of the U.S. Federal Reserve (Fed) cutting interest rates increase, fueling optimism about cryptocurrencies such as Ethereum and Bitcoin.

While some risks remain due to previous tariffs and labor supply shortages in sectors such as agriculture, hospitality, and construction, markets have reacted strongly to the CPI decline, showing that US economic signals continue to have a strong influence on cryptocurrency sentiment.

Don’t fight with BOJ. -ve real interest rate is the explicit policy. $JPY up to 200, and $BTC Millie. pic.twitter.com/PdZh87ruVI

— Arthur Hayes (@CryptoHayes) December 19, 2025

Nevertheless, the BOJ raised interest rates by 25 basis points to 0.75%, the highest level in 30 years and marking the second increase this year. Governor Kazuo Ueda said further increases could follow in 2026 even if Japan’s financial conditions remain accommodative as real interest rates remain negative.

The yen has weakened to around 156 per dollar, lowering the immediate risk of a carry trade liquidation. Bitcoin has been volatile in response to the BOJ hike, with past rate hikes historically triggering declines of 23-31%. The US 10-year Treasury yield rose to 4.14%, and the dollar index (DXY) recorded 98.52.

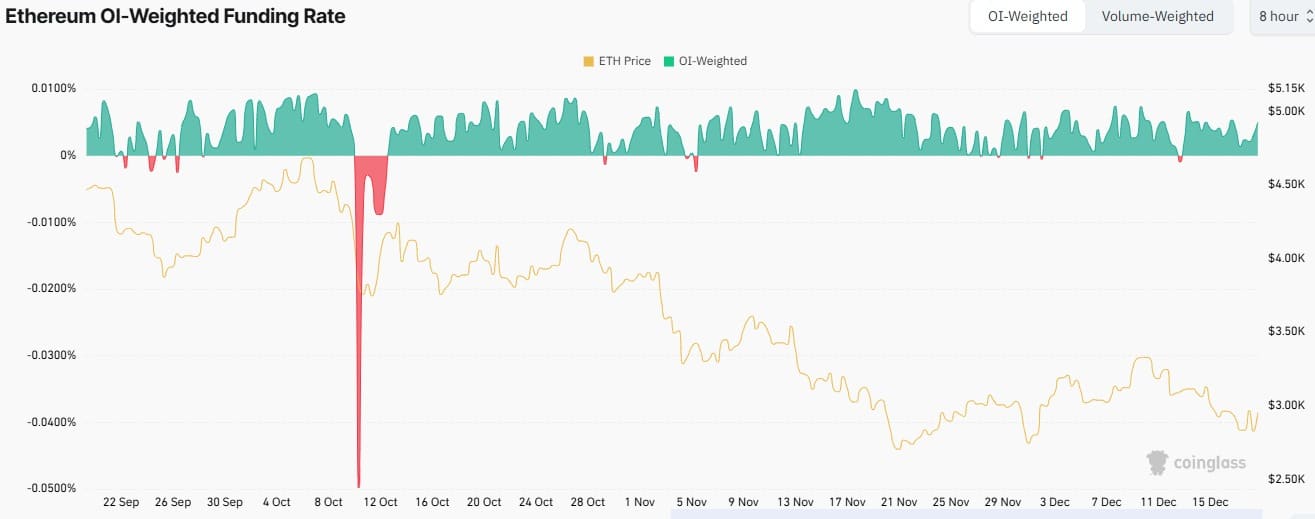

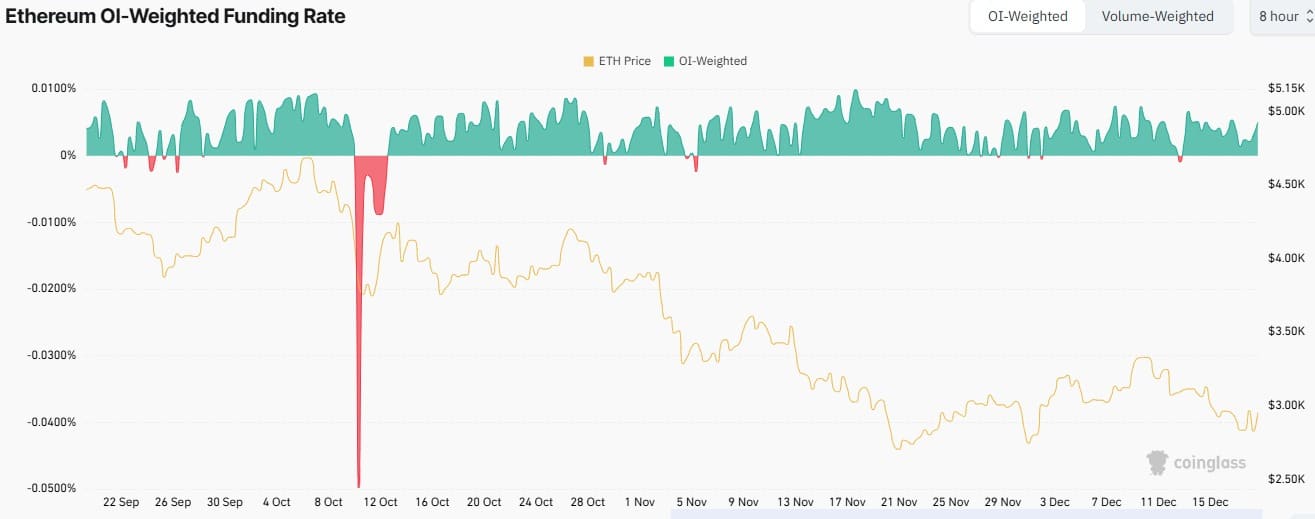

Ethereum Bearish OI-weighted funds surge, market stabilizes

Ethereum’s price OI-weighted funding ratio, which shows how much traders pay or earn on their positions, was mostly positive. However, on October 10-12, short-term downward pressure was seen, indicating the presence of short-term downward pressure.

Despite these funding rate fluctuations, ETH price has shown an overall downward trend, consistent with a period of negative funding rates and showing that short-term bearish pressure has contributed to the decline.

The funding rate has stabilized close to 0, meaning that a balanced market has been formed between short sellers and short sellers. While some positive surges continue, they do not translate into strong upward price momentum, highlighting a cautious or neutral mood.

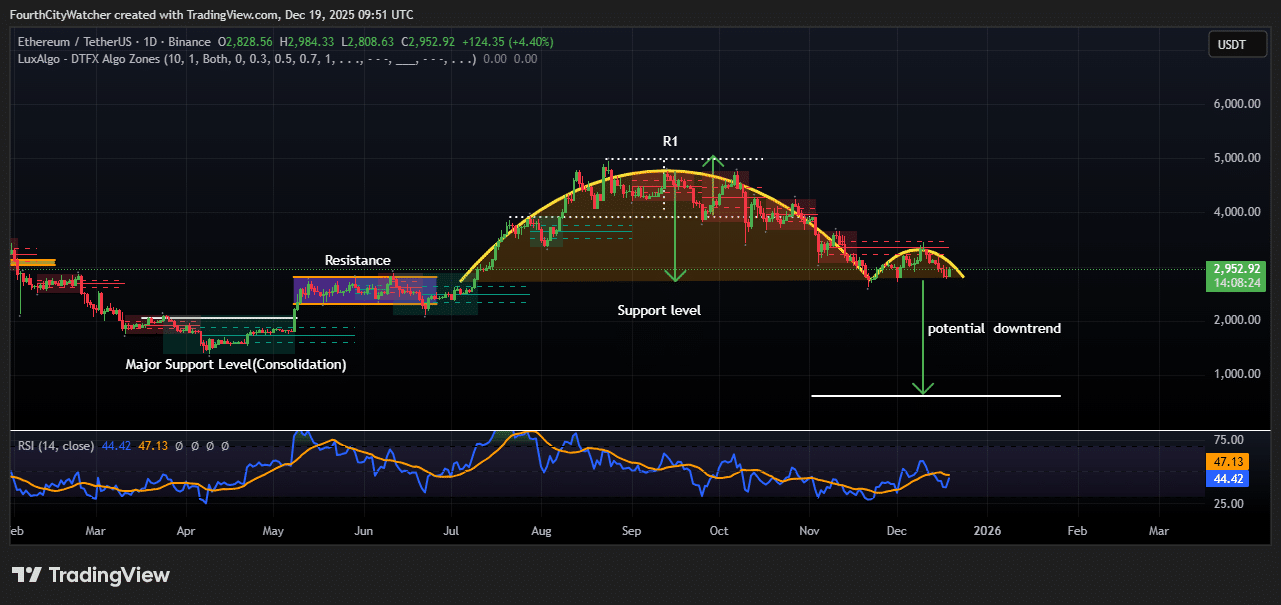

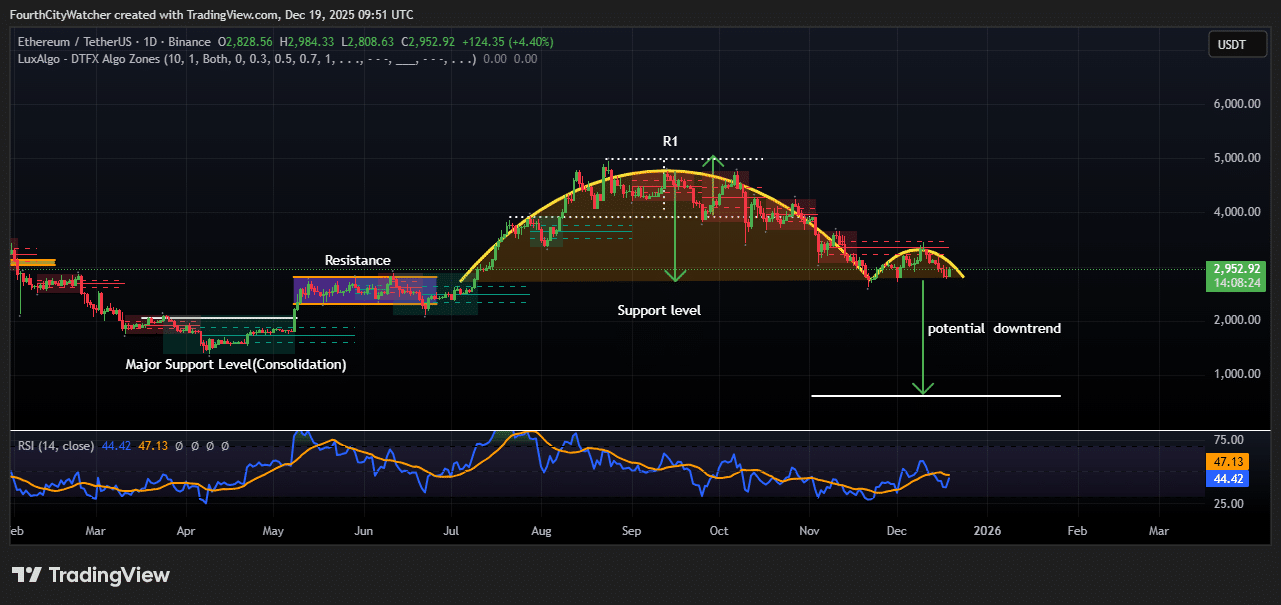

Ethereum Price Faces Downside Risk as $2,800 Support Tested

Daily ETH/USDT price action shows a clear transition from a consolidation to a downward trend from the beginning of 2025 until December 19, 2025. From February to April, ETH traded in a narrow range and built strong support around the $2,000 level.

During this phase, prices remained stable with buyers and sellers in balance, creating a solid foundation for further increases.

In May, ETH broke out of this consolidation and began an upward trend, but soon encountered resistance. Price action slowed and began to move sideways again, creating hesitation among traders and increasing selling pressure as buyers tried to push prices higher.

Between June and September, ETH experienced a strong bullish rally that pushed the price towards the $5,000 resistance area. However, momentum waned near this level and the chart formed a round peak that peaked in early September.

Previous support within the uptrend failed, leading to a decline in the price. There was a small attempt at a rebound, but it was weak and failed to break previous highs, maintaining an overall downward trend.

The RSI(14) indicator supports this view as it has fallen below the 50 line, weakening buying momentum and increasing the risk of further downside.

Currently, ETH is trading around $2,957, just below a small resistance area. If key support is broken near $2,800, ETH could continue falling and retest the previous key support area around $1,000-$1,200.

Related articles:

Best Wallet – Diversify your cryptocurrency portfolio

- Easy to use and highly functional cryptocurrency wallet

- Get early access to the upcoming token ICO

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake to win native token $BEST

- 250,000+ monthly active users

join us telegram A channel to stay up to date on breaking news coverage