Decentralized financial systems (DeFi) provide users with a variety of features, including asset trading, lending, and staking, without the involvement of third parties such as traditional banks.

In DeFi systems, transactions are recorded in blockchain blocks, similar to a ledger. Additionally, these transactions are verified by one of the many users on the network.

Once the verification reaches consensus, the block is encrypted. A new block is then created containing the information from the previous block, and this process continues indefinitely.

Market performance in 2023

The year started positively, with the industry experiencing significant value increases. In the first quarter of this year, more than 50% of the top cryptocurrencies were added to portfolios. The industry recorded significant price volatility on the charts over the next eight months.

As the hype around Bitcoin spot ETFs grows, the market has regained momentum, and with a bull run looming, the industry is poised to hit new all-time highs (ATHs) with each cycle.

The DeFi industry has successfully regained $100 billion in value, with an increase of approximately 29%. The total number of users this year exceeded 7 million, which means that investor interest in it is increasing.

DeFi has revolutionized payment systems and has come a long way since its launch. Even though the category has experienced a massive correction over the past year, it has regained momentum and is up more than 50% in year-over-year (YOY) valuation. The industry is expected to achieve new heights in the coming years.

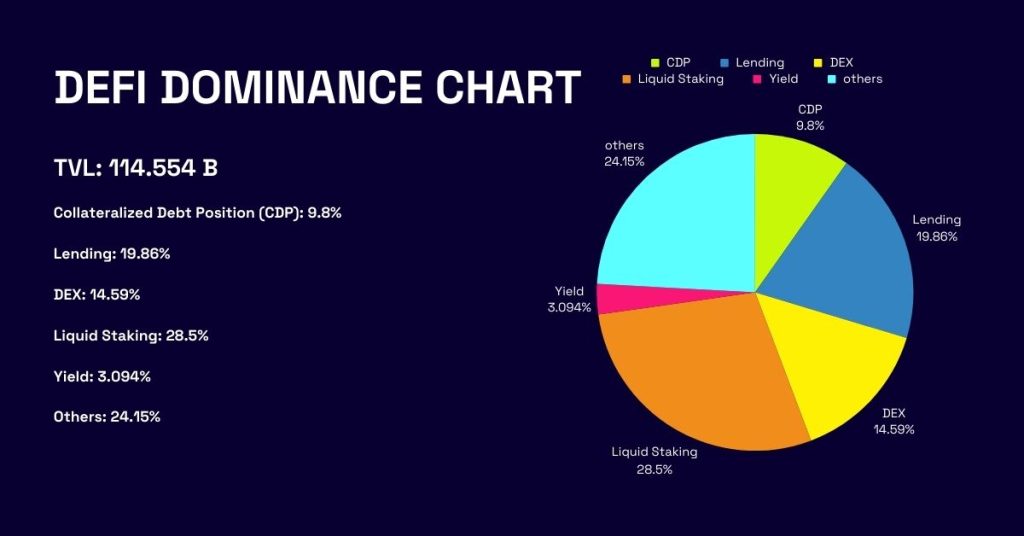

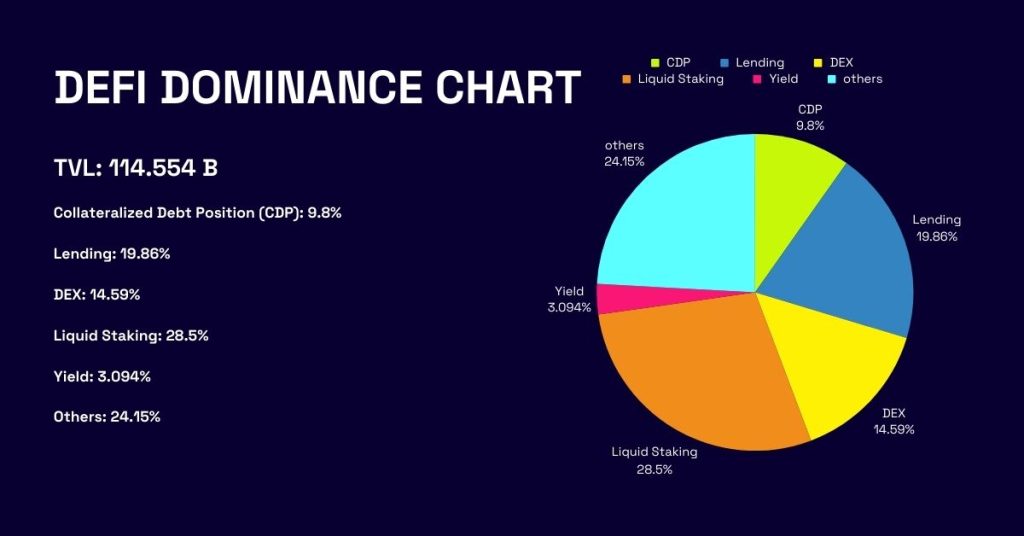

Top DeFi Categories:

The DeFi market is still in its infancy and folds are expected to increase during the upcoming bull run. The decentralized financial system hit a peak of $171 billion during its previous run.

Additionally, the category is divided into several sub-parts that play an important role in the field. Most TVL is currently in Collateralized Debt Positions (CDPs), lending, DEX, liquid staking, and yield.

Collateralized Debt Position (CDP):

CDPs created by Maker DAO play a unique role in DeFi systems, locking up collateral assets in smart contract exchanges for stablecoins. It is widely used to understand customer databases that other applications use to analyze, track, and manage customer interactions.

The value of secured debt positions recorded an increase of 15.73% from $8.14 billion in 2022 to $9.377 billion currently. The increase in value highlights investors’ growing confidence in the system.

Maker DAO accounted for the majority of CDP TVL with a total value of $5.823 billion this year, followed by JustStables with $1.24 billion and Liquity with $737.78 million.

loan:

This is a form of decentralized finance (DeFi) system that allows investors to lend cryptocurrency to borrowers in exchange for interest payments. Cryptocurrency loans are easy because they require no additional documentation and the interest rates are low compared to other sectors.

Lending plays an important role in the DeFi ecosystem as it makes up a large portion of the industry’s TVL. Over the past year, the loan category has demonstrated a strong upward trajectory, with value rising by more than 91%.

JustLend has the highest loan value with a total of $6.6 billion, a 154% increase from the $2.59 billion recorded on December 31, 2022. Following this, the AAVE token came in second place with a value of $6.391 billion, followed by Compound Finance with a value of $2,361. 10 billion.

Agility:

This specifically indicates the number and amount of assets deposited by the liquidity provider in the chosen protocol. DEXs play a unique role because they do not require KYC verification or documents providing personal information. This helps prevent your personal information from being sold to third-party apps.

Despite the industry showing signs of recovery, the DEX category lost more than 11% year-on-year (YOY) to $13.42 billion at the time of writing, up from $15.036 billion previously.

The Uniswap blockchain, comprised of 12 chains, has the highest decentralized exchange (DEX) value at $4.083 billion, followed by Curve DEX with a total value of $1.754 billion, and PancakeSwap with a total value of $1.456 billion. no see.

Liquid Staking:

This allows users to stake tokens and actively participate in securing the proof-of-stake blockchain. Staking is a win-win situation as it helps you maintain the liquidity of your assets and earn passively from them.

Liquid staking represents a large portion of the category, accounting for 28% of the total industry value of $29.45 billion at the time of this writing.

Lido DAO has the highest liquidated stake with a value of $20.93 billion, followed by Rocket Pool with a value of $2.635.4 billion. Binance Staked ETH’s TVL is the third highest at $1.736 billion.

Produce:

This means depositing coins/tokens into a DeFi protocol’s liquidity pool to earn rewards. Rewards are typically distributed through protocol governance tokens. Yield farming allows investors to leverage their holdings and earn additional tokens.

Over the past year, Yield has recorded a steady increase in value, increasing by approximately 20% from $1.311 billion in 2022 to $1.573 billion at the time of writing.

Convex Finance dominated the yield category as it contributed most of the valuation of this category with a total value of $1.977 billion, followed by Aura with $392.89 million and Pendle with a fixed value of $253.35.

Top DeFi achievements in 2023:

The DeFi category has successfully regained the momentum it once lost, despite its valuation falling more than 50% due to the market boom at the beginning of the year. On the other hand, the top blockchains in this category, including Lido Dao, Maker Dao, and Uniswap, have continued to see notable price action in 2023.

- Lido DAO (LDO): LDO blockchain has the highest Total Value Locked (TVL). It shows an increase in value of more than 255% compared to the previous year (YOY), from $5.787 billion to currently $20.934 billion. After ETH withdrawals were activated, LDO recorded a significant increase in value and has since jumped over 73%.

- Maker DAO (MKR): The MKR token has lost its dominance over LDO as the blockchain’s current TVL is $8.549 billion, up 27.48% from the previous $6.76 billion. The MKR token has recorded significant price fluctuations during the third quarter as it has gained tremendously optimistic sentiment in the cryptocurrency market.

- Uniswap (UNI): Despite the industry’s massive gains this year, the UNI blockchain added 23.20% to its TVL. The chain has seen significant price volatility, resulting in ongoing dumps in the market.

- AAVE (AAVE): Aave has shown notable performance, adding over 73% to TVL from $3.826 billion in 2022 to $6.41 billion in 2023. It added 43% to total gains for the year following a market rally in October.

- Rocket Pool (RPL): Its valuation has risen significantly this year. RPL increased by more than 366% from $565.01 million previously to $2.635 billion in 2023. RPL recorded major trading moves in mid-2023 to surge. The October pump also played a significant role, accounting for 56.75% of the total rise.

The future of DeFi:

The DeFi industry plays an important role in the cryptocurrency world as it has housed some of the most unique and fundamentally powerful projects in the world. DeFi’s Total Value Locked (TVL) is now just over $120 billion, a discount of more than 35% from the previous ATH of $175.517 billion recorded during the previous bull market.

Decentralized finance (DeFi) systems will soon reshape traditional financial systems as they introduce new and unique payment systems with enormous potential.

conclusion:

The DeFi industry has made significant progress over the years, recording continued increases in value. Additionally, the DeFi category market is seeing growing user interest in it as more users are recorded switching to the platform.

The DeFi market is expected to regain lost strength and record new ATHs next year. Because this category plays an important role in blockchain technology and financial systems.