The cryptocurrency world is abuzz with the recent surge in Ethereum (ETH). Currently trading at around $4,050 per token, Ethereum is on pace to set new records. Ethereum’s contrasting performance has become a focus for investors as Bitcoin recently fell below $70,000. In this article, we analyze the bullish, bearish, and fundamental predictions for Ethereum as we get closer to 2025.

Bull Case: Jump to $15,000

Ethereum’s bullish trajectory is supported by three key catalysts: potential SEC approval of a spot Ethereum ETF, Dencun upgrades aimed at improving layer 2 network efficiency, and increased adoption of decentralized finance (DeFi). These significant developments, along with a shift to a deflationary model following the “merge” upgrade, could provide the momentum for Ethereum to surpass the coveted $10,000 mark and possibly reach $15,000 by 2025 if all factors align perfectly.

Bearish scenario: down to $800

However, Ethereum’s path is not without obstacles. The bearish scenario hinges on declining DeFi adoption, user migration to more efficient and cheaper blockchains like Solana, and potential instability due to increasingly centralized Ethereum staking. If these factors weaken the ecosystem and reduce network effects, Ethereum could plummet to around $800 per token.

Base Case: Balancing Risk and Reward

Amidst the extreme bullish and bearish scenarios, a more moderate view suggests a base price target for Ethereum of around $10,000 by 2025. Considering market volatility, potential regulatory changes, and competition from other blockchains, this price level represents a balanced outlook for Ethereum’s future. , considering its established role as the backbone of DeFi and Web3.

Ethereum’s current market dynamics

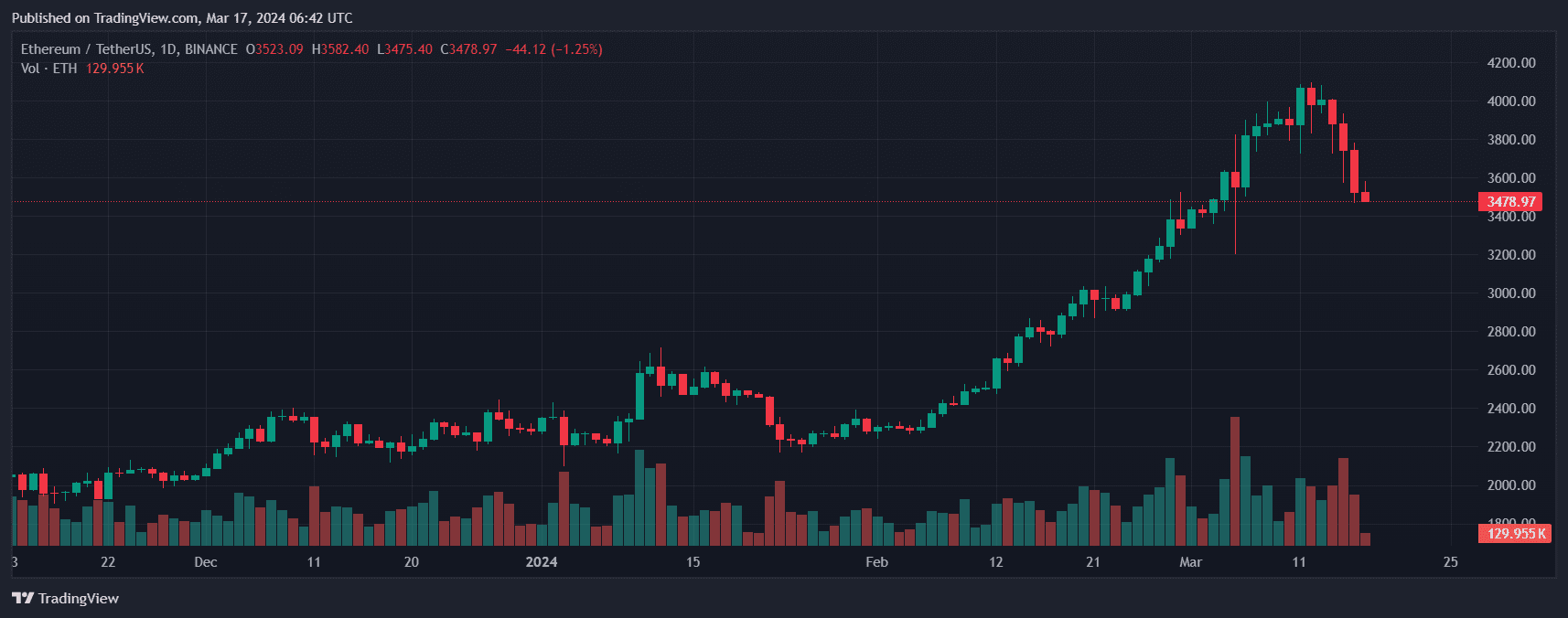

Despite Ethereum’s promising outlook, its price is not immune to fluctuations in the broader market, especially the recent Bitcoin crash. Ethereum is currently experiencing a decline, with technical experts suggesting that it is likely to fall to the $3,527 support level. If this level fails, Ethereum could fall further to $3,200, a significant step back from its current ranking.

Conversely, if the bulls re-enter the market, Ethereum could witness a recovery, recovering and surpassing the $4,093 range highs. This recovery could strengthen Ethereum’s position and set the stage for further upward movement.

conclusion

Ethereum’s journey through the cryptocurrency market is emblematic of the volatility and complex dynamics of the sector. The future holds promising potential for Ethereum, especially as a core part of DeFi, but investors must navigate the uncertainty cautiously. The contrast between Ethereum’s prospects and Bitcoin’s current slump further illustrates the independent paths that cryptocurrencies can take based on their intrinsic value and market perception.

Featured Posts